Investors are becoming concerned about a market crisis that may or may not occur, but John Wyn-Evans, head of market analysis at Rathbones, has suggested they also need to think about “what could go right” in 2026.

Last year, markets made strong returns, “pleasantly surprising investors who are still climbing a wall of worry,” he said.

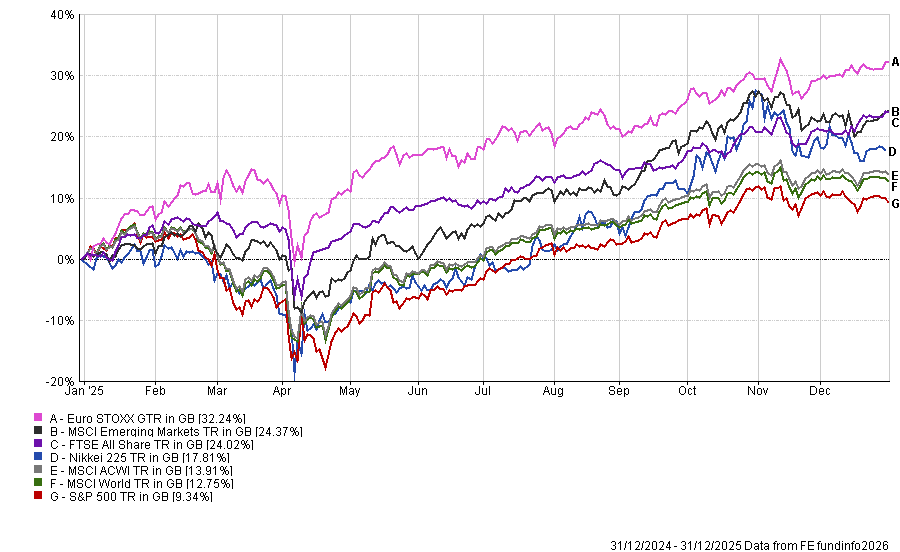

Indeed, the MSCI World made 12.8% in 2025, with areas outside of the US faring particularly well. Europe led the rankings, while emerging markets and UK equities all made more than 20%, as the chart below shows.

Performance of indices in 2025

Source: FE Analytics

Despite this, the “general mood does not reflect that”, said Wyn-Evans, as towards the end of the year there was a more cautious mood among investors.

Data from Calastone this week revealed equity fund outflows peaked during the summer and autumn, as UK investors became more nervous, although this tapered off towards the end of the year.

Overall, investors took some £6.7bn out of equity funds last year, more than double the previous record of £3.3bn set in 2016 following the Brexit referendum.

Wyn-Evans said: “Some [investors] are disappointed not to have made more, given another exceptional period for companies involved in the development of generative artificial intelligence (genAI); others remain fearful that some sort of market crisis is just around the corner.”

Much of this may stem from the volatility experienced in 2025, which was brought about largely thanks to US president Donald Trump’s ‘Liberation Day’ tariffs. The prospect of upsetting the post-war economic world order caused a near 20% fall in US equities and a weakening in the bond markets and the US dollar, although the president quickly announced a pause in their application, leading to a strong recovery.

Looking ahead, Wyn-Evans looked at areas investors might wish to pay close attention to this year and outlined the risks and potential positive outcomes that could take place.

Artificial intelligence (AI)

The big AI winners of 2024 suffered significant bouts of volatility in 2025, starting with the emergence of China’s DeepSeek, which threatened to replicate the performance of US tech giants at a much lower cost. “The reality was not quite as compelling, and confidence soon recovered,” Wyn-Evans said.

Then came the release of an MIT study claiming that 95% of corporations employing AI were seeing no benefit.

“We are very early in the adoption cycle and it seems that many of the users were trying to use generic large language models where application-specific tools were needed. We remain confident that usage will evolve and deliver increases in productivity,” he said.

However, the risk remains that, with these tech giants spending “hundreds of billions of dollars” each year on data centres, investors will be “keen to see a return on that investment”.

As such, we are at an “inflexion point” where companies will need to show more revenue and profits. This is not out of the question and the success of rumoured initial public offerings (IPOs) for currently private tech firms OpenAI and Anthropic could be a good litmus test for the sector.

The economy

Investors may be hung up on technology and trade, but Wyn-Evans noted that global economic conditions are “generally favourable”, with consumer and corporate finances in “decent shape”.

With inflation lower, interest rates are falling in the majority of countries while governments around the world remain fiscally expansive. “Even Germany has rediscovered the spending habit,” he said.

“A year of tariff-related uncertainty has left a potential backlog of (non-AI) capital investment that needs to be made. The probability of recession – one of the main threats to an equity bull market – is currently low.”

However, the risk investors will need to watch is whether growth is “too perky” or inflation proves “too sticky”.

“Our central view is that it is likely to remain generally higher and more volatile than in the pre-Covid era, fuelled by political preferences (for more deficit spending and less ‘globalisation’) and issues such as climate change and demographics,” he said.

This will have an impact on the bond market in particular, where he prefers shorter-dated and less interest-rate-sensitive government bonds to longer-dated bonds, which “remain vulnerable to concerns about persistently high government debt”.

For diversification, precious metals such as gold can still play a role, although he caveated that investors shouldn’t expect last year’s strong gains to be repeated.

Politics

Already this year politics has taken centre stage after the US captured Venezuelan president Nicolás Maduro and took temporary administration of the country.

However, when it comes to Trump, Wyn-Evans said the president “may well be keen to whip up support and not create economic upsets” as the country moves towards November’s mid-term congressional elections, particularly as his favourability ratings are at a low point.

There is potentially more alarm domestically, where there is little optimism that prime minister Keir Starmer or his chancellor Rachel Reeves will remain in place for much longer if betting markets are to be believed.

“A change of leadership could take Labour’s policies further to the left, a prospect that investors are unlikely to cheer,” he said. “The pound is a barometer of political risk to keep an eye on. For now, it remains in the middle of the trade-weighted range held since the Brexit referendum.”

Asset allocation

With uncertainty abounding, but some pockets of optimism, Wyn-Evans said balanced portfolios should continue to do well in 2026. Last year’s equity gains were made on the back of strong corporate profit growth, but prices have risen further relative to earnings in anticipation of future growth. “It is harder to see valuations going up again this year, he warned.

“But we also continue to resist talk of a bubble in equity markets. Yes, the average price of shares in the US market looks elevated at around 22x 2026 earnings forecasts, but with projected earnings growth of around 13% and a core of very profitable companies, a specific catalyst such as an unexpected economic deceleration or sharply higher interest rates and bond yields (we’re not expecting either) would be needed to push valuations lower,” he said.

He does expect the broadening out trend of 2025 to continue, however, with non-US markets still on attractive valuations despite their strong relative gains last year.

“It wouldn’t take many things to ‘go right’ for them to attract further interest from investors,” he said. “As ever, diversification is the key to sustainable returns.”