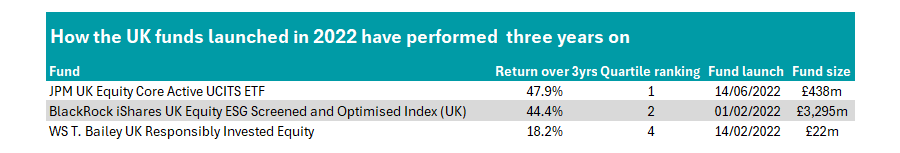

Three UK funds launched in 2022 crossed their pivotal three-year anniversary last year, data from FE Analytics shows, but only one was able to top its sector while establishing its track record.

In this series, Trustnet looks at the funds launched in 2022 that turned three years old during 2025. To maintain consistency, we have looked at their performance over the three years from the start of 2023 to the end of 2025. Previously we have looked at the US.

JPM UK Equity Core Active UCITS ETF was the only top-performer of the young UK funds. One of three funds on the list from the IA UK All Companies sector, it made a 47.9% return between 2023 and 2025, placing it in the top quartile of the peer group.

Managed by James Illsley, Callum Abbot, Christopher Llewelyn and Richard Morillot, the £424m fund aims to beat the FTSE All Share index by moderately overweighting stocks the managers have the most conviction in, while underweighting those they are least keen on.

This strategy means the fund will have broad sector exposure that is similar to the index and a large number of stocks. Currently it holds 145 companies, with HSBC and AstraZeneca (7.5% of the portfolio each) the largest holdings.

It is similar in nature to the JPM UK Equity Core portfolio but uses a different fund structure. Active exchange-traded funds (ETFs) are managed by investment professionals who make decisions on asset selection in real time and aim to outperform the market through stock selection.

They have gained traction in the UK and across Europe as regulatory changes and investor demand for flexibility have aligned.

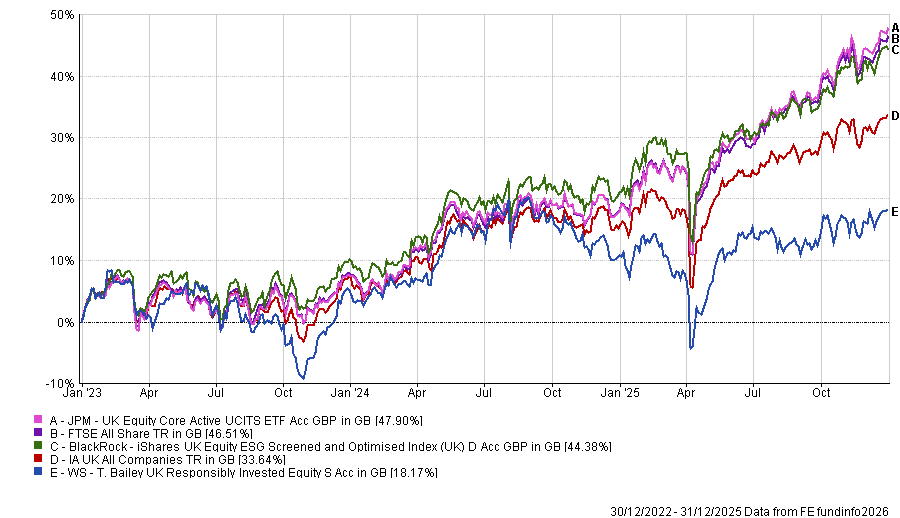

Source: FE Analytics

The next-best performer launched in 2022 was the £3.3bn iShares UK Equity ESG Screened and Optimised Index (UK). This passive fund tracks the Morningstar UK ESG Enhanced index, which uses environmental, social and governance (ESG) screens to whittle down stocks, weighting the remaining constituents accordingly based on their market capitalisation.

It has the same top two holdings as the JP Morgan fund above, although it has higher weightings at 8.7% and 8.3% respectively and has made a similar return, up 44.4%. This was ahead of the sector average, but placed the fund at the top of the peer group's second quartile.

Among the three IA UK All Companies funds launched in 2022, WS T. Bailey UK Responsibly Invested Equity has the weakest performance.

The £21.8m fund run by Elliot Farley and Peter Askew since its launch has made just 1.4% since inception in February 2022.

Returns over three years to the end of 2025 are better, with the fund up 18.2%, although this remains a bottom-quartile performance in the sector.

Performance of funds vs sector and FTSE All Share over 3yrs

Source: FE Analytics. Data to 31 December 2025.

It invests in stocks that have positive environmental and social sustainability characteristics. The 30-stock portfolio particularly struggled in 2025 as large-caps dominated.

In the fund’s December factsheet, the managers said: “Whilst UK equities remain supported by comparatively high dividend yields and global revenue exposure, domestic growth has remained constrained.

“This market structure has remained a headwind to the fund throughout the year as, despite their share price trajectory, the majority of these market leaders don’t meet the metrics of sustainable financial strength to be eligible investments.”

Indeed, funds with an ESG investment approach lagged their conventional peers in 2025, particularly in the UK, where ESG-focused funds made around 3.7 percentage points less than their more traditional peers.

WS T. Bailey UK Responsibly Invested Equity has a high weighting to industrial goods and services, while just 6.7% in banks, 8.2% in construction and materials, 3.4% in basic resources and nothing in energy.