The BH Macro investment trust offers UK-based private investors access to one of the world’s largest hedge funds: Brevan Howard. With a market capitalisation of £1.3bn, it was trading at a 12.2% discount on 25 October, potentially making this an opportune time to consider investing.

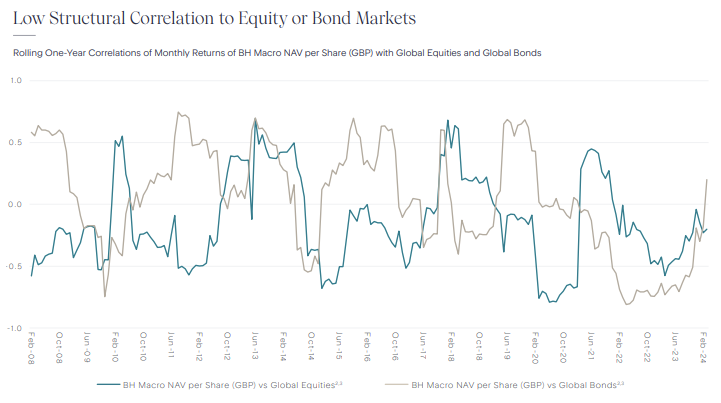

One of the trust’s main selling points is the diversification it offers by being uncorrelated to equities and fixed income.

Chris Clothier, co-manager of the Capital Gearing Trust, said BH Macro “tends to perform best when other asset classes are struggling, so in periods of high equity market volatility, it has historically performed very well”.

Source: BH Macro

The portfolio is comprised of multiple different trades executed by 155 traders and portfolio managers across equity, bond, currency and commodity markets as well as digital assets.

Brevan Howard structures ‘convex’ trades, where the upside potential significantly outweighs the downside, using options and stop losses. A risk management overlay ensures that the overall portfolio has balanced exposures.

Clothier described BH Macro as a “structurally long volatility trust”. Its traders buy options which perform well when volatility spikes. When markets are steady, “you tend to be bleeding option premiums [but] the traders at Brevan Howard are sufficiently skilful that when markets are calm, they don’t appear to lose much money and to make a bit of money most of the time”, he explained.

“So what you tend to see is periods of quite dull performance and then periodic surges of very good performance, probably just when you need them, because the rest of your portfolio might not be doing so well.”

One drawback is that Brevan Howard’s strategy is “not hugely transparent”, Clothier noted. The hedge fund shares risk data showing its exposures but that data is often retrospective and the portfolio can shift positioning quite suddenly.

Performance has been impressive over the long term, especially during periods of equity market stress, but “mediocre” and “disappointing” for the past two years, said James Yardley, senior research analyst at Chelsea Financial Services.

BH Macro achieved an 8.8% annualised net asset value (NAV) per share return from inception on 9 March 2007 until 31 December 2023, net of fees, with just 8% volatility.

Its share price volatility was 13.6%, still lower than the S&P 500’s annualised volatility of 18% over the same period.

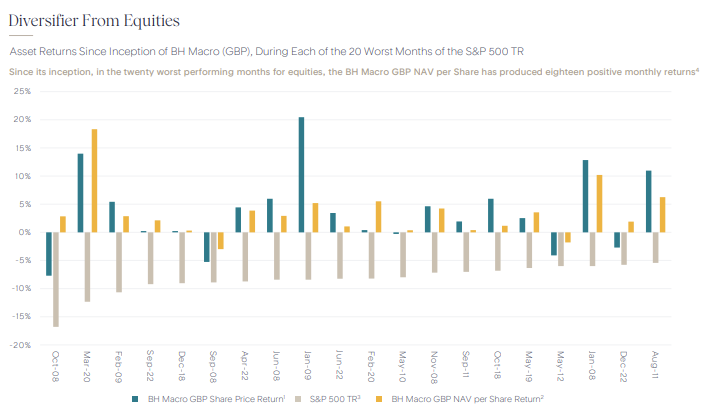

William Heathcoat Amory, managing partner at Kepler Partners, said: “In each of the S&P 500’s 20 months of worst performance since 2007, BH Macro has significantly outperformed the index, delivering a positive sterling share price return in all but five of those months, with an average monthly share price return of 3.7% net of fees.”

Source: BH Macro

Yardley added: “In 2021 and 2022, as higher inflation caused panic in the bond and stock market, BH Macro delivered very strong returns. This helped shield many investors' portfolios from falls they were suffering from their other holdings. In other words, this trust has a track record of doing its job and being there for you when you most need it.”

In 2022, BH Macro’s NAV and share price both rose more than 21% net of fees. By comparison, the MSCI All Country World Index lost 8% in sterling terms that year.

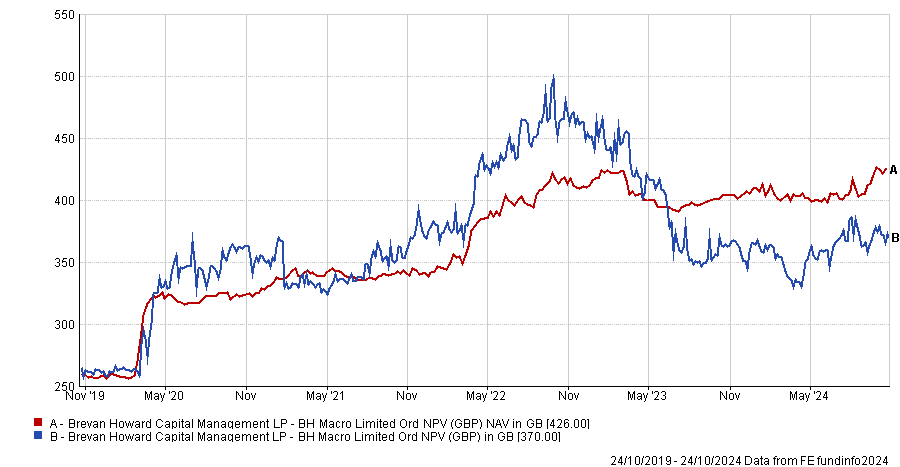

Strong performance propelled BH Macro’s share price to a 22% premium by September 2022. The trust responded to high demand from investors by issuing new shares in February 2023 raising £315m.

The timing proved unfortunate because in April 2023 the trust’s largest shareholder, Rathbones, merged with another large shareholder, Investec.

Fears that Rathbones and Investec would hold more than 30% of BH Macro after the merger and would become forced sellers caused the trust’s share price to fall to an 18% discount by 30 April 2024. This represented a 20% loss for investors who had bought the new shares at a 2% premium.

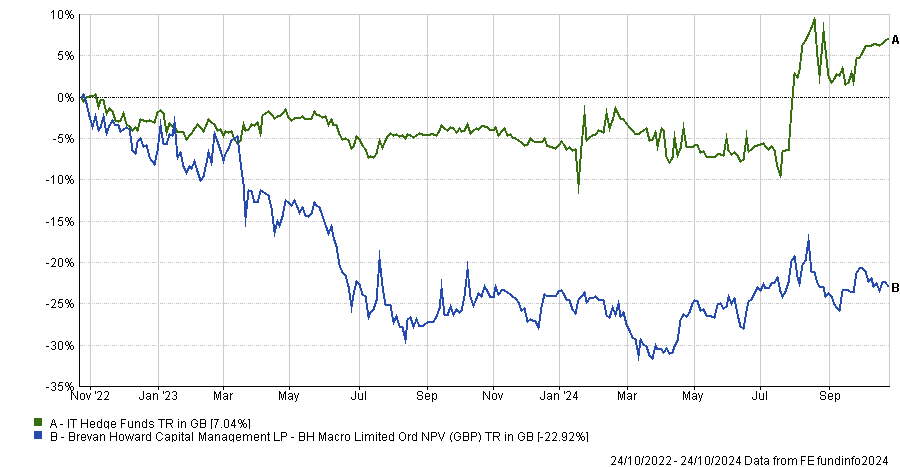

Total return of trust vs sector over 2yrs

Source: FE Analytics

Yardley said the double-digit discount “exacerbated the drawdown and volatility of the trust” but pointed out that “the underlying NAV performance has not actually been nearly as bad as the share price”.

BH Macro’s share price vs NAV over 5yrs

Source: FE Analytics

The equity raise also preceded a period of poor investment performance. The trust’s NAV fell 7.1% between March and May 2023 after an interest rate trade went against Brevan Howard, according to Investec analysts Alan Brierley and Ben Newell.

Clothier said BH Macro was positioned for a much weaker US economy and had not expected markets to remain so calm.

A third reason for the discount is fees. The trust pays a 1.5% management fee, a 50 basis points administrative fee and a 20% performance fee. Yardley said BH Macro’s high fees are “out of kilter with current market pricing”.

Given Brevan Howard’s reputation and the trust’s long-term track record, “you can certainly make the case that it's worth it and a double-digit discount certainly makes the high fees easier to stomach,” he added.

Clothier concurred. “We don’t love paying high fees […] we stomach them through gritted teeth”, he said, adding that the trust’s long-term track record of 8.8% per annum is after fees.

Some investors are taking advantage of the discount. Capital Gearing started buying BH Macro in February 2024 and the trust is now one of its largest positions, worth 1.1% of the multi-asset portfolio.

BH Macro’s discount has narrowed since then, not least because the trust has been buying back its own shares.

Heathcoat Amory said that “given the role BH Macro plays in a portfolio – as a potential diversifying counterweight to an otherwise equity-focussed portfolio – there is never a bad time to buy BH Macro, other than when it is on a significant premium to NAV”.

“Now that it is trading on a significant discount, this could prove an attractive entry point to the flagship strategy of one of the most successful hedge funds of all time. In terms of being a strong diversifier to equities, I would say there are no real equals,” he concluded.