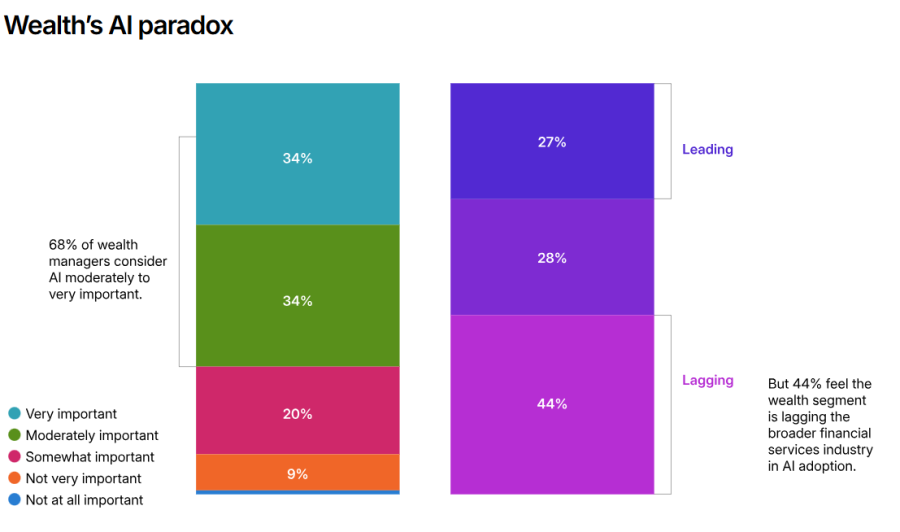

Despite 68% of wealth managers considering Artificial Intelligence (AI) to be moderately or very important to their industry, just 27% believe they are leaders in AI adoption, according to a recent MSCI survey.

Instead, a greater proportion of wealth managers (44%) believed that they were behind other financial services firms in terms of their AI adoption.

Joseph Wickremasinghe, executive director at MSCI Research and Development, said: “Wealth managers appear to feel they are lagging other investment managers in an area they consider a strategic focus.”

Source: MSCI.

Indeed, other parts of the financial services industry are increasingly implementing AI into their businesses and analysts at Fidelity International said this is starting to reshape business fundamentals.

Almost half (49%) of analysts at the firm International said last month that AI will increase company profitability this year, with financial businesses set to be one of the biggest beneficiaries.

They expect more than 80% of financial firms to benefit from AI this year through further improvements to the customer experience or more personalised services.

For MSCI’s Wickremasinghe, the gap between how important AI adoption is to wealth managers and how well they think they are implementing it “may be less about technology and more about the yardstick wealth managers use to measure their AI success”.

Wealth managers and other asset managers have different goals, which can affect their AI implementation. For example, asset managers may use AI to support their funds and trusts by generating new ideas or helping them find ways to outperform the benchmark and deliver returns for investors, the MSCI director said.

Because they typically do this in-house and generally do not use third-party providers for their data sets, asset managers are “more likely to require a bigger investment in AI to achieve their goals”

By contrast, wealth managers oversee hundreds of portfolios and must balance all their unique objectives while attracting new clients. On top of this, they also need to make sure that “every proposal also reflects the client's unique circumstances and preferences”.

“Their competitive edge lies not in proprietary data or complex trading models, but in the strength of their client relationships and their ability to deliver a deeply personalised service,” Wickremasinghe said.

Wealth managers comparing themselves to asset managers or hedge funds may develop the wrong idea of what AI implementation looks like because they are not applying it to their “core competency” of client proposal generation and personalised experiences.

“This may explain why 44% of wealth managers see their segment as lagging other areas of investment management in AI adoption: The survey responses suggest advisers tend to focus on proposal generation, for which there are already off-the-shelf solutions,” the MSCI director said.

Instead, wealth managers should rethink their AI implementation by focusing on their unique needs and differences between their processes and those of asset managers or hedge funds.

“That means focusing their AI use on measurable improvements that may support business goals such as growth and client retention – and measuring their progress against their own needs, rather than those of other investment professionals,” Wickremasinghe concluded.