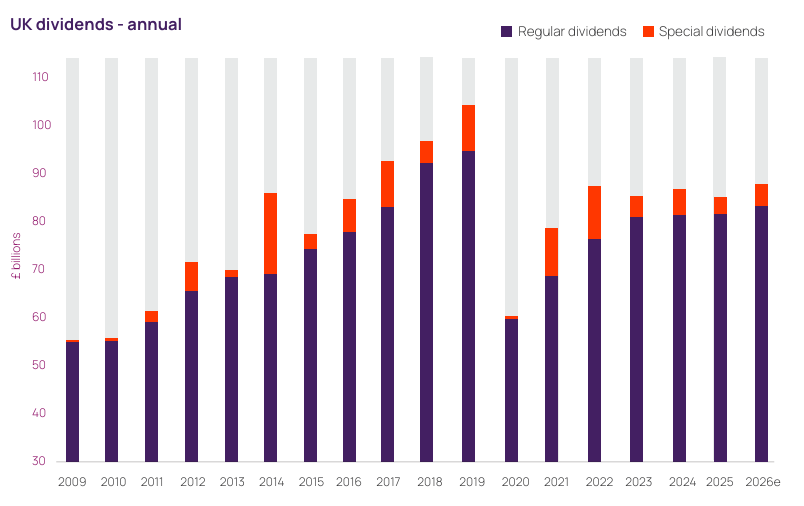

UK dividend payouts declined in 2025, marking another year in which distributions failed to regain the levels seen before the pandemic.

Computershare’s latest Dividend Monitor report said the 0.9% fall brought total payouts to £87.5bn, continuing a pattern of slow recovery since 2020. This is on a headline basis, which includes currency movements and one-off payouts.

Lower one-off special dividends contributed to the headline decline, while exchange-rate headwinds and sector-specific cuts from mining and telecoms companies also dragged.

Regular dividends, which exclude one-off special payments, rose to £84.7bn. Underlying growth on a constant-currency basis reached 3.6%, ahead of the 2.5% forecast.

Source: Computershare Dividend Monitor

Computershare’s Mark Cleland said: “Dividend payouts have still not regained pre-pandemic highs and the slow dividend growth we’ve seen since 2020 largely continued last year.”

Cuts from Vodafone in the telecoms sector and reductions across mining companies masked healthier results from the broader dividend market. The median dividend increase at the company level was 3.7% in 2025.

This median figure suggests the headline decline is distorted by large cuts from a small number of companies. Most companies increased their dividends at rates above the headline performance.

The fourth quarter showed a positive turning point for the market. Dividends rose 1.3% to £14.3bn during the three-month period, the only quarter of the year to post a headline increase.

Regular dividends climbed 2.1% on a constant-currency basis to £13.9bn in the final quarter. The report noted that the fourth quarter ended positively thanks to better than anticipated payouts in the energy, consumer basics and property sectors.

“Rates did improve as 2025 progressed – and might well have been higher although many companies used significant sums of capital to undertake share buyback programmes,” Cleland said.

Companies promoted from AIM provided an additional boost. A late surge in volatile special dividends, notably from Sainsbury and Admiral, also lifted fourth-quarter performance.

The industrial goods and support sector made the strongest contribution to full-year growth. Rolls-Royce returned to the dividend tables after a four-year absence while BAE Systems delivered a large increase, reflecting buoyant aerospace and defence markets.

Banks, insurers and general financials increased regular dividends by £1.2bn across the three sectors collectively.

Healthcare, utilities and basic consumer goods also made notable positive contributions, but housebuilding and the consumer sector saw reductions from Bellway and Burberry.

Share buybacks reached a provisional £63.6bn last year, up from £30.8bn in 2019. Buybacks were worth 73p for every £1 in dividends in 2025, compared with just 30p in 2019.

The increase in share buybacks over the past six years has reduced annual dividend growth by approximately three percentage points.

Looking to 2026, the Computershare Dividend Monitor predicts total dividends of £88.8bn, up 1.5% on a headline basis. Regular dividends of £85.9bn are anticipated to rise 2% on a constant-currency basis.

The modest growth projection suggests the slow path back to pre-pandemic levels will continue and UK equities are expected to yield 3.3% in 2026.

Cleland said: “There are no clear indications that dividends will grow much faster in 2026, but a median dividend growth of 3.7% suggests a healthier market trend than the outlying figures suggest.”