Gold has been the standout safe haven of the past decade, turning £10,000 into £30,904 in real terms while traditional alternatives have either stagnated or lost substantial buying power, according to analysis by AJ Bell.

The yellow metal dominated the headlines in 2025, setting successive record highs over the course of the year. The precious metal rose over 50% during 2025 alone, leaving other traditional safe havens trailing far behind.

Laith Khalaf, head of investment analysis at AJ Bell, said: “Gold is on an absolutely blistering run at the moment. It's now cruised through the $5,000 mark when it was only trading at $2,000 an ounce just over two years ago.”

AJ Bell reviewed the performance of several safe havens over the past 10 years and found an investment of £10,000 in gold a decade ago would now be worth £43,198 in nominal terms. After accounting for inflation, that same investment would still be worth £30,904, a real return of 209%.

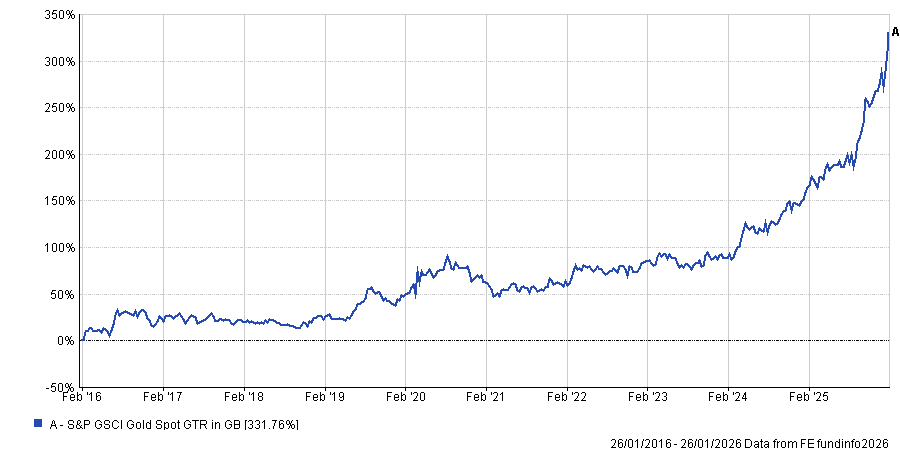

Performance of gold over 10yrs

Source: FE Analytics

Of course, with the metal at a record, investors will be asking how high it can go from here. Khalaf acknowledged the difficulty in assessing gold’s future trajectory.

“These questions are extremely difficult to answer because, like its digital counterpart Bitcoin, there is little in the way of underlying fundamentals to provide a meaningful valuation for gold,” he said.

“Its price is therefore highly driven by sentiment, unpredictable macroeconomic tides and for technical traders, by pretty shapes on a chart.”

But current market conditions seem to continue to support gold's appeal. Khalaf noted the unstable geopolitical environment and US president Donald Trump's repeated attacks on the Federal Reserve as factors that can support the metal’s price.

“Neither of those genies look like climbing back in their bottles any time soon,” he added.

He pointed to broader structural factors underpinning gold's strength, including the huge amount of government debt issuance in developed economies.

But Khalaf urged some caution about chasing gold’s recent performance, warning that strong past performance can indicate crowded positioning and warn of a looming correction.

Gold's volatility presents particular risks for conservative investors: While gold is often touted as the ultimate safe haven because it’s free from government interference, it is volatile and downdrafts can be painful for investors. Those with a cautious disposition and a low tolerance for losses should take note.”

He therefore recommended a typical balanced portfolio should have only have 5% to 10% invested in gold to cushion falls in stocks or bonds.

AJ Bell’s figures show the performance of gold over the past decade is substantially better than the other safe havens investors often turn to.

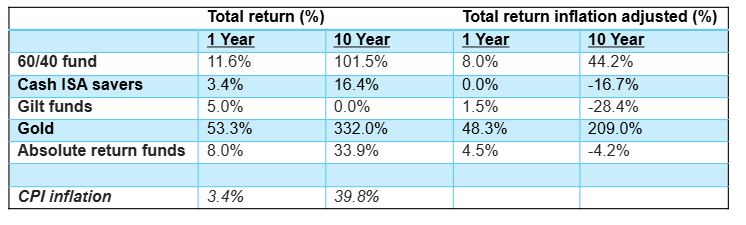

Safe havens compared: % returns

Source: AJ Bell, Bank of England, FE, Morningstar, ONS, total return in GBP to 31 December 2025. Category definitions: 60/40 fund – Vanguard LifeStrategy 60%; Cash ISA savers – average Cash ISA; Gilt funds – IA UK Gilt sector average; Gold – average of three popular Gold ETCs; Absolute return funds – IA Targeted Absolute Return sector average.

Cash savings have fared particularly poorly over the period. “The average cash ISA has actually gone backwards over the past 10 years once inflation is factored in,” Khalaf said.

The data shows £10,000 invested in the average cash ISA a decade ago would now be worth just £8,325 in real terms, a loss of 16.7%. In nominal terms, the same investment would have grown to £11,637, representing a 16.4% return before inflation.

The decade included a prolonged period of ultra-low interest rates followed by an inflation crisis. Khalaf noted this combination has been particularly damaging: “Perhaps such factors will not be repeated any time soon, but these numbers still provide a salutary lesson in why holding too much cash can open you up to significant inflation risk, especially over longer time periods.”

UK gilt funds have suffered even steeper losses in real terms as £10,000 invested 10 years ago would now be worth £7,155 after inflation, down 28.4%.

The shift to higher interest rates inflicted heavy losses on bondholders. “The transition to higher interest rates was absolutely brutal for gilts, which saw enormous price falls in 2022,” Khalaf said.

The changed rate environment has altered gilt market dynamics and, now that interest rates have risen and yields are higher, he argued that gilts look more appealing as a safe haven.

Khalaf highlighted shorter-dated, low-coupon gilts as being particularly attractive, not least for their favourable tax treatment. However, he also noted risks remain in the form of high issuance levels, potential sustained inflation above target and disruption in global bond markets in the US and Japan.

For investors willing to hold to maturity, gilts offer certainty. “If you buy individual gilts and hold them to maturity, you're guaranteed your return, except in the extremely unlikely event of the UK government defaulting,” Khalaf said.

Absolute return funds have also disappointed over the decade, according to AJ Bell’s analysis. The average fund in the IA Targeted Absolute Return sector has lost 4.2% in real terms over 10 years: £10,000 invested would now be worth £9,582 after inflation, despite these funds typically aiming to beat inflation.

Khalaf acknowledged the sector contains wide performance dispersion. “But it's fair to say that as a category absolute return funds have not covered themselves in glory over the past 10 years,” he said.

The structural approach of these funds may explain their struggles. "These funds often contain both long and short positions, which means investors get less of a tailwind from rising market levels and returns are more heavily dependent on the decisions of the manager, so fund selection is key," he said.

A traditional 60/40 equity-bond strategy has performed more credibly as £10,000 invested in a 60/40 portfolio 10 years ago would now be worth £14,418 in real terms, a gain of 44.2%.

The strategy doubled investors' money in nominal terms, reaching £20,153, despite the nasty bond sell-off that hit their fixed income allocations when interest rates rose.

“For many cautious investors a 60/40 portfolio, or a broader multi-asset portfolio, will tick a lot of boxes in terms of balancing risk and long-term returns,” he said.