The past few years have been an abject disaster for the active fund management industry, with investors turning their back on the professionals in favour of simply tracking the entire market.

Active managers have been left out in the cold by investors, in particular, over the past three years. Data from Calastone shows that, from the start of 2022 to the end of 2025, some £56.4bn was added to passive funds, while £26.6bn was removed from active strategies.

It means that over the past decade, £7.4bn has been added to active managers, while £89bn has been put into tracker funds. There have been years when investors have backed active funds (in 2015, 2017 and 2021) but they have been few and far between.

The data backs up that it has been a poor time to invest actively. Last year, active funds outperformed their passive counterparts in 22 sectors, while passives were the better choice in 27 peer groups, including popular sectors such as IA Global, IA UK All Companies, IA UK Equity Income and IA North America.

The rise of passive investing has been a huge part of the market upswing. Furore around artificial intelligence (AI) has pushed the largest US stocks higher. The ‘Magnificent Seven’ of Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia and Tesla have risen to astronomical sizes, both in terms of market capitalisation and their weighting in premier US and global indices.

As more people pile into global or US equity market trackers, more money flows disproportionately to these companies, which has made it very difficult for active managers to overweight them and outperform.

Last year, investors began to look elsewhere, concerned that the AI hype may have caused too much froth. Yet investors have been so ingrained into investing passively that much of the money moving out of the US was redistributed into different markets around the world through other passive vehicles.

This is underscored by the performance of markets in the UK. The FTSE 100 index of large-caps rocketed higher as investors put their cash in funds that track either the large-cap index or the FTSE All-Share – an all-market benchmark that is heavily weighted to the largest stocks.

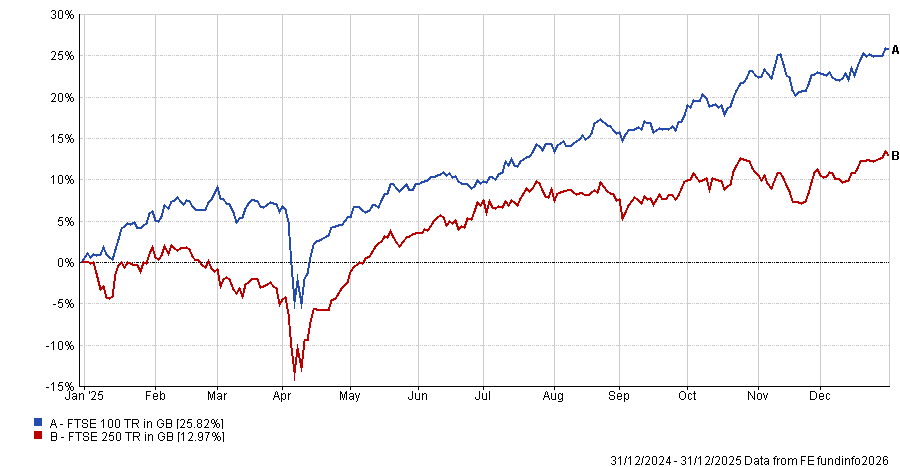

Active managers tend to hunt in the FTSE 250 mid-cap space, which severely lagged; in 2025 the FTSE 100 made 25.8% while the FTSE 250 rose just 13%.

Performance of indices in 2025

Source: FE Analytics

This is not a new phenomenon. Only once in the past five years (2023) have UK mid-caps topped their large-cap cousins.

There are risks that come from a world where passive investing dominates. Perhaps most importantly, when markets fall, tracker funds will feel the full brunt of any losses.

But there are no guarantees with active managers either. Some may protect on the downside, while others may win big on the upside. A very select few may do both. Yet there are a whole host of portfolios in the middle that will fail to do either in this new world.

The ‘safer’ pick may be to follow the herd, investing in passives to ensure you get 100% of the upside (assuming active managers will struggle to beat this), while taking your lumps when markets fall.

But the future is unlikely to look like the past and, with geopolitical uncertainty rife (stemming in particular from the US), markets could be choppier than in the past, with market falls possibly becoming more frequent.

Time will tell if active managers can weather this better and come out on top but for now, the recent past shows that there has only truly been one reliable winner – the funds that have followed the market.

While past performance is a poor guide for what the future may bring, backing against passive investing is a brave move. Now may be the time, but it will take nerves of steel to do so. And the results will only be evident much further down the line.