The surge of artificial intelligence (AI) has not only injected fresh momentum into the technology sector but also created pockets of exuberance that fund managers need to navigate carefully.

Michael Seidenberg, manager of the £1.9bn Allianz Technology Trust, said he does not look for “story stocks” in the AI race but for the companies making themselves invaluable in the build-out of the technology.

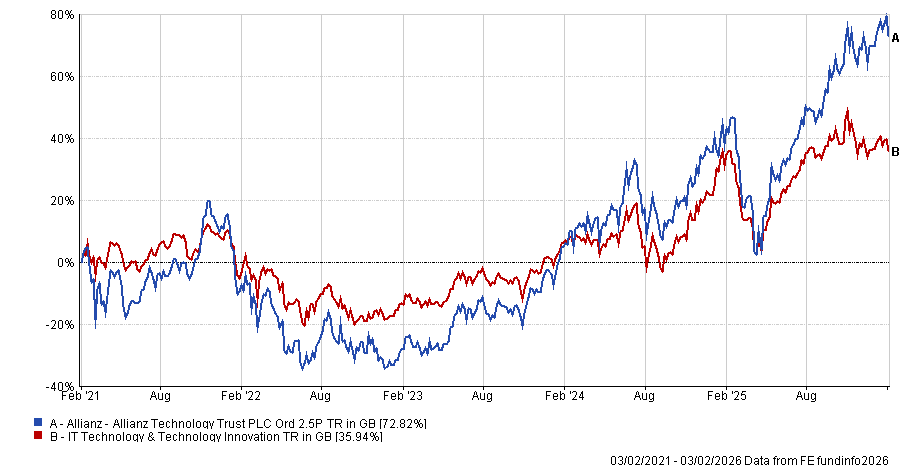

The trust has consistently been in the second quartile for returns in the IT Technology & Technology Innovation sector over one, three and five years, gaining 72.8% over five years – more than double the sector average of 35.9%.

Over a decade, the trust has delivered a first quartile return of 833.6%.

Performance of the trust vs sector over 5yrs

Source: FE Analytics

Although five of the Magnificent Seven currently sit in the trust’s top 10 holdings, Seidenberg argues strongly that returns will increasingly come from a broader opportunity set.

“The Magnificent Seven are amazing companies and they did well last year – they have had an incredible run,” he said.

“But we also want to see breadth in the market. We need to see other companies contribute to the evolution of technology because you don’t want to be dependent on a handful of names.”

As markets continue to broaden out, Seidenberg said he would expect to find “better ideas elsewhere”.

Below, he explains how he identifies genuine AI beneficiaries.

Please explain your process.

I have been working on the trust since 2009 and running it since 2022. I used to work at Oracle and worked in biotech before business school. I have always loved technology and loved learning about what makes businesses in the sector tick.

Our core philosophy is predicated around building a technology-focused mosaic by looking at a variety of inputs.

Not only are we looking at results, which gives us a snapshot of a business, but we also tend to go and meet these companies as I believe it is important as a technology investor to understand the products and services that you are investing in.

Ultimately, we get to a portfolio that sits somewhere between 40 and 75 stocks, depending on the environment. Over the past few years, we have run it tighter with fewer names and I think that has been good for our investors as, on average, the trust has been less volatile.

Do you think there is an AI bubble and how do you identify the winners?

I’m not worried about AI being a bubble long term. The reality is that it has huge potential to disrupt and influence many industries, which means there is and will continue to be a lot of opportunity.

Of course, not every company that says it is an AI winner is going to be a winner but it is still true that the value AI is driving is really impressive.

I am not going to invest in a business just because it claims to use AI. How is that AI manifesting itself? What does that mean for company’s competitive positioning? What does this mean for its customer base?

We also tend to be more focused on mid- and large-cap companies. Recently, we have been very overweight semiconductors – not necessarily the obvious picks like Nvidia.

What were the biggest winners for the trust over the past 12 months?

Our best contribution last year was Micron, which we have held since around 2016 and made up 4.6% of the portfolio as at the end of December. Micron has been a stalwart for us. It is one of those names that is cyclical, so we tend to vary our position in it.

Our holding in Micron is currently a 3.6% overweight to the index.

[The share price is up over 220% over one year and 313% over five years.]

Another winner is Celestica, which is a manufacturer of white boxes – some of the products that go inside a data centre that are built from a proprietary standpoint.

Celestica was initiated [into the portfolio in] November 2024. Again, the position size has varied, including a short period of not owning it in the second quarter of last year. It is still held now at a 1.15% overweight to the index as of end of December 2025.

[Celestica’s share price is up 188% over one year and 3,561% over five years.]

And the losers?

Our biggest negative attribution last year was software company Atlassian. Software has been a really tough space for the past couple of years. Traditionally, it has been a rich area for us.

The company has been in and out of the portfolio. We held it from mid-2021 to mid-2022, from the third the fourth quarter of 2022 and then not until November 2024.

The position size was built up a little in January 2025, roughly halved in June 2025 and sold fully in October 2025.

[The company’s share price is down 47% over one year and down 41% over five years.]

But if I take a ratio of our portfolio’s biggest winner to our bigger loser, it’s roughly three to one – I’ll take that all day long.

The trust’s discount to NAV currently stands at around 7%. Do you place much emphasis on closing the discount?

My job is to create the best portfolio for our investors – I don’t have a lot of control over the discount. If we continue to deliver good returns for our investors, over time, the discount will take care of itself. I don’t spend a whole lot of time fretting about it.

What do you like to do outside of fund management?

I love to read and to cook – ultimately, I am really interested in learning.