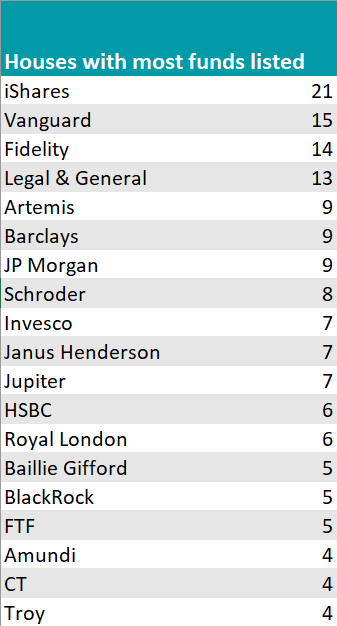

iShares was the most represented fund house on the UK’s major best-buy lists in 2025, underlining the dominance of low-cost passive strategies in the selections made by investment platforms.

Across Hargreaves Lansdown’s Wealth Shortlist, AJ Bell’s Favourite Funds, interactive investor’s Super 60, Fidelity’s Select 50 and Barclays’ Funds List, iShares had 21 recommended funds – more than any other management group.

Vanguard followed with 15, while Fidelity ranked third with 14. The data shows that providers with strong passive ranges continue to attract broad analyst support, although several active managers also featured.

iShares leads the field

iShares, which is owned by BlackRock, topped the rankings with 21 recommended funds. The range is best known for its exchange-traded funds (ETFs), offering low-cost exposure to mainstream equity and bond indices.

Several of its largest and most widely used products appeared on multiple lists. The iShares Core MSCI EM IMI UCITS ETF, which tracks emerging markets equities, was recommended by both AJ Bell and Fidelity. It has assets of £24.4bn and an ongoing charge figure (OCF) of 0.18%.

Developed market exposure was also prominent, with the iShares Core S&P 500 UCITS ETF (£15.1bn, 0.07% OCF) and the iShares Core FTSE 100 UCITS ETF (£13.9bn, 0.07% OCF) among the funds backed by AJ Bell, with the FTSE 100 tracker also making Fidelity’s list.

The breadth of iShares’ representation reflects how central low-cost, highly liquid index trackers have become to best-buy lists designed to serve as core building blocks for portfolios.

Vanguard close behind

Vanguard ranked second, with 15 recommended funds. Like iShares, its presence was driven primarily by its passive offering, reinforcing the view that platforms place significant weight on cost, scale and index fidelity.

One notable addition during the year was the Vanguard Global Small-Cap Index fund, which was added by interactive investor and also appeared on Fidelity’s Select 50. The fund has £4.6bn in assets and an OCF of 0.29%, offering exposure to smaller companies globally.

Vanguard’s flagship S&P 500 UCITS ETF, with assets of £59.0bn and a charge of 0.07%, also featured, recommended by Fidelity.

Multi-asset strategies were represented too, including Vanguard’s popular LifeStrategy range. The largest version by assets under management is the 60% Equity version, which has £18.1bn in assets, an OCF of 0.22% and a place on interactive investor’s Super 60.

Fidelity blends passive and active

Fidelity placed third with 14 recommended funds, standing out for combining index trackers with actively managed strategies.

On the passive side, Fidelity Index World, which has £13.9bn in assets and an OCF of 0.12%, was recommended by Hargreaves Lansdown, AJ Bell and Barclays, making it one of the most widely backed global equity trackers across platforms.

Fidelity also featured strongly for its active funds, however. Fidelity European, with assets of around £4bn and an OCF of 0.91%, was recommended by interactive investor, while Fidelity Special Situations, also a £4bn strategy with a 0.91% charge, appeared on the best-buy lists of Hargreaves Lansdown, AJ Bell and Fidelity itself.

Both are run by FE fundinfo Alpha Managers (Samuel Morse and Alex Wright, respectively), reflecting continued analyst support for selected active approaches alongside passive exposure.

L&G and index investing

Outside the top three, Legal & General Investment Management (L&G) had 13 recommended funds, placing it just behind Fidelity. L&G was recognised for its passive expertise, particularly in UK equities and fixed income.

Among its recommended funds were the L&G All Stocks Gilt Index Trust, which has £2.7bn in assets and a 0.15% OCF, and the L&G Emerging Markets Government Bond (US$) Index fund.

The group’s Future World ESG Tilted and Optimised range also featured, including the developed markets, emerging markets and UK equity variants, reflecting demand for low-cost ESG-tilted index strategies.

Active managers still featured

The top purely active house was Artemis, which had nine recommended funds, four of which are run by FE fundinfo Alpha Managers.

These included Artemis Corporate Bond (Alpha Manager Grace Le and Stephen Snowden convinced both Hargreaves Lansdown and AJ Bell analysts); Adrian Frost’s Artemis Income, which isn’t only popular among Hargreaves, interactive investor and Barclays analysts but is an investors’ favourite too, having amassed £5.3bn of AUM (its High Income sibling also made Hargreaves’ list); as well as the Artemis Strategic Bond, another managed by Le alongside David Ennett and Liam O'Donnell, which is on AJ Bell’s Favourite Funds list.

Next up was JPMorgan Asset Management, which housed nine recommended funds, including strategies across equities and bonds.

Among them were JPM Global Bond Opportunities (£154m, 0.64% OCF), added by Hargreaves Lansdown in July, and JPM Global Equity Income (£709m, 0.84% OCF), recommended by AJ Bell. Larger strategies such as JPM Emerging Markets (£2.4bn, 1.12% OCF) and JPM US Equity Income (£2.5bn, 0.63% OCF) were also present.

Schroders followed with eight funds, including Schroder Asian Discovery (£154m, 1.00% OCF, recommended by HL) and Schroder Managed Balanced (£1.9bn, 0.93% OCF, HL).

Invesco rounded out the list with seven recommended funds, four of which run by an Alpha Manager: William Lam and his team convinced with their Invesco Asian and Invesco Global Emerging Markets portfolios, while Michael Matthews’ Invesco Corporate Bond and Invesco Sterling Bond strategies also featured.

Source: Trustnet