The main reason why investors choose active over passive funds is the hope of making more money than by investing in a simpler, cheaper index fund. This is particularly pertinent for thematic funds, where unfortunately, only a handful of active funds consistently beat their benchmarks.

In this series, we are looking at the funds with the highest (and lowest) average outperformance against their benchmarks to establish which packed more punch for investors.

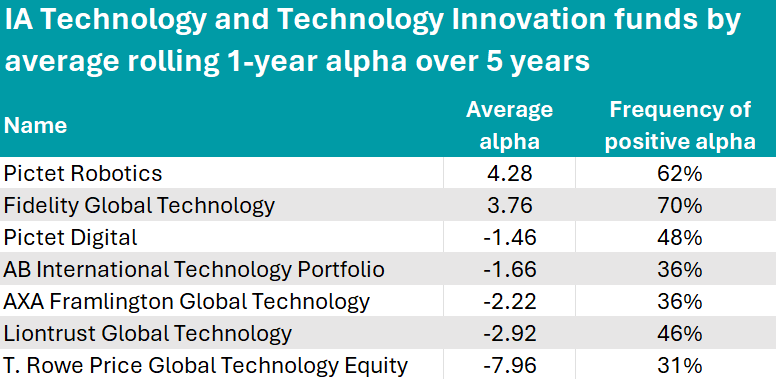

We took each fund’s one-year rolling alpha every month for the past five years, accounting for 61 year-long rolling periods, and found the average. This time, we take a look at thematic funds, where the highest scores were in the IA Technology & Technology Innovation sector.

The only fund with an alpha score higher than 4 was Pictet Robotics, which achieved a 4.3 score against the MSCI All Country World index since 2018.

This $10.2bn strategy focuses on companies that contribute to, or profit from, developments in robotics and enabling technologies. The portfolio mainly includes stocks in the automation (52.4%), technology enabling (33.8%) and services (12.7%) sectors.

The largest holding is Alphabet (7.9%), followed by Salesforce (6.3%) and Taiwan Semiconductors (5.8%).

Source: Trustnet

The Fidelity Global Technology fund had the second-highest score of 3.76%. It is managed by FE fundinfo Alpha Manger Hyunho Sohn, whose bottom-up approach is designed to select companies either with growth prospects (focused on innovations or with disruptive technology), cyclical momentum (found in sub-sectors and typically with strong market positions) or special situations (mispriced businesses with recovery potential).

The funds’ top-10 holdings include industry favourites such as Taiwan Semiconductors, Microsoft, Apple and Alphabet, but also Texas Instruments, Swedish telecom Ericsson and US software company Autodesk.

Unfortunately, a sector as rewarding as technology can be, can also represent a challenge for active investors who are looking to make money beyond the established routes. In fact, every other fund in the peer group had a negative average alpha, meaning active decisions penalised returns.

Paying the highest price for trying to break away from the herd were T. Rowe Price Global Technology Equity (average alpha: -8), Liontrust Global Technology (-2.9) and AXA Framlington Global Technology (-2.2).

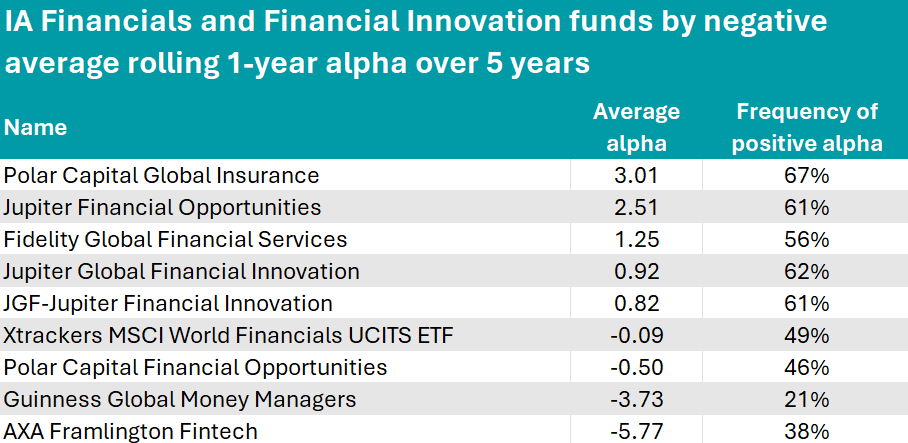

Next up is IA Financials and Financial Innovation, where the rewards weren’t as large but the pitfalls also not as deep.

The best alpha scorer here was the £2.2bn Polar Capital Global Insurance, with 3.

Managed by Dominic Evans and Nick Martin, this fund was highlighted by Square Mile analysts for its “sensible” strategy in a sub sector of markets that is not widely covered.

“Martin has built a deep pool of company knowledge and is well informed as to the intricacies of investing in these markets. We believe he should be able to achieve his objectives over the long term, but there will be times where he may struggle to meet these, such as during falling markets when stocks are sold off indiscriminately and irrespective of company fundamentals,” they said.

“Nonetheless, we like the clear performance objective on the fund to deliver investors an annualised 10% total return over the long term and pleasingly the fund's management team has, on an annualised basis, been able to consistently deliver returns in line with this.”

Source: Trustnet

Jupiter stands out for occupying two positions in the table with Jupiter Financial Opportunities and Jupiter Global Financial Innovation, both managed by Guy de Blonay, scoring well.

The manager screens for companies to best play out themes identified at the macro level, as explained by Rayner Spencer Mills Research analysts.

“By having a mix of companies with different opportunity sets and being flexible in his adherence to the benchmark, the manager seeks to maintain a portfolio that can perform across the full market cycle,” they said.

“This is quite a specialist mandate and therefore likely to appeal to only a limited investor base, however the manager has developed a clearly defined process and proved he can run the fund successfully through changing economic environments.”

On the negative side of alpha were AXA Framlington Fintech (-5.8), Guinness Global Money Managers (-3.7) and Polar Capital Financial Opportunities (-0.5).

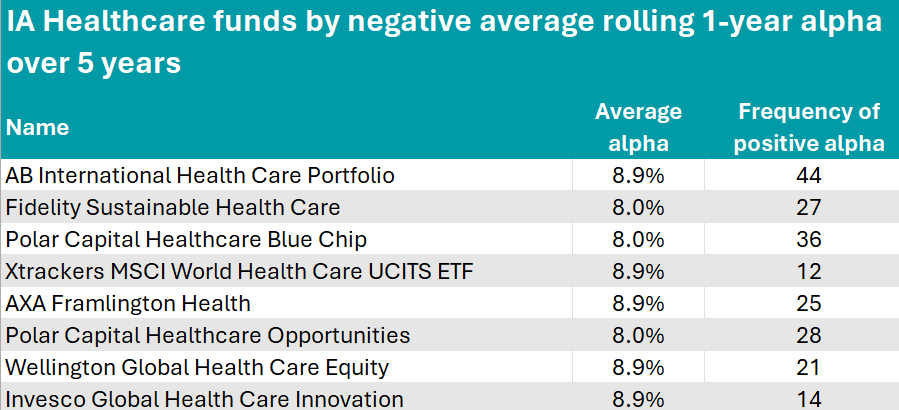

Finally, there were more risks than rewards in the IA Healthcare sector, where only two funds achieved a positive average alpha, barely staying above the MSCI ACWI/Health Care index.

AB International Health Care Portfolio scored 1.4 by investing in companies that are expected to attract healthcare spending, generally through the introduction of new treatments and therapies or by offering customers cost reduction opportunities.

Its main holdings are pharmaceutical companies Eli Lilly (8.6%), Novo Nordisk (8.3%), Merck & Co (6.3%), GSK (4.7%) and Roche Holding (4.66).

Source: Trustnet

Just above zero was Fidelity Sustainable Health Care. Manager Alex Gold invests in companies that are set to benefit from long-term health care trends such the ageing of the population and increased health care needs – the average alpha was 0.1.

The worst alpha in the sector were those of Invesco Global Health Care Innovation, Wellington Global Health Care Equity and Polar Capital Healthcare Opportunities.

This was the final instalment in a series that previously covered: UK Equity Income, UK All Companies, Global, Global Equity Income, Sterling bonds, smaller companies, global bonds, cautious funds, balanced and adventurous funds, European funds, Asia funds, emerging markets.