Now that ‘the income is back in fixed income’ and bonds are offering diversification from equities again, the asset class’ appeal for investors has increased.

Yet there are plenty of clouds on the horizon, from historically narrow spreads (meaning investors are not being compensated for taking credit risk) to uncertainty over the speed of interest rate cuts and whether the US economy will achieve a soft landing.

Against this backdrop, Trustnet asked several bond managers how their portfolios are positioned, where they are seeing the best opportunities, and what risks they are watching out for.

J. Safra Sarasin: Risk premiums are historically low

Rate cut expectations and the soft-landing narrative are pushing down expected default rates for 2025 and beyond, said Alex Rohner, fixed income strategist at J. Safra Sarasin Sustainable Asset Management.

“As a result, credit spreads continue to grind tighter. Risk premiums across all fixed income sub-asset classes are now close to their lowest levels over the past 12 years.”

Despite that, he has a neutral outlook for investment-grade credit and high yield. “In the absence of meaningful economic weakness, the magnitude of any potential widening in spreads going forward will likely not be large enough to warrant a structural underweight in credit,” he explained.

Negative economic surprises could prompt a more decisive response from central banks than is currently priced in, he warned. Therefore, there is a chance that bond yields could move lower during the next six to 12 months.

Nonetheless, he believes “the risk/return trade-off for owning duration remains attractive for now”. J. Safra Sarasin prefers intermediate maturities (five to 10 years).

Neuberger Berman favours ‘up-in-quality’ credits

Although corporate spreads are tight relative to history, all-in yields are attractive, said Ashok Bhatia, co-chief investment officer of fixed income at Neuberger Berman.

“Given growing strains on the economy, ‘up-in-quality’ credits with defendable balance sheets seem particularly appealing. In an environment of generally narrow credit spreads, differentiation among segments and issuers has become especially important,” said Bhatia, who manages the NB Global Flexible Credit Income fund.

“We continue to find value within securitized products across various sectors, maturities and risk profiles, observing that spreads remain around long-term historical averages, in contrast to corporate credits.”

Mirabaud eyes low-rated investment grade and high-quality high yield

Corporate bonds have performed well as spreads across the rating spectrum have compressed throughout the year, said Fatima Luis, senior fixed income portfolio manager at Mirabaud Asset Management. “Resilient macro data, especially in the US, continues to serve as a tailwind.”

Mirabaud favours low-rated investment grade credit and high-quality high-yield bonds because “the attractive coupon provides decent income return”, she said.

“Given the uncertainty around the pace of further cuts and the rate of disinflation going forward, our preference is for corporate bonds with maturities in the middle of the curve.”

T. Rowe Price is finding opportunities in short-dated corporate credit

Short-dated investment-grade credit is attractive, especially in Europe, according to Amanda Stitt, portfolio specialist for the T. Rowe Price Dynamic Global Bond strategy. “This is driven by a combination of high-all in yields, healthy corporate fundamentals, and supportive technicals,” she said. “We see room for European credit spreads to tighten versus the US, particularly if the eurozone economy improves.”

T. Rowe Price also likes inflation-linked bonds, including German bonds and US Treasury inflation-protection securities (TIPS). “With breakeven inflation rates – a measure of market-implied inflation forecasts – currently priced below headline inflation rates, we believe inflation-linked bonds offer investors good value,” she explained.

Nomura is protecting against credit default risk

Nomura Asset Management’s Richard ‘Dickie’ Hodges is taking a more cautious stance and has increased the protection strategies within his $2.3bn Nomura Global Dynamic Bond fund.

He has a cautious view on risk assets and believes volatility could increase due to the forthcoming US presidential election and because “the full extent of the central bank rate cuts that have been priced-in may not be delivered”.

Therefore he has re-increased his exposure to protection strategies based on credit default swaps, which now have a combined notional value worth 20% of the fund’s assets.

“We also have a degree of cheap equity put option protection in place. The cost is only a few basis points, but if equity markets fall from what are (to our eyes) lofty valuations, the degree of protection will grow to be meaningful,” the FE fundinfo Alpha Manager said.

LGIM: We’re fans of emerging market debt

Colin Reedie, head of active strategies at Legal & General Investment Management, believes that fixed income deserves to “play a far greater role” in portfolios. “There's a genuine return to fixed income, in a way that there hasn't been for some for time now, and it's a proper value proposition. We're not going back to the days of zero interest rates anytime soon,” the Alpha Manager said.

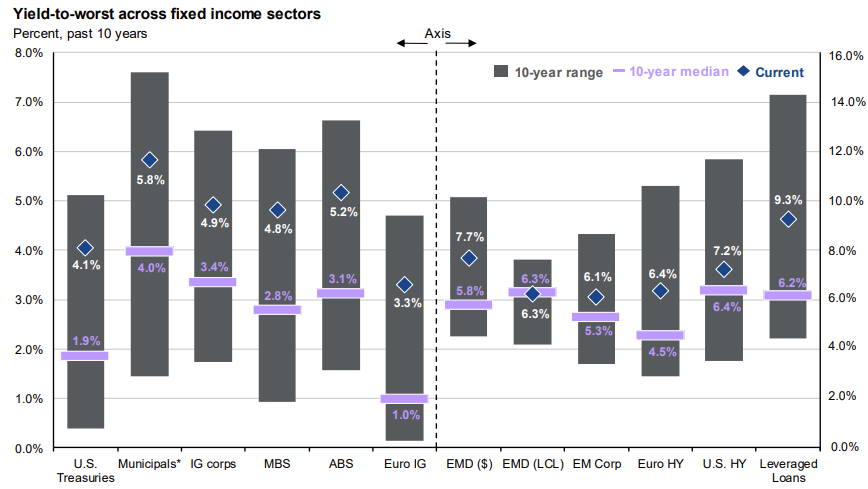

Bond yields are elevated relative to the past decade

Sources: JP Morgan Asset Management Guide to the Markets, Bloomberg, FactSet, data to 14 Oct 2024

One of the most compelling areas is emerging market debt, Reedie said, describing himself as a “fan” of the asset class. “Fiscal sustainability is a key issue in markets now and deficit wise, emerging markets look pretty good,” he said.