China was the only game in town in February, when seven out of the 10 best performing funds were Chinese equity specialists.

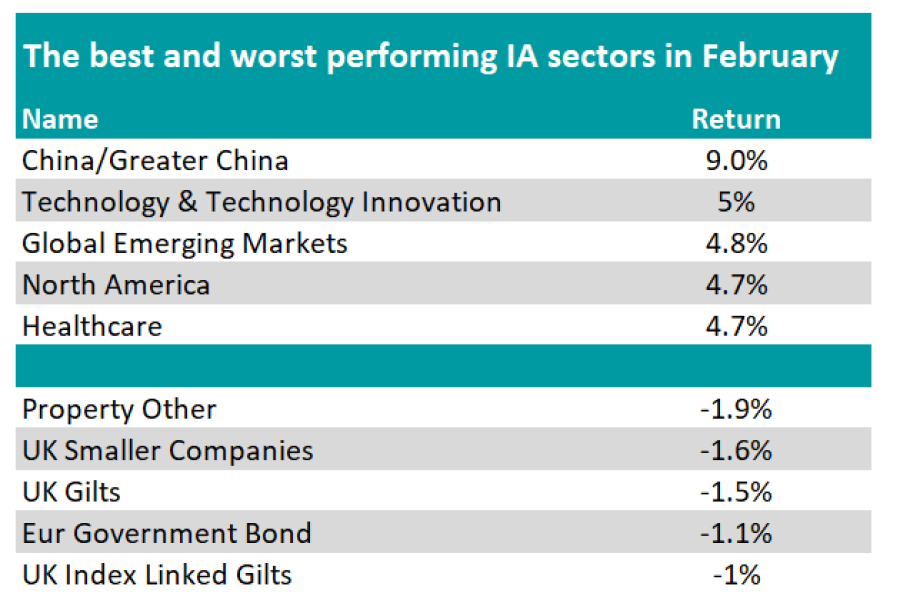

The IA China/Greater China sector was up 9%, significantly ahead of IA Technology & Technology Innovation, although China’s gains came on the back of lacklustre performance in January 2024 and steep losses in 2023, when the sector fell by 20%.

Ben Yearsley, director at Fairview Investing, said: “China was the surprise package last month with the Hang Seng gaining over 6% on more targeted stimulus measures. Despite this, Chinese equities remain at 20+ year lows against broader equities. Even after a good February the Hang Seng is still down in 2024.”

Source: FE Analytics

Chinese GDP grew by 5% in 2023, but the world’s second largest economy remains weak. The manufacturing purchasing managers' index shrank for a fifth month in a row, while overseas investment expanded at the slowest pace in 30 years.

On the positive side, spending over the recent lunar new year reached levels last seen in 2019.

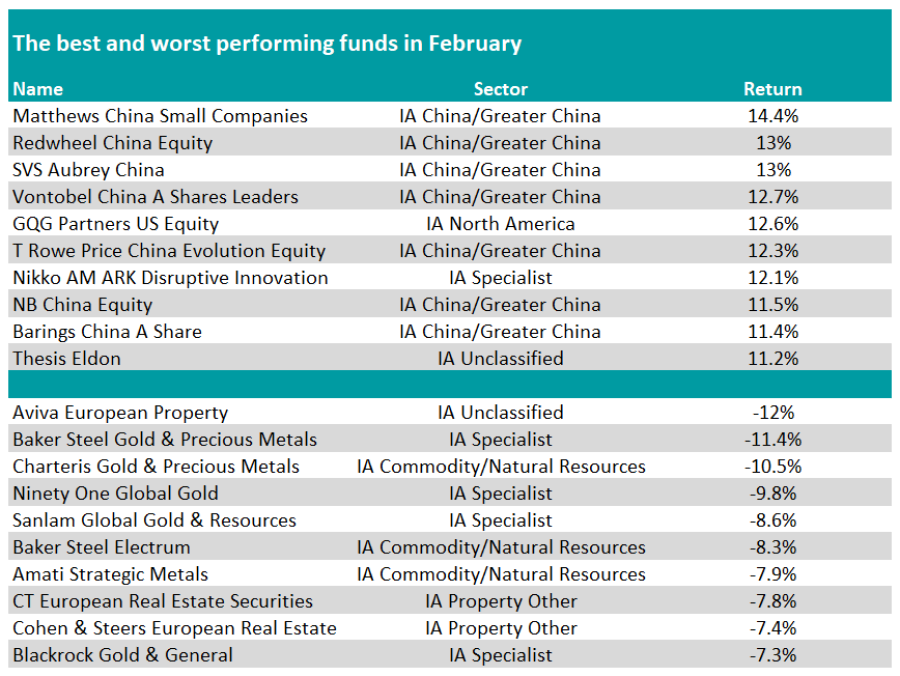

Turning to individual funds, Matthews China Small Companies topped the ranking with a gain of 14.4% last month. The next best performing funds were Redwheel China Equity, SVS Aubrey China and Vontobel China A Shares Leaders.

GQG Partners US Equity, Nikko ARK Disruptive Innovation and Thesis Eldon were the only three funds in the top 10 that do not belong to the IA China/Greater China sector.

At the bottom of the table, there were several fixed income sectors including IA UK Gilts, IA UK Index Linked Gilts and IA Eur Government Bond.

Yearsley said: “Bonds were off last month with rate cuts pushed back by strong US economic data.”

This hardening outlook for interest rates may also explain the underperformance of the IA Property Other sector, which was at the bottom of the table, with the average fund losing 1.9%.

Source: FE Analytics

At the fund level, property and gold/precious metals were the two clear losing themes last month, with Aviva European Property being the worst performing strategy.

Yearsley said: “Looking at property, the big story in February was undoubtedly L&G turning their physical property fund into a hybrid of property shares and physical. The writing for physical property funds has been on the wall for many years and with the Financial Conduct Authority too timid to make any kind of judgement on the sector, it’s been left to fund managers to kill the sector.”

Baker Steel Gold & Precious Metals, Charteris Gold & Precious Metals and Ninety One Global Gold also had a rough time last month.

Yearsley added: “Whilst gold is near an all-time high, gold funds have been languishing for a while now and other metals, such as lithium have really been in the doldrums.”

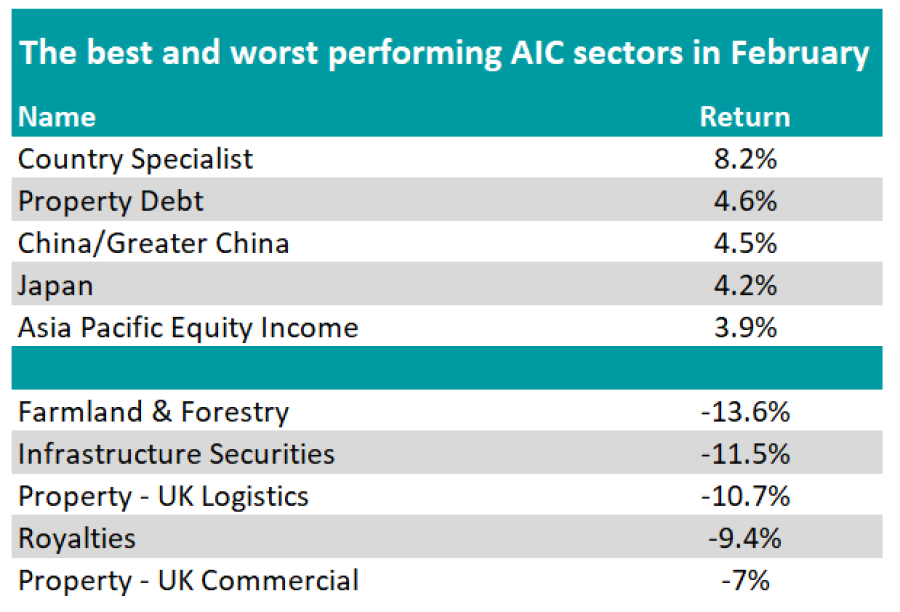

Investment trust sectors performed differently to funds last month. Within the Association of Investment Companies universe, the IT Country Specialist sector led the table.

Source: FE Analytics

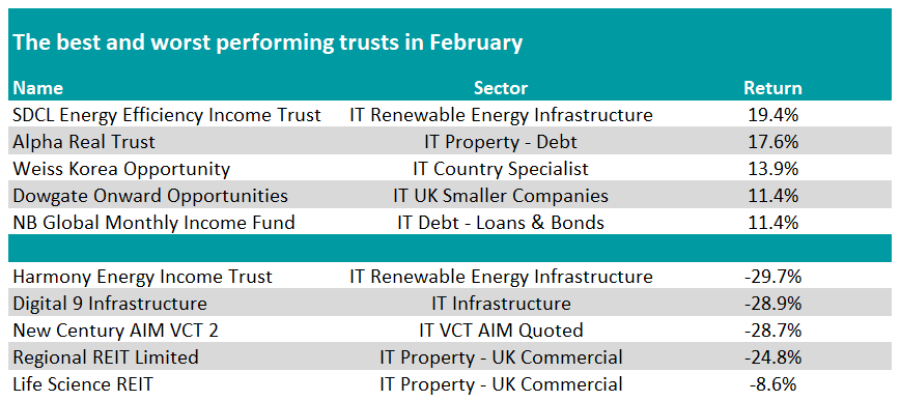

Although three out of the four investment trusts in this sector are Vietnam specialists, it was the one focusing on Korea, Weiss Korea, which did the heavy lifting.

“Korea has been vying with China for the title of the cheapest market for a while now,” Yearsley said.

However, SDCL Energy Efficiency Income Trust and Alpha Real Trust did even better, although the 65p share price of the former is well below its 94.9p 12-month high.

Source: FE Analytics