June ushered in the eighth consecutive month of net inflows into emerging market funds, with Asia (ex-China) taking the lion’s share. So why have investors been adding Asian equities to their buy lists? Well, recent performance has certainly played its part, with the MSCI Asia Pacific Index chalking up a healthy total return of almost 9% in sterling terms, in the first half of 2024.

But this ignores the bigger picture: put simply, the region is becoming increasingly difficult to ignore. It is home to around 60% of the world’s population and generates almost half of the world’s GDP (on a purchasing power parity basis). And it’s the growth story in particular that has been grabbing the attention of investors, with Asia forecast to generate more than twice the GDP growth of the G7 countries, thanks to three key mega-trends.

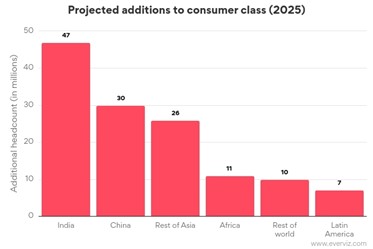

The first is the shift in the global consumer class from West to East. Asia has been the primary driver of growth since 2000 and India is forecast to contribute more to the newly-minted consumer class than Africa, Latin America and the rest of the world combined in 2025, as shown in the chart below.

This burgeoning middle-class will drive a significant increase in domestic consumption, enabling economies to reduce their dependence on export-led growth and proving a boon for consumer products firms such as Samsung, Toyota and JD.com.

Source: The World Consumer Outlook 2025, World Data Lab

Next on the list is the ‘re-shoring’ trend, prompted by the disruption to supply chains during the pandemic and ongoing geopolitical tensions, with Vietnam, Malaysia and Thailand benefiting from this so-called ‘China plus one’ strategy. And as a key supplier of nickel to electric vehicle manufacturers, Indonesia has demonstrated its ability to maintain strong relations with both the Chinese and North American markets.

Finally, Asia is well-positioned to ride the tailwinds of the net-zero transition and roll-out of artificial intelligence (AI). China is a global leader in clean energy and installed as much solar power as the rest of the world combined in 2022. It is also a leader in battery cell manufacturing and home to a booming electric car industry, with China accounting for nearly 60% of new car registrations in 2023, according to the IEA.

And on the AI front, Asia boasts the largest semiconductor foundry in the world in TSMC (which supplies Nvidia, Apple and Advanced Micro Devices, amongst others) and is tapping into soaring demand for chips as the ‘picks and shovels’ of the AI revolution.

In fairness, it has not been all plain sailing, with Japan only recently emerging from its ‘lost decades’, a prolonged period of economic stagnation, and China continuing to grapple with structural issues. That said, the broader macroeconomic backdrop is supportive as Asian economies haven’t faced the inflation-led macroeconomic problems of the West, nor their record levels of public debt.

However, treating the region as a homogenous unit ignores one of its key selling points as a diverse universe of sectors and countries, from the more mature economies of Singapore and Hong Kong to their high-growth neighbours in India, Thailand and Indonesia. Valuations also look relatively undemanding, with the MSCI Asia Pacific Index trading on a forward price-to-earnings ratio of 14.2x, some 30% below that of the MSCI World Index (as at 28 June 2024).

The investment case for Asia may be compelling but it is worth acknowledging the challenge for retail investors due to the breadth and complexity of the region, together with a relative lack of equity research. One option is an actively-managed Asian fund that provides a ready-made, diversified portfolio created by managers with the expertise to exploit pricing opportunities in relatively inefficient markets.

One such example is Schroder Asia Pacific, which is managed by Richard Sennitt and Abbas Barkhardor, who have a combined experience of nearly 50 years working in Asian and emerging markets teams at Schroders. They are supported by the 40-plus strong Schroders research team based in six offices across the region.

The managers are bottom-up stock pickers, aiming to hold a portfolio of around 60 ‘quality’ companies with sustainable earnings, sound balance sheets and good corporate governance. The trust’s tilt towards Taiwan and India has helped to drive superior returns, delivering a one and five-year total net asset return of 13% and 31% respectively (as at 12 July 2024).

Alternatively, investors looking for country-specific exposure could cast their eyes over Ashoka India. It is the top-performing trust in the AIC India & Indian Subcontinent sector over the past five years, with a net asset value total return of 160%, with recent performance boosted by its overweight position in small and mid-caps.

Japan continues to be among the top-performing countries and Schroder Japan aims to deliver capital growth from a diversified portfolio of around 60-70 companies. The trust has achieved a five-year net asset total return of 50% and recently announced an enhanced dividend policy with 4% of the average net asset value to be paid in dividends each year.

Due to its higher volatility, Asia is best suited for investors willing to take a longer-term view. However, given its ever-increasing dominance on a global scale, this may be an opportune time for investors to review their portfolio allocation: the sun may not be setting on the West but it is certainly rising in the East.

Jo Groves is an investment specialist at Kepler Partners. The views expressed above should not be taken as investment advice.