Wide discounts persist across the investment trust sector, not just in out-of-favour areas such as battery storage but also among trusts investing in plain vanilla equities.

Yet amidst the swathe of for-sale signs lurk some comparatively expensive companies. Mergers amongst real estate investment trusts (REITs) in particular have caused discounts to narrow sharply and other REITs to re-rate.

Below, Peel Hunt analysts Anthony Leatham and Markuz Jaffe identify some of the cheapest investment companies on the market, as well as pointing out which areas no longer offer such compelling value.

Bargains

Four equity trusts look like bargains, according to the analysts: Baillie Gifford European Growth is on a 16% discount; UK small-cap specialist BlackRock Throgmorton (-12%); and Schroder Oriental Income (-7%).

Finally, BlackRock World Mining is trading on a 10% discount despite a recent surge in popularity. It was the most-bought investment trust on interactive investor’s platform in September as investors sought to take advantage of the surging gold price by gaining exposure to miners.

In the flexible sector, Caledonia Investments' shares are on a 38% discount, with RIT Capital Partners hot on its heels at -30%. Alastair Laing, who manages Capital Gearing, recently added RIT Cap to his portfolio after the Financial Conduct Authority exempted trusts from having to disclose ongoing charges. RIT Cap’s charges were 4.5%, which Laing believes is why its discount had widened so far.

The trust has also begun to buy back its own shares. “Buying shares at a 30% discount is very powerful,” Laing said.

Leatham and Jaffe noted “holders of both JPMorgan Multi-Asset Growth & Income and JPMorgan Global Core Real Assets might want to look at other flexible strategies to rotate into”, after the former merged with JPMorgan Global Growth & Income earlier this year, while the latter failed a continuation vote, which triggered a strategic review.

Elsewhere, Impax Environmental Markets is trading on a 13% discount and could potentially benefit from money shifting out of two peers that are undergoing strategic reviews: Menhaden Resource Efficiency and Jupiter Green.

Turning to alternative assets, battery storage specialists are out of favour. Gresham House Energy Storage is on the largest discount at 53%, followed by Harmony Energy Income (-47%) and Gore Street Energy Storage (-46%). All were listed as bargains by the Peel hunt analysts.

Private equity also suffers from negative sentiment and the hangover from high fee disclosures. HarbourVest Global Private Equity has a 43% discount, while Augmentum Fintech is on -39% and Oakley Capital Investments has a 28% discount.

Trusts with ongoing charges greater than 1.5% (including performance fees) should benefit the most from changes to cost disclosure rules and several private equity trusts fall into this category, said Leatham and Jaffe.

Within the infrastructure sector, Octopus Renewables Infrastructure stands out for its 26% discount, while Sequoia Economic Infrastructure Income is also cheap, on an 18% discount.

Meanwhile, Riverstone Energy, which invests in listed equities, unquoted holdings and decarbonisation assets, is on a 41% discount. This looks “generous” given that geopolitical tensions are putting pressure on the oil price, said Leatham and Jaffe, even taking into account the trust’s illiquid private assets. “The company has committed to repurchasing shares or paying dividends equal to 20% of net gains on realisations,” they added.

Stablemate Riverstone Credit Opportunities has been in realisation mode since May 2024 and is trading on a 24% discount, with a portfolio of seven positions.

Expensive trusts and narrower discounts

The most expensive investment trust, 3i Group, is on a c. 47% premium to the end of June 2024, although it has rewarded its investors with a year-to-date NAV total return of 11% and a share price total return of 37%.

Leatham and Jaffe believe the premium looks “stretched”, especially given the trust’s portfolio is heavily concentrated into one successful business, the discount retailer Action.

Although few trusts are trading on a premium, several investment companies' discounts have narrowed substantially over the past year, often as a result of corporate action.

For instance, JPMorgan UK Small Cap Growth & Income had a 12-month average discount of 9% and a 12-month low of 17%, but following its merger with JPMorgan Mid Cap, its discount has narrowed to 4%.

Balanced Commercial Property and Tritax EuroBox have narrowed following a cash offer from Starwood and an all-share offer from Segro, respectively.

Elsewhere, shareholder activism at PRS REIT led to the appointment of two new board members and a new chair, as well as the discount narrowing.

After a “deluge of corporate activity in the real estate sector”, other trusts in the space have narrowed; Schroder REIT has gone from a 12-month average discount of 23% to 13%, the analysts noted.

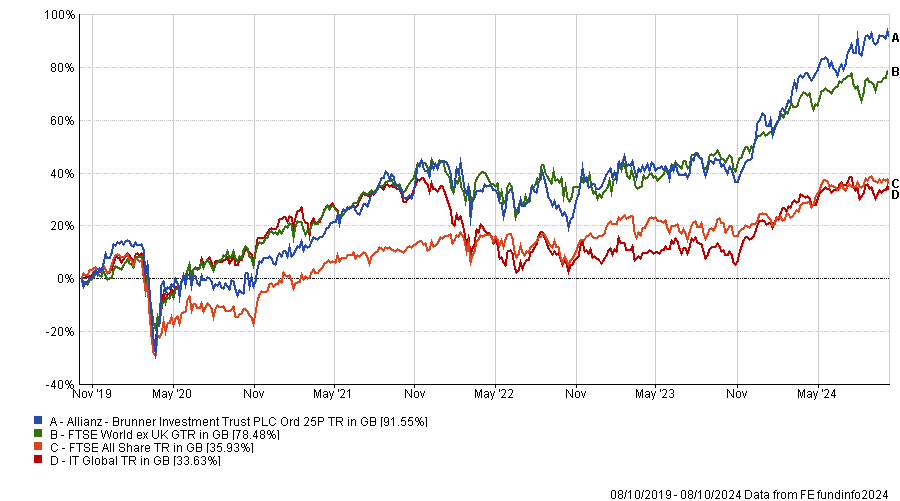

Away from real estate, global equity trust Brunner has achieved top-quartile total returns over one, three and five years and its shareholders have also benefitted from the discount narrowing to 2% compared to a 12-month average of 8%. However, Leatham and Jaffe warned that “given the lack of discount control policy or buybacks and the sizeable (30%) family shareholding, the discount could re-emerge.”

Total return performance of trust vs benchmarks and sector over 5yrs

Source: FE Analytics

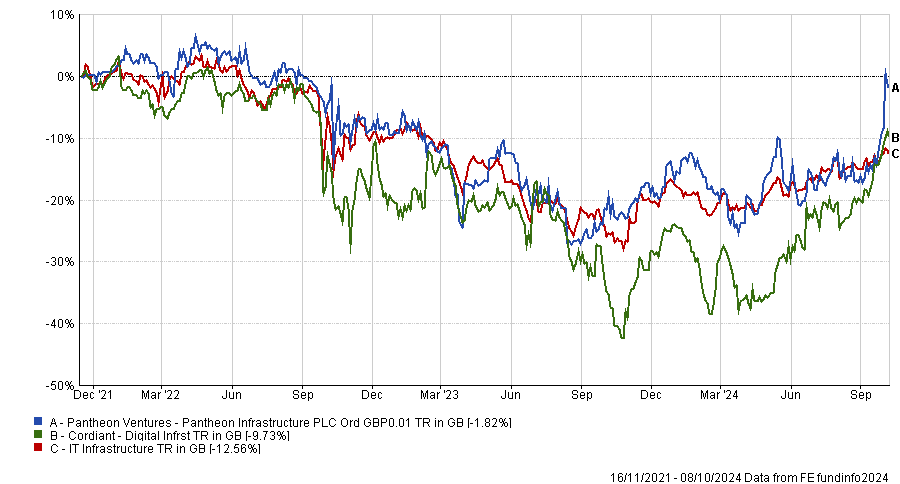

Not all are trusts that have narrowed their discounts are expensive however, and Peel Hunt believes that several trusts which have benefitted already from substantial narrowing have further to go, including Pantheon Infrastructure and Cordiant Digital Infrastructure.

Pantheon Infrastructure has committed up to £18m in buybacks and has achieved “robust” NAV performance, said Leatham and Jaffe. Cordiant has a high-quality portfolio and a positive outlook that “bodes well for future growth”. Their discounts have already narrowed from 25% to 18% for Pantheon and from 39% to 28% for Cordiant.

Both trusts have achieved strong 12-month total returns (to 8 October 2024), with Cordiant up 39.5% and Pantheon delivering 21.8%, but that follows on from a tough five years, as the chart below shows.

Total return performance of trusts vs sector over 5yrs

Source: FE Analytics

Chrysalis (-37%) and HBM Global Healthcare (-18%) could also benefit from further narrowing, the analysts argued.