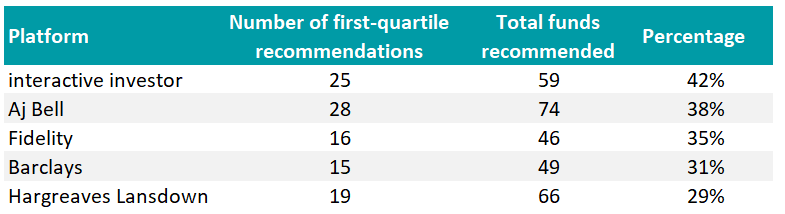

Interactive investor had the highest proportion of first-quartile funds on its best-buy list over one year, according to a Trustnet review of platform recommendations.

The study examined the one-year performance of funds featured on 2026 best-buy lists from the major UK investment platforms and assessed how many landed in the top quartile of their respective sectors last year.

While AJ Bell recommended the largest absolute number of first-quartile funds, interactive investor stood out for having the highest share relative to the size of its list.

The analysis reviewed one-year returns for all funds on each platform’s best-buy list, excluding strategies in the specialist commodities, unclassified and absolute return sectors. However, investors should note that these lists are built with the long term in mind and are not designed for every selection to top the charts every year.

Across the platforms, interactive investor’s Super 60 list contained 25 first-quartile performers out of 59 recommended funds, equating to 42%. This was the highest proportion among the top five UK platforms.

AJ Bell followed with 28 first-quartile funds from a larger list of 74, giving it a 38% share. Fidelity ranked third, with 16 of its 46 recommended funds – or 35% – delivering first-quartile performance over one year.

Barclays placed fourth, as 15 of its 49 recommended funds made the top quartile, representing 31% of its list. Hargreaves Lansdown had the lowest proportion among the group, with 18 first-quartile performers from 66 recommendations, or 27%.

Source: Trustnet

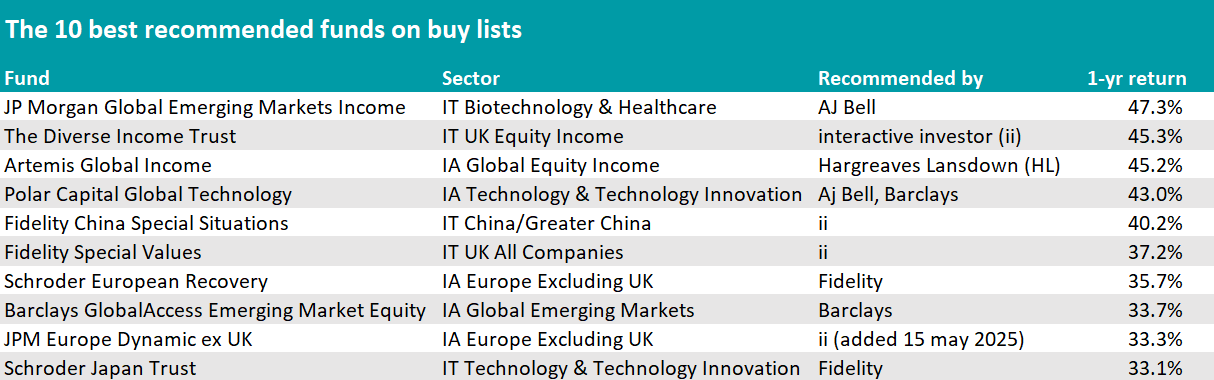

When looking at individual funds, income emerged as a winning theme across global, emerging markets and the UK sectors, with value and recovery funds also topping the performance table.

The strongest one-year return among best-buy recommendations came from JP Morgan Global Emerging Markets Income, which delivered a 47.3% gain and was recommended by AJ Bell.

Compared to its benchmark, the MSCI Emerging Markets index, manager Omar Negyal maintains an overweight to China (30.1% of the fund, a 7.2 percentage points overweight), Indonesia (4.3%, 3.1 above the index) and Mexico (4.9%, 3 percentage points overweight). Crucially, it had a 7.8% underweight in last year’s most disappointing market, India.

The performance table is evenly (five to five) split between open-ended and closed-ended vehicles, with the best trust being The Diverse Income Trust from the IT UK Equity Income sector, which was recommended by interactive investor and returned 45.3% over one year. Co-managers Gervais Williams and Martin Turner invest combining exposure to large, mid and smaller companies.

Artemis Global Income ranked third, with a 45.2% return and appearing on Hargreaves Lansdown’s best-buy list. The fund is an all-cap strategy that combines bottom-up stock selection with consideration of broader economic conditions and has historically had limited direct UK exposure.

Turning to value funds, with China positively surprising last year, Fidelity China Special Situations returned 40.2%. Recommended by interactive investor, its manager Dale Nicholls focuses on smaller and mid-sized companies, seeking to exploit the mispricing opportunities that arise in this under-researched hunting ground.

In the IT UK All Companies sector, another interactive investor pick was Fidelity Special Values, (37.2% return). It is run by FE fundinfo Alpha Manager Alex Wright, a contrarian investor with a bias towards medium and smaller companies, with flexibility to invest overseas where suitable opportunities are not available in the UK market.

Recommended by Fidelity, Schroder European Recovery delivered a 35.7% one-year return. It’s another strategy that invests in companies considered to be out of favour, and runs a relatively concentrated portfolio (58 holdings).

Staying in Europe, JPM Europe Dynamic ex UK returned 33.3% over one year. It was recommended by interactive investor and added to the platform’s list on 15 May 2025, with a return since that date of 18.8%.

Elsewhere, Polar Capital Global Technology also featured, delivering a 43% one-year return. Recommended by both AJ Bell and Barclays, this was the only fund on the list backed by more than one platform. Rounding out the top 10 was Schroder Japan Trust, which delivered a 33.1% return over one year.

Source: Trustnet

Although first-quartile performance indicates outperformance relative to peers, it did not guarantee positive returns across the board. Three funds ranked in the first quartile of their sectors over one year despite posting losses over the period.

Jupiter India, Findlay Park American and HSBC Global Aggregate Bond ETF all fell into this category. Their one-year returns were -0.1%, -0.5% and -2.7% respectively.