A new global equity strategy has topped Trustnet’s annual research on funds that have outperformed their peers on a diverse spread of risk and return measures, after three years of dominance by Royal London Global Equity Select.

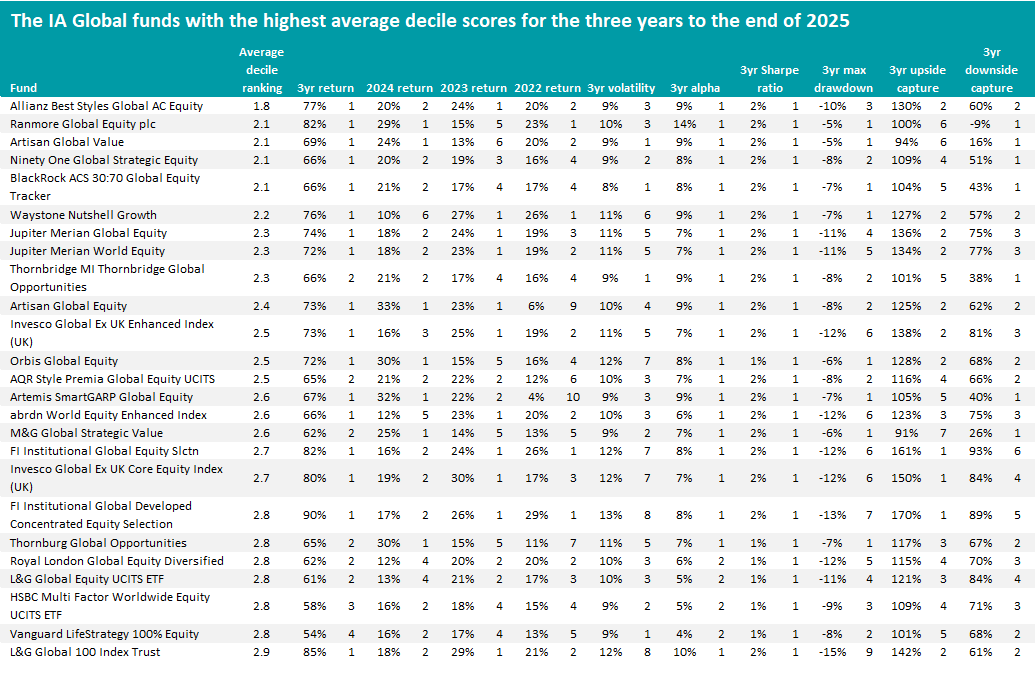

Trustnet runs this series at the start of each year and scores funds on 10 key metrics: cumulative three-year returns to the end of 2025 as well as the individual returns of 2023, 2024 and 2025 (to ensure performance isn’t down to one standout year), three-year annualised volatility, alpha generation, Sharpe ratio, maximum drawdown and upside and downside capture ratios, relative to the sector average.

Funds are then ranked on their average decile for the 10 metrics to discover which were most consistently at the very top of their sector. Put simply, the lower a fund’s average decile score, the stronger it has been on multiple fronts over the past three years.

Royal London Global Equity Select was the top-ranked fund in the IA Global sector during 2023, 2024 and 2025 but has fallen into 67th place with an average decile rank of 3.3 in 2025. This year, the fund below has come first in the place.

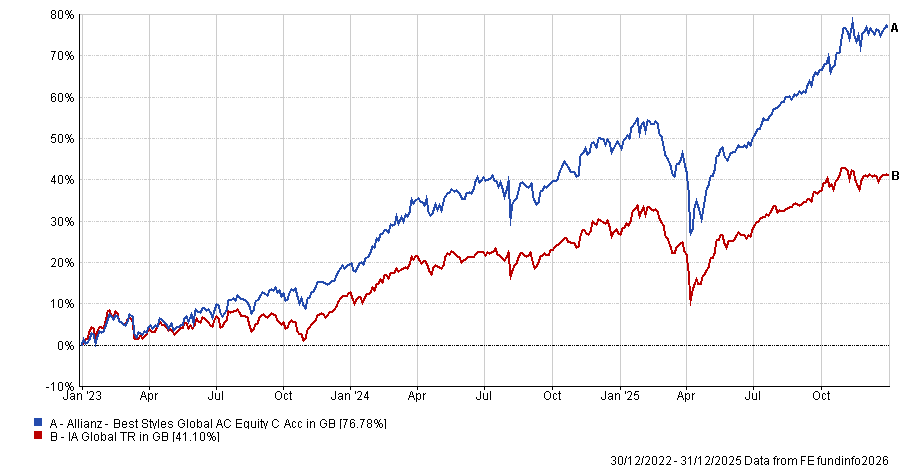

Performance of Allianz Best Styles Global AC Equity vs sector and index over 3yrs to end of 2025

Source: FE Analytics

Allianz Best Styles Global AC Equity has an average decile score of 1.8, thanks to first-decile numbers for three-year returns, performance in 2024, alpha and Sharpe ratio. It is also in the second or third decile for the remaining six metrics.

Manager Erik Mulder uses a ‘best styles’ approach when building the portfolio, which allows him to follow different investment styles – value, quality, growth, momentum and revisions - when selecting individual stocks, depending on market conditions.

The £248m fund has its largest sector overweight to information technology, followed by healthcare and communication services, while South Korea, China and the UK are the biggest country overweights. Tech stocks Nvidia, Apple, Microsoft and Alphabet are the largest individual holdings.

Source: FE Analytics. Funds with same average decile score are ranked by three-year returns

Ranmore Global Equity came in second place with an average decile score of 2.1. Its three-year total return of 82.3% is higher than that made by Allianz Best Styles Global AC Equity; it is also in the IA Global sector's top decile for returns in 2023 and 2025, alpha, Sharpe ratio, maximum drawdown and downside capture.

Sean Peche uses a value approach when running the £1.6bn fund, looking at long-term cashflow streams while avoiding over-leveraged businesses and following the crowd. The manager also does not meet company management (“we don’t want biases”) and only focuses on the one fund.

Explaining the process, Peche said: “We prefer to buy companies when they’re out of favour and the market is pessimistic about the outlook because that’s when you’re not paying for ‘the future’. If the future turns out to be as bad as feared, it was often already discounted in the price, meaning the downside is limited. But if the future is not as bad as feared or better still, good, the reassessment of this less bad/rosy future can lead to great returns. It’s this asymmetry we seek – low downside, meaningful upside.”

Ranmore Global Equity is significantly underweight the US and information technology, with big overweights to Asia and consumer discretionary. Top holdings include Greggs, Comcast and easyJet.

Artisan Global Value is in third place in this research with an average decile score of 2.1 and a 68.5% total return. Managers Daniel O’Keefe and Michael McKinnon invest in high-quality, undervalued businesses and count Samsung Electronics, Alphabet and Heidelberg Materials among their top stocks.

The fortunes of some of the largest and best-known global equity funds is mixed, however. Fundsmith Equity – the biggest active member of the IA Global sector – is ranked 401st on the back of its 7.4 average decile score and three-year return of 23.3%.

Earlier this month, manager Terry Smith explained the reasons for the £15.8bn fund’s recent underperformance, pointing to index concentration, the rise of index funds and dollar weakness as contributing factors.

Rathbone Global Opportunities is ranked in 206th place in this research after scoring 4.8, while Lindsell Train Global Equity is 333rd with a 6.2 average decile score. The £11.1bn Vanguard LifeStrategy 100% Equity fund, on the other hand, averaged a 2.8 decile on the 10 metrics we examined, putting it in 24th place.

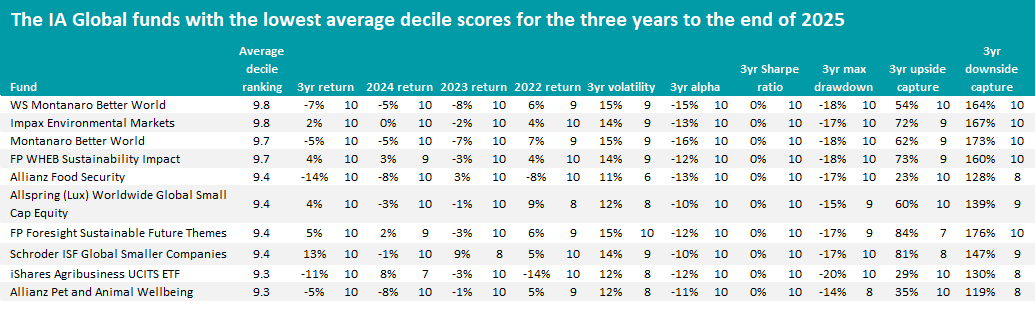

Source: FE Analytics. Funds with same average decile score are ranked by three-year returns

The IA Global funds that came out worst in this research largely fit into a handful of themes.

Responsible investing has struggled over recent years, as interest rates remained much higher than the historic lows they had sat at for the previous decade.

WS Montanaro Better World, Impax Environmental Markets and FP WHEB Sustainability Impact all appear on the list with average decile scores of 9.7 or 9.8.

Smaller companies have also underperformed during the recent past as the market was led by a handful of US mega-cap tech companies, as reflected in the appearance of Allspring (Lux) Worldwide Global Small Cap Equity and Schroder ISF Global Smaller Companies.