Nearly half of UK savers have no intention of switching savings accounts despite the potential to lose hundreds of pounds a year.

A survey by Opinium for Hargreaves Lansdown in September 2025 found that 43% of savers have no plans to move their money to a better-paying account. For someone with £20,000 held in an easy-access account with a high street bank, that reluctance could cost as much as £689 a year in lost interest.

Only 22% of those who do not plan to switch said it was because they already had the best deal. A larger share cited trust in their existing provider, while others pointed to inconvenience or indifference. The findings underline how behavioural factors, rather than lack of opportunity, continue to shape outcomes for savers.

For Sarah Coles, head of personal finance at Hargreaves Lansdown, savers are “horribly sticky”.

“About 43% of savers say they’ll never switch for a better deal, with 27% never having moved in the past either,” she said.

“Unfortunately, this is costing them dear, because the vast majority of money is still in easy-access accounts with the high street giants, so savers are missing out on hundreds of pounds of interest a year.”

A move, she noted, could almost quadruple their rate, with the most competitive easy-access accounts paying up to 4.12% compared with an average of 1.08% at the main high-street banks. On a £20,000 balance, that difference equates to £840 a year versus £217, or £151 in the weakest accounts.

The survey suggests that loyalty and inertia remain powerful influences. Among those planning to stay put, 44% said they trusted their current provider, rising to 50% among savers aged 55 and over.

Practical considerations also played a role: 16% said switching was too much hassle, while 9% said they probably should move but “can’t be bothered”. Meanwhile, banks are benefiting directly from that reluctance.

“High-street banks are cashing in on our fear of faff,” Coles said.

Perceptions about the rate environment also appear to be discouraging action. One in five respondents said interest rates were so low that switching was not worthwhile, while 7% said they were waiting for rates to rise before moving their money. Coles warned that this strategy is unlikely to pay off, noting that “rate rises from here look distinctly unlikely”.

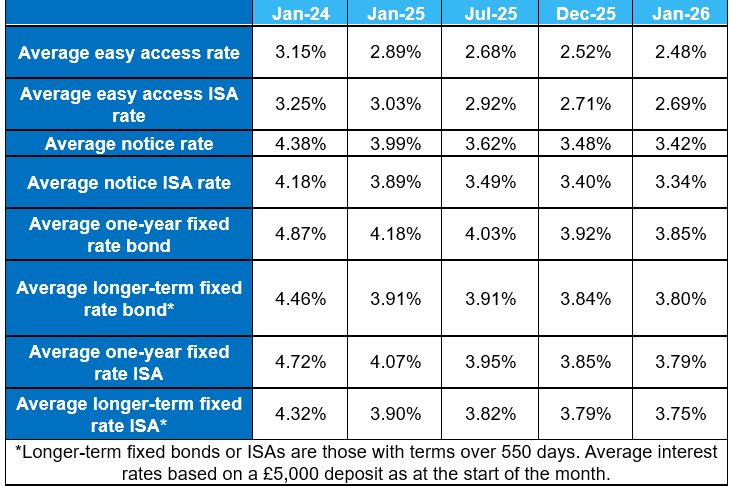

That assessment is supported by data from Moneyfacts, which shows average savings rates falling across most categories as the impact of December’s base rate cut feeds through into retail products.

Savings market average rates

Source: Moneyfacts Treasury Reports

According to the Moneyfacts UK Savings Trends Treasury report, the average easy-access rate fell to 2.48% in January, its lowest level since July 2023, and to 2.69% for cash ISA accounts, while one-year fixed rates slipped to 3.85% and longer-term fixed rates fell to 3.80%, both at their lowest since 2023.

At the same time, the overall number of savings deals has begun to contract. Excluding ISAs, the number of live savings accounts fell to 1,661, while the number of providers dropped to 151, its largest monthly fall since May 2024. Although the number of cash ISA deals rose modestly, the total remains below recent peaks.

Caitlyn Eastell, personal finance analyst at Moneyfacts, said the market was entering a new phase after several years of volatility.

“The impact of December’s base rate reduction is already making itself known, as all average rates have fallen for the first time in over six months.”

“The number of accounts paying above base rate saw its biggest rise on record to 877, accounting for just under 40% of the market. However, this means that over 60% still don’t match base rate, leaving savers’ cash languishing and making it harder to build financial security.”

Eastell said interest rates were expected to settle in a range of 3.25% to 3.50%, levels last seen in December 2022. At that time, the Moneyfacts Average Savings Rate stood at around 2.80%, compared with 3.35% at the start of 2026.

“Together, this signals that current savings rates may not last and there’s still plenty of headroom for rates to fall,” she said.

The combination of lower rates and reduced competition heightens the cost of inaction for savers who remain in underperforming accounts.

The effect is particularly acute for ISA savers ahead of the end of the tax year. While ISA season typically brings a brief increase in competition, Eastell cautioned that waiting for better offers could prove costly.

“Any fluctuations against the trend are likely to be providers reacting to individual targets,” she said, adding that savers should review their rates regularly to ensure allowances are fully used.