Last year was an immensely strong one for equity investors, provided they eschewed the US in favour of other areas such as Europe, the UK and Japan.

Unfortunately for the Trustnet editorial team, we lacked this foresight. Instead, our selections for 2025 were centred around global equities, which are predominantly weighted towards the US.

Despite a strong first half in which most of our selections were ahead of the benchmark, in the end, we fell a long way short of global markets.

Anyone invested in the combination of fund picks we selected at the start of last year would have made less than MSCI World index. In fact, only one of our selections beat the index, despite it being a far from banner year for the common global benchmark.

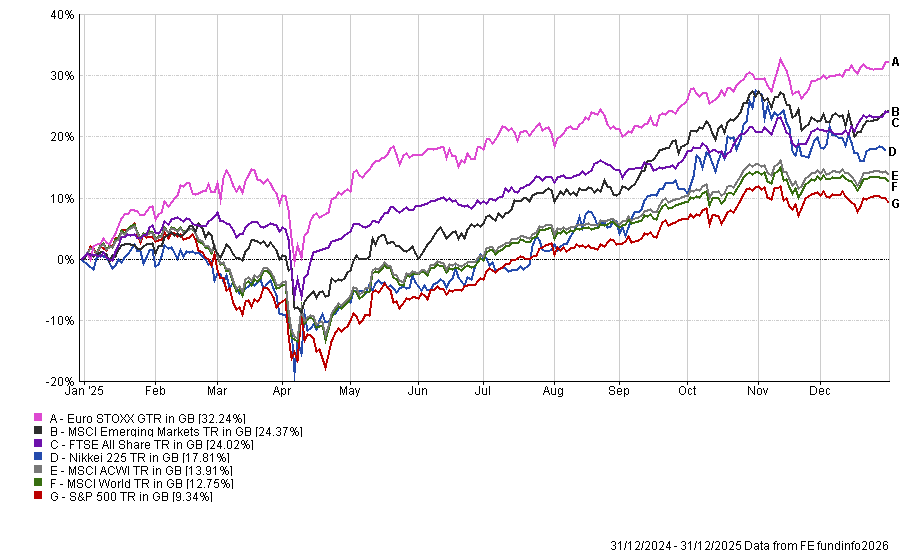

Among major equity markets, the MSCI World languished near the bottom, only ahead of the S&P 500, while the European, UK and emerging markets indices all near-enough doubled the return of the index.

Performance of indices in 2025

Source: FE Analytics

Below, we look at what our team got right in 2025 and (more aptly) what we got horrendously wrong.

The only good pick of the year

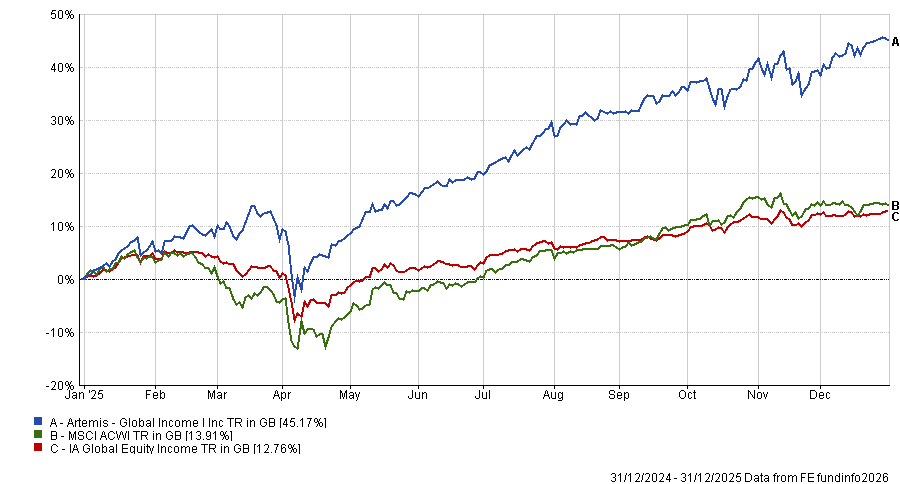

This section is short and sweet, but at least there was one positive last year. That was the selection of Artemis Global Income made by reporter Patrick Sanders. At the time, he liked the fund for its “broad exposure” to global markets.

While the US was the fund’s largest allocation at the start of 2025 (31.1% at the end of 2024), it has since been overtaken by Europe (32.6%), with the US second (30.3%) and the emerging markets (25.1%) in third.

This asset mix helped the fund last year, which was the top performer in the IA Global Equity Income sector, up an impressive 45.2% overall.

Source: FE Analytics

There were some positives with these picks, if you really looked for them

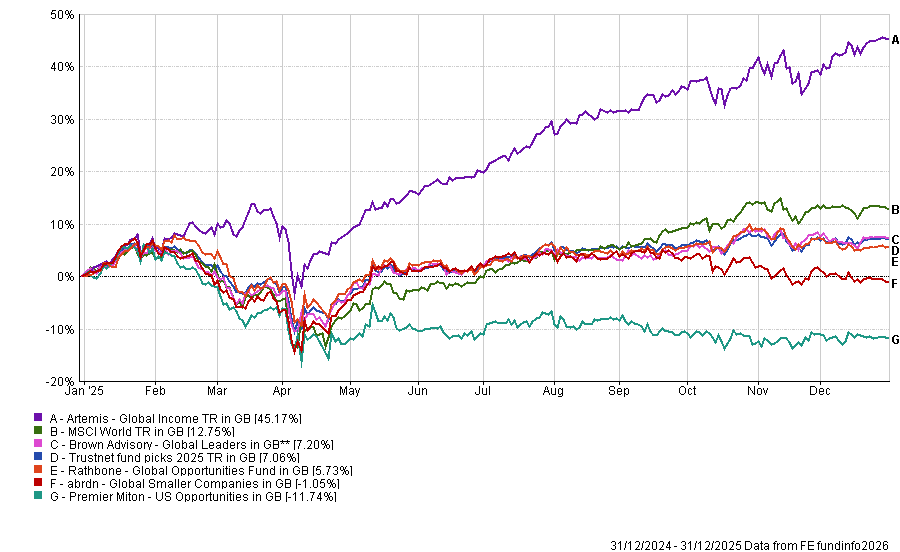

No other funds selected by the Trustnet team made top-quartile returns in their respective sectors last year. In fact, none of them beat their average peers in 2025 either.

In truth, the rest of the list is a disappointing one, but we have broken it into two parts as the next group were less disastrous than the selections below.

Brown Advisory Global Leaders (up 7.2% in 2025) and Rathbone Global Opportunities (5.7%) were both third-quartile performers in the IA Global sector last year, but at least made positive returns.

The first fund was picked by former news editor Emma Wallis, who worried at the time that 2025 could be a volatile one. “I am still undecided about whether the US will continue outperforming all other regions or if cheaper areas are a safer bet. So I’ve decided to delegate geographic decisions to the experts,” she said.

“I don’t know how much longer the current late-stage bull market will last and if next year will be volatile – quite possibly with Donald Trump at the helm of the US. But wherever markets and economies are headed, the companies within Brown Advisory Global Leaders, which are solving problems for their customers and taking market share, are well placed to weather any storms.”

While the fund made money last year, it was a poor one for quality-growth strategies with some of the most high-profile names in the sector struggling.

It was a similar story for my pick: Rathbone Global Opportunities. Heavily skewed to the US (albeit less than an index tracker), I thought Trump would broadly be constructive for markets, having run his campaign on the promise of huge fiscal spending.

As it happens, his ‘Liberation Day’ tariffs and aggressive trade policies had the opposite effect last year. However, one thing I got broadly right was that the fund’s diversification (through holding some ‘Magnificent Seven’ names alongside more defensive companies) at least allowed it to cushion some of the worst falls of the year.

Performance of Trustnet fund picks vs MSCI World in 2025

Source: FE Analytics

The abject disasters

In a year when every major market made money, investors were hard-pressed to pick an equity fund that made a loss, yet two of our picks last year managed this unwanted feat.

Head of editorial Gary Jackson picked abrdn Global Smaller Companies, which ended the year down 1.1%, the sixth-worst return in the IA Global sector.

At the time, he said: “Historically, small-cap companies have shown the potential for higher growth compared to their larger counterparts, particularly during periods of economic recovery. With global economies stabilising and the direction of interest rates likely to remain favourable, smaller companies could stand to benefit.”

However, with so much uncertainty in the US, investors turned their attention to large markets elsewhere in the world. This boosted the returns of non-US large-caps, but did little to bolster minnows in these regions.

Yet, then senior reporter (now deputy editor) Matteo Anelli took the wooden spoon last year with Premier Miton US Opportunities registering an 11.7% loss.

His assertion that the best returns would move away from the ‘Magnificent Seven’ large-cap tech names and filter down the market to other areas that the Premier Miton fund invests in proved incorrect, with large-caps dominating again (although the best returns overall were outside the US).

Here’s hoping our selections this year prove more consistent.