Guinness Global Equity Income, IFSL Evenlode Global Income and Artemis Global Income are some of the largest and best-known names in the IA Global Equity Income sector, with a combined £8bn in assets under management.

While all of them have delivered strong performance, their investment strategies and styles have nuanced differences. Guinness has a high conviction, equally-weighted portfolio, whereas Evenlode is more defensive. Artemis, meanwhile, pursues a value-focussed approach.

Given these differences, investors may be uncertain as to which fund would suit them best, so Trustnet asked four experts for their preferences.

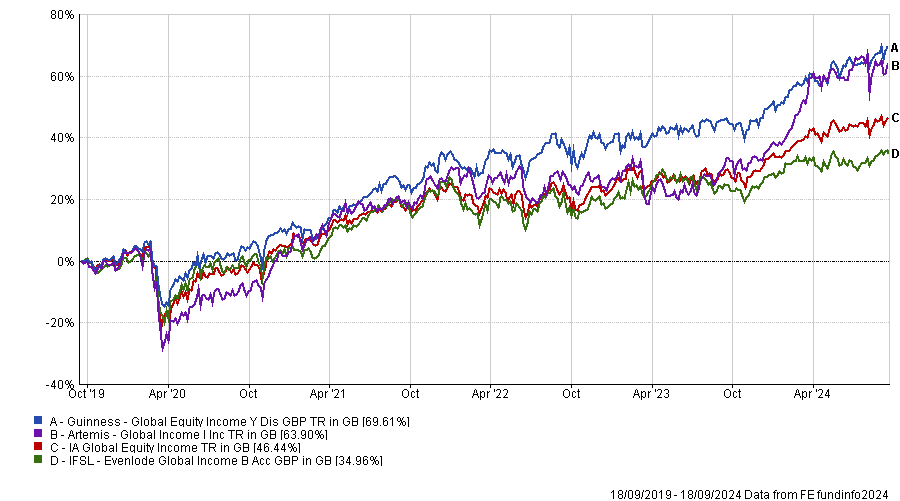

Performance of funds vs sector over 5 yrs

Source: FE Analytics

Guinness Global Equity Income

The £4.8bn Guinness Global Equity Income fund, led by Ian Mortimer and Matthew Page, stood out for its high conviction strategy.

With just 35 holdings, the fund employs an equally weighted, one-in, one-out structure where every stock is expected to contribute meaningfully to the portfolio. No stock is weighted above 3.5%, with just 16.1% of the fund represented by its top five holdings.

Jason Hollands, managing director at BestInvest, said: “This fosters a strong Darwinian ‘survival of the fittest’ discipline: when the managers want to add a new stock to the portfolio, they must sell an existing position to make way for it.”

This strategy has led to great results, with the portfolio ranking as a top 10 performer within its sector over three, five and 10 years.

Darius McDermott, managing director at FundCalibre, said: “By prioritising stock selection over dividend yield, the managers are uniquely positioned to identify hidden opportunities in the market.”

However, the recent year has proved more challenging for the portfolio, which fell into the second quartile of its peers, although it remained ahead of the sector average.

Evenlode Global Income

The £1.6bn Evenlode Global Income fund pursues a more defensive strategy. Lead manager Ben Peters favours stocks with resilient earnings and sustainable dividend growth, and avoids “businesses with complex models, highly geared balance sheets and economically sensitive companies with low pricing power,” Hollands explained.

This is a quality-led approach, with stocks such as Microsoft featuring prominently in its top five holdings, but it is still relatively high conviction with just 39 holdings.

The portfolio is up by 75% since its inception in November 2017, compared to the 67.4% average for the peer group.

Its best years relative to its peer group were 2018 and 2019. With returns of 1.8% in 2018, it was one of just five funds in the whole sector – including Guinness – that enjoyed positive results.

In the following year it was the third-best fund in its sector, with an impressive performance of 24.3%.

Nevertheless, the fund has faced challenges and has fallen to the bottom quartile over three and five years. Marshall and McDermott both noted that the fund’s defensive, quality-focused strategy has struggled in recent years, falling out of favour as growth funds gained in popularity.

Artemis Global Income

In comparison, the £1.4bn Artemis Global Income fund has a value-focused approach and its managers, Jacob de Tusch-Lec and James Davidson, are willing to invest in more cyclical companies.

Kate Marshall, lead investment analyst at Hargreaves Lansdown, said that this differentiates the fund from many others in the Global Equity Income sector.

Ben Yearsley, director at Fairview Investing, added that the fund is adaptable, blending “core income, growth and risk buckets” and varying their weights depending on the managers’ viewpoint.

Artemis Global Income counts itself among the sector’s 10 best performing funds over the past one, three and five years.

Its one-year performance has proven particularly impressive compared to its peers, with a best-in-class return of 22.4%. “[This was] a notable achievement, especially given its lack of exposure to any of the Magnificent Seven stocks,” McDermott added.

Marshall added: “This diversification is important to help build a portfolio that has the potential to perform well in different market conditions.

Which fund is the best choice?

Ultimately, the decision of which fund to pick will depend heavily on the structure of each investor’s portfolio, Yearsley said. “It’s all about what you pair them with. What you don’t want is to pair quality with quality for example,” he explained.

All four fund pickers had positive things to say about at least two of three portfolios, but some stood out more than others.

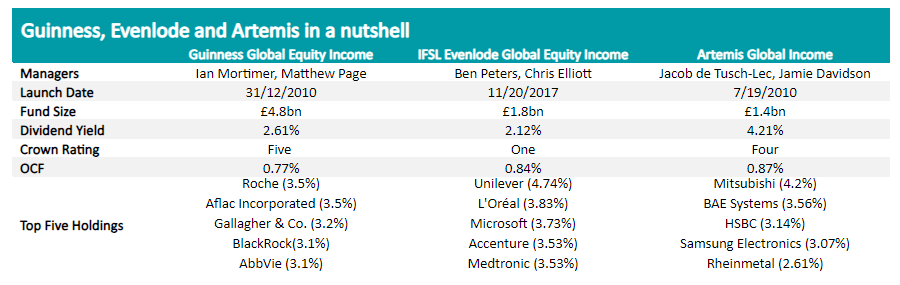

The funds in a nutshell

Source: FE Analytics

While both McDermott and Hollands are fans of Evenlode Global Income, it is difficult to deny that it has struggled recently in terms of performance; the fund has not managed to break into the top quartile over one, three or five years.

Marshall and Yearsley preferred the better-performing Artemis Global Income fund, with Marshall citing its more experienced senior management team, who successfully guided the fund through key market developments, such as the financial crisis.

Despite being the smallest fund of the three by assets under management, Artemis’ strategy has a stellar recent track record, with top-quartile performance over one, three and five years.

Although its 10-year number fell to the second quartile, it remains a popular investment choice for the experts, with Yearsley noting that he has followed the portfolio for many years.

Impressively, it has achieved this record without relying on high-octane tech stocks such as the Magnificent Seven.

It was Guinness however that garnered the most recommendations. It is Elite Rated by FundCalibre and features on Bestinvest’s Best Funds List. McDermott said he regards it as a solid choice and “a core global equity income holding”.

Yearsley was also a supporter of the fund, noting that he has used it in the past, and still recommends it for investors looking for a “standalone” fund to hold.

Crucially, it has a strong long-term record. While top quartile three, five and 10-year returns were followed by a dip into the second quartile over the past year, the portfolio has rebounded in the past six months to the top 25% in the sector.

Notably, it ranked top quartile for both Sharpe and Sortino ratios, meaning that it made strong returns per unit of risk.