The Japanese market enjoyed a renaissance in 2025, sitting behind only the emerging markets as the top-performing major equity region last year.

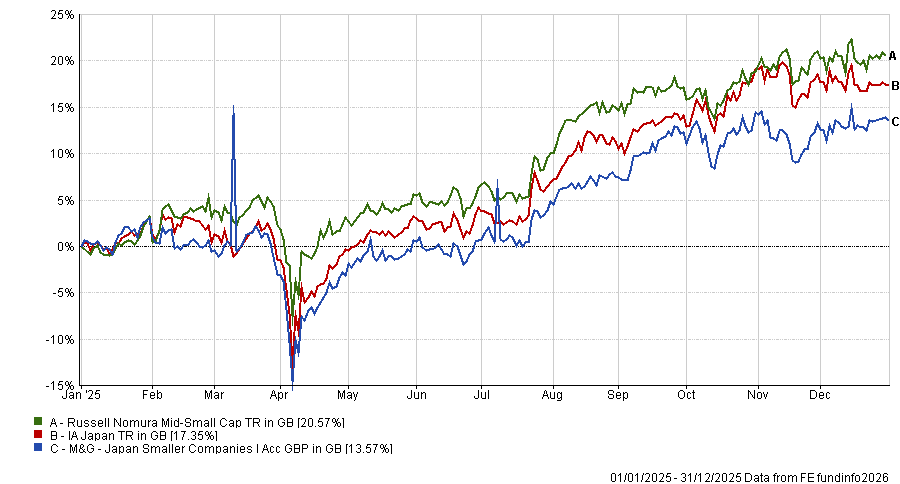

But not all funds were able to benefit from its resurgence. Indeed, FE fundinfo Alpha Manager Carl Vine’s M&G Japan Smaller Companies delivered a fourth-quartile 13.6% return over one year, lagging both its benchmark and the broader sector, with the former gaining 19.8%.

This short-term slip contrasts sharply with the strategy’s long-term credentials. Over 10 years, the fund has returned 190.6%, placing it among the sector’s first quartile winners over a period where Japanese equities performed poorly relative to other markets.

The strategy aims to beat the Russell/Nomura Mid‑Small Cap index over rolling five-year periods by running a high‑conviction, bottom-up portfolio of typically fewer than 60 holdings – picked from a core universe of over 250 Japanese companies.

The portfolio leans towards industrial goods and services and technology, with top holdings including Ichigo, Sparx Group and Infroneer Holdings.

Despite its short-term performance, FundCalibre analysts said the fund’s longer-term track record has been bolstered by the deep regional experience of the management team, reinforced by M&G’s Asia Pacific team.

They said: “Vine and his team have delivered excellent long-term performance in a very tricky and high-risk market. This is thanks to the team’s vast experience and deep knowledge of the companies they invest in and what their drivers are.

“Their strong engagement strategy with companies helps them uncover unique investment opportunities. The fund should be a strong consideration for anyone looking for Japanese smaller companies exposure.”

Performance of the fund vs sector and benchmark in 2025

Source: FE Analytics

Conversely, where the M&G fund faltered, a cluster of long-term laggards enjoyed a renaissance in 2025 as the market rebounded.

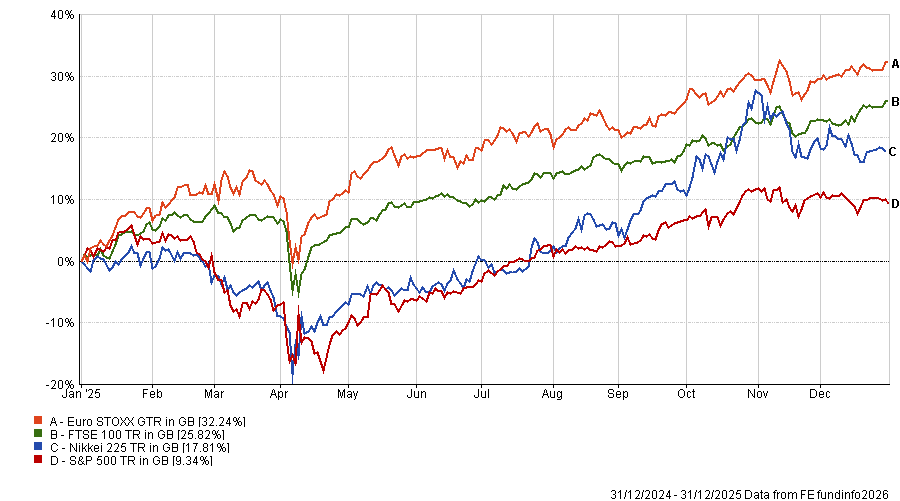

The Nikkei 225 gained 26.6% over the 12 months as a combination of global and domestic forces propelled the market higher.

While anticipation of US Federal Reserve rate cuts and an artificial intelligence (AI) build-out surge on the world stage were boons for the market, at home, Japan also benefited from rising wages, ongoing corporate governance reforms and strengthening retail participation.

Performance of the Nikkei 225 vs FTSE 100, Euro Stoxx and S&P 500 in 2025 (in sterling terms)

Source: FE Analytics

Against this backdrop, funds in the Investment Association (IA) Japan sector made an average 17.4% in 2025, making it one of the top 10 best-performing sectors for the year.

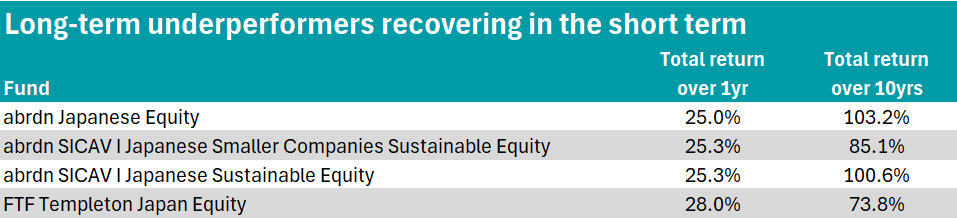

Benefitting from this shift in particular were a trio of strategies from Aberdeen Investments and FTF Templeton Japan Equity.

Source: FE Analytics

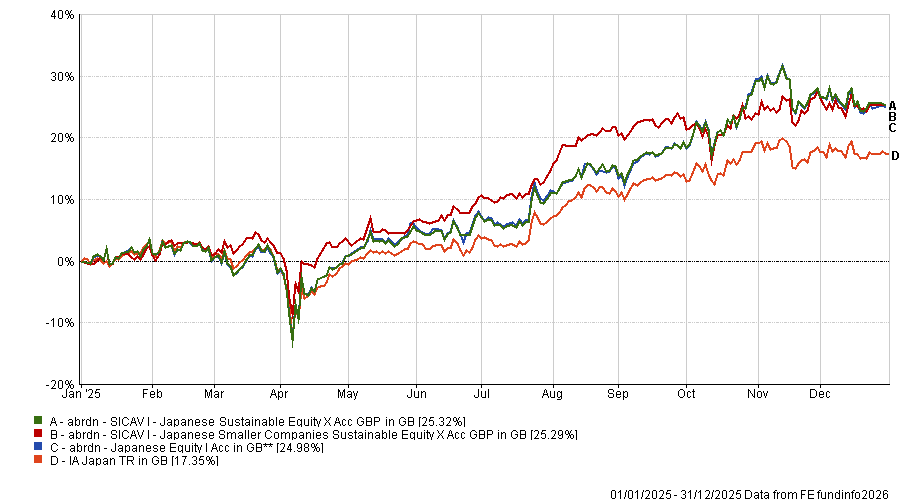

Abrdn Japanese Equity gained 25% over the year, making up a quarter of its total return over 10 years (103.2%). Led by managers Chern‑Yeh Kwok, Yuki Meyer and Zui Shiramoto, the strategy aims to outperform the MSCI Japan index via a 61-stock portfolio anchored by household names including Mitsubishi, Sony and Toyota.

Its small-cap sister strategy, Abrdn SICAV I Japanese Smaller Companies Sustainable Equity, managed an almost identical one-year return of 25.3% but has a weaker 10-year track record of 85.1%.

The fund’s sustainable investing framework – overseen by Kwok, Hisashi Arakawa and Jun Oishi – targets smaller companies considered environmental, social and governance (ESG) leaders or those showing clear potential to improve, with subsequent engagements and exclusions based on the asset manager’s ESG House Score system.

The one-year rebound also extended to Abrdn SICAV I Japanese Sustainable Equity, which matched Abrdn SICAV I Japanese Smaller Companies Sustainable Equity’s 25.3% return over one-year. It is also the best-performing fund of the three of 10 years, gaining 100.6%.

Performance of the funds vs sector in 2025

Source: FE Analytics

Rounding out the list of short-term standouts was FTF Templeton Japan Equity, which delivered the strongest one-year gain of the group, up 28%. It has a more modest 10-year return of 73.8%.

Managed by Chen Hsung Khoo and Ferdinand Cheuk, the £138.4m strategy aims to increase value through investment growth over periods of five years or more.

The portfolio carries a distinct tilt toward industrials and financials, with allocations of 31.1% and 24.5% respectively – higher than the benchmark weightings of 26.5% and 16%.

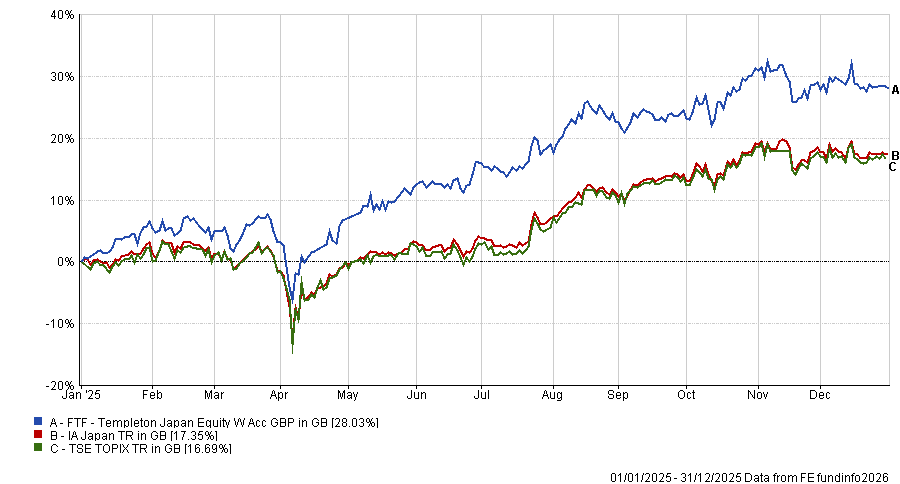

Performance of the fund vs sector and benchmark in 2025

Source: FE Analytics