Real estate investment trusts (REITs) have suffered through a daunting couple of years as inflation and interest rates have risen, but those headwinds are dissipating. With many trusts trading at wide discounts, experts believe this is a good time to revisit the sector.

Typically, higher inflation and rising interest rates make real estate a less attractive proposition because borrowing costs and mortgage rates increase, purchasing power falls and other asset classes such as bonds and cash become more appealing.However, with UK inflation falling to 2.0%, rate cuts seem to be on the horizon, potentially supporting a rebound in real estate.

Richard Williams, property analyst at Quoteddata, said: “Even if that first cut is only a quarter point, it will send a message to lenders and borrowers that the trajectory is down and the forward yield curve should follow suit.

“Confidence that the bottom of the real estate market has been hit would facilitate more investment activity and a return to positive valuation growth.”

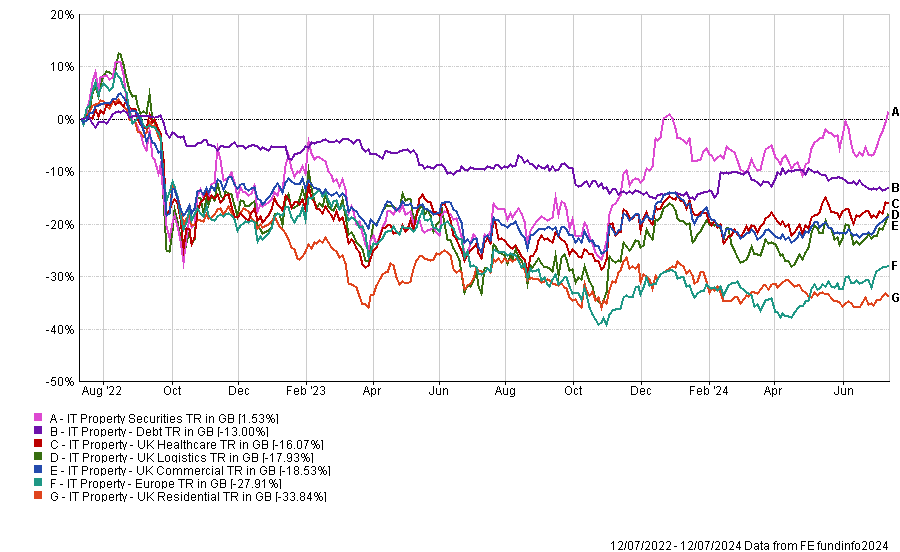

Performance of sectors over 2yrs

Source: FE Analytics

Another compelling point for REITs is the discounts at which they are currently trading, following their recent rout. Private equity firms have seized this opportunity to make acquisitions. For example, Blackstone bought Industrials REIT last year, while Brookfield is in the early stages of making an offer for Tritax EuroBox.

Mick Gilligan, head of managed portfolio services and partner at Killik & Co, said: “The high level of property M&A in the past 12 months indicates there is good value in the sector. Property players have taken advantage of low valuations, picking up assets at significant discounts.”

Below, experts suggest which investment trusts to back to benefit from a real estate revival.

Schroder Real Estate Investment Trust

Anthony Leatham, investment companies research analyst at Peel Hunt, suggested Schroder Real Estate Investment Trust for generalist exposure to the real estate sector.

Led by Nick Montgomery, this REIT is currently trading at a 22% discount and offers a 7.1% yield.

The portfolio, valued at £459 million, consists of 39 properties, with significant investments in the industrial and office sectors.

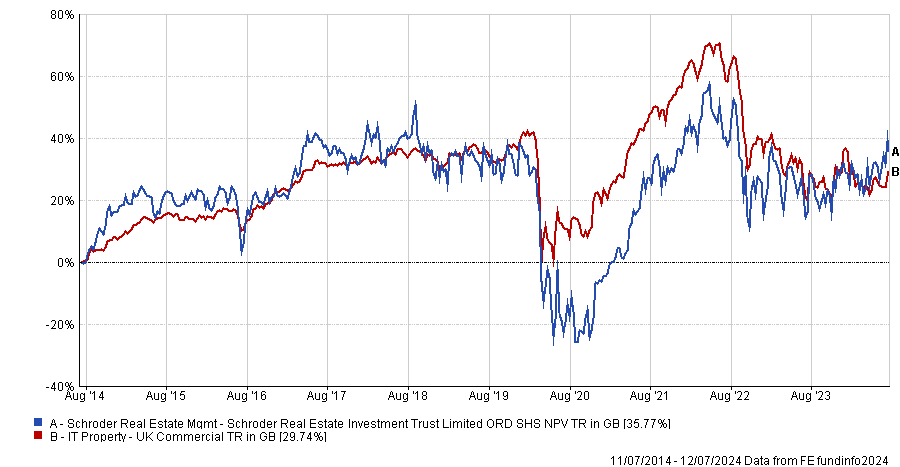

Performance of investment trust over 10yrs vs sector

Source: FE Analytics

Leatham said: “Schroder Real Estate Investment Trust is pioneering a brown-to-green investment strategy across UK commercial property, which aims to meet the increasing occupier demand for more sustainable buildings and capturing the rental and valuation ‘green’ premium from efficient buildings with strong environmental credentials.”

Picton Property Income

Picton Property Income is trading at a 30% discount and its management team has a track record of adding value, according to Williams.

Its £745m portfolio is almost 60% weighted to the industrial sector, which displays promising rental growth prospects, he said. The trust has been reducing its office exposure, which stood at 30% at the end of March, but has fallen further after recent sales.

“This has not been achieved through cut-price sales into a falling market, instead the company has maximised values by unlocking their alternative uses potential – in the main, gaining planning consent for change of use to student accommodation and residential,” Williams said.

As debt levels are at a loan-to-value of 28%, long-dated and with a fixed cost of 3.7%, the trust has increased its dividend target for this year by almost 6% to 3.7p.

Performance of investment trust over 10yrs vs sector

Source: FE Analytics

Impact Healthcare REIT

Emma Bird, head of investment trusts research at Winterflood, tipped Impact Healthcare REIT.

Specialising in UK care homes, this investment trust is currently trading at a 27% discount. Bird believes it offers "considerable value”, with a prospective 8.2% dividend yield fully covered by earnings.

She said: “This fund has seen its underlying asset valuations hold up considerably better than many other property investment trusts, supported by the contractual, inflation-linked uplifts in its rents, which we expect to continue to support earnings and dividend growth going forward.”

Performance of investment trust since launch vs sector

Source: FE Analytics

The trust has increased its dividend each year since its launch in 2017, a policy that Bird believes will differentiate Impact Healthcare REIT in a higher interest rate environment.

TR Property

Both Leatham and Gilligan pointed to TR Property, managed by Marcus Phayre-Mudge.

Leatham described this investment trust as a "one-stop shop" for property equity exposure, as it holds REITs, shares and securities of property companies and related businesses across Europe. Additionally, it invests directly in UK properties.

Leatham said: “This pan-European strategy has invested through several property cycles and we highlight the active approach to sector and stock selection. With discounts across pan-European real estate equities still widespread and TR Property trading on c.6% discount to NAV, it has the potential to outperform on the way up.”

TR Property has been the beneficiary of several M&A transactions. The largest contributor to NAV performance in fiscal year 2024 was the acquisition of Industrials REIT by Blackstone.

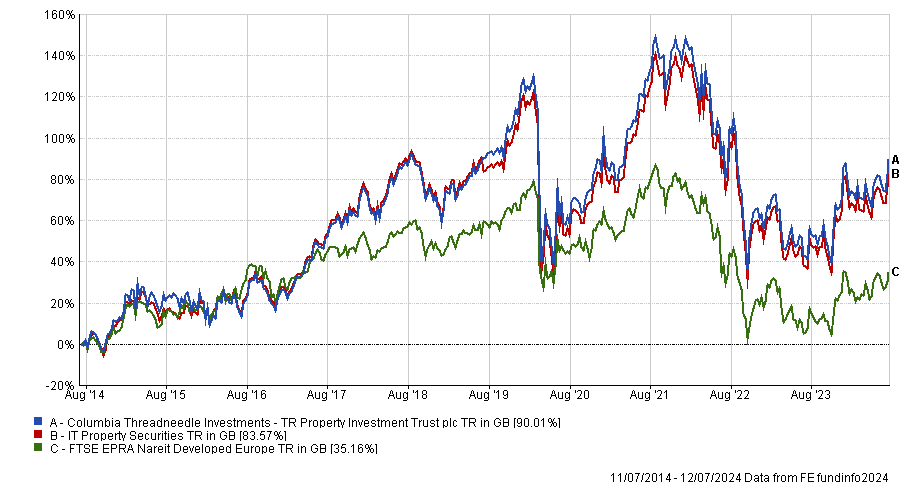

Performance of investment trust over 10yrs vs sector and benchmark

Source: FE Analytics

Gilligan believes that TR Property will continue to benefit from M&A, as several of its smaller holdings are potential acquisition targets.

He prefers internally managed REITs such as TR Property over "classic" investment companies with external management structures. He believes that the alignment of interests between managers and shareholders is better in the former, often incentivised through various metrics, including total shareholder return.

He said: “Property investment trust managers tend to be rewarded on NAV alone. Fee structures also tend to penalise the shareholder during downturns as they continue to pay fees on the old stale NAV, which is usually outdated and higher than the share price, while the share price tends to look forward and discount market conditions. For these structural reasons, I don’t think the investment trust property sector (i.e. those holding physical property assets) has a particularly bright future.”

As a result, Gilligan expects consolidation to continue and warned that the days for small sub-scale trusts with high fee burdens are numbered.