The outcome of the US election is the source of much speculation among market commentators, but the results are less important than investors may think, according to experts.

There are just three weeks to go until the US picks its next president, with either Democrat Kamala Harris or Republican Donald Trump bidding win both the Senate and the House of Representatives.

But Mark Sherlock, manager of the $1.2bn Federated Hermes US SMID Cap fund, and Kirsty Gibson, manager of the £689m Baillie Gifford US Growth Trust, said it is irrelevant.

Sherlock said: “There is a lot of chat in the news, understandably so, about who might win. My observation would be that typically, there’s not much that stops the North American capitalist juggernaut either way”.

Below Trustnet breaks down how markets are likely to react to either Harris or Trump taking over the Oval Office.

The US economy under Democrats and Republicans

Indeed, the US economy has enjoyed remarkable resilience regardless of which party has come into power, despite their often very differing fiscal policies.

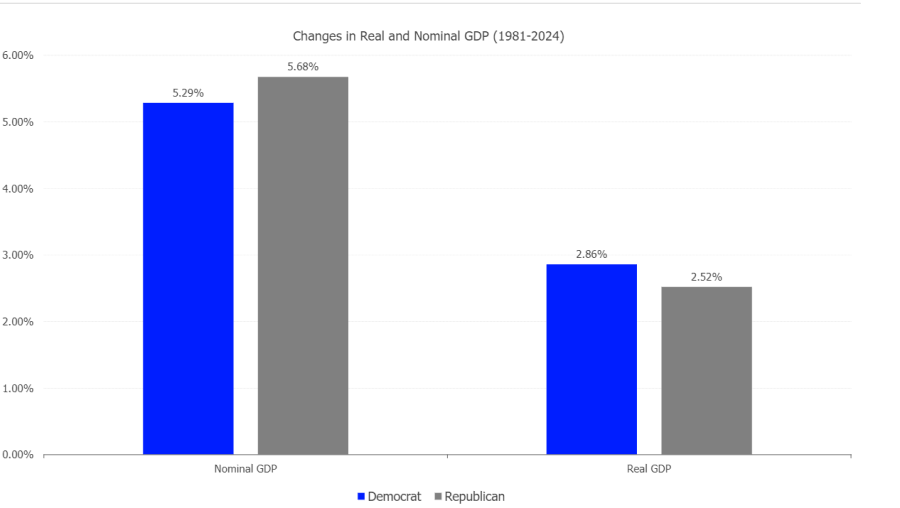

According to research conducted by the London Stock Exchange earlier this year, historical GDP growth has been broadly similar regardless of which party has been in power. Under a Democratic president, real GDP has risen by 2.9% since 1984. In the same period, GDP climbed by an average of 2.5% under Republican presidents.

Average changes in real and nominal GDP, 1981-2024

Source: London Stock Exchange. FTSE Russell/LSEG. Data as of 31st of August 2024.

In an election year candidates will usually campaign on the platform of a strong economy because that is the pledge that wins votes, said Sherlock. This time around, both candidates seem to lack a clear economy policy making it a comparatively “issueless” election .

He added: “Really, when you boil it all down, everyone wants a strong domestic economy, and both candidates will be supportive of that”.

Markets and presidencies

Of course, it is worth remembering that the economy and the market are not the same thing. Gibson said: “Even if we assume the president influences the economy completely, which is debatable in itself, it is not the singular factor driving the market forward.”

Indeed, market developments and mega trends have often had a more notable impact on the performance of the US market than which side of the political spectrum comes to power.

For example, while Gibson noted that the average return for the S&P 500 under Republican presidents was 5% per year, compared to 11% per year under Democratic candidates, these numbers are distorted.

This discrepancy is largely the result of wider market circumstances rather than the political or fiscal leanings of any one candidate.

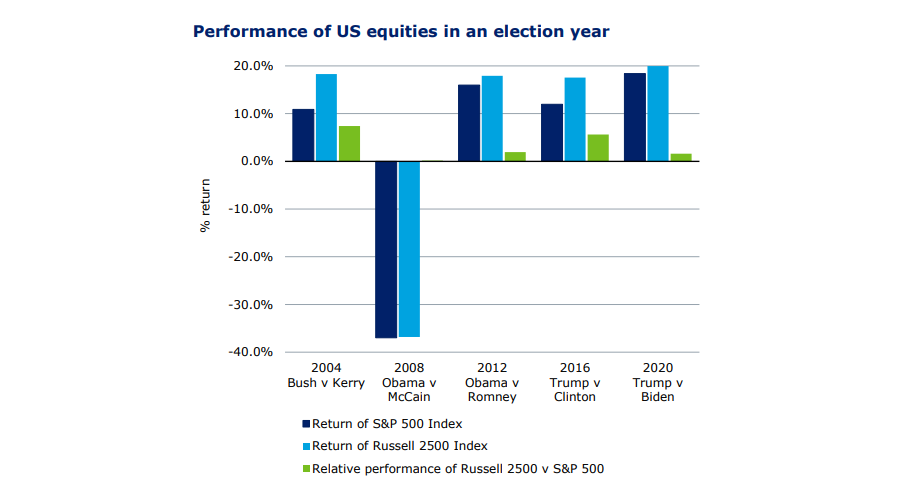

Performance of US Equities in an election year

Source: Federated Hermes. Bloomberg as of 31 August 2024. Returns in USD

For example, in four out of five elections since 2004, the US indices enjoyed broadly similar rises in value during election years. The only exception to this was 2008 when US equities fell by more than 30% because of the global financial crisis.

Similarly, Republican George W. Bush’s numbers looked far worse because the dot-com bubble burst almost immediately after his election. By contrast, Democrat Joe Biden enjoyed much better numbers as he was able to enjoy the massive recovery in US equities following the pandemic period.

Furthermore, even a division between Congress and the presidency is not proven to affect the future of the US economy.

For example, in 2014, during Barack Obama’s second term, despite Congress being controlled by Republicans, the S&P 500 rose by 20% in sterling terms that year. By contrast, during Bush’s second term when Congress was controlled by Democrats, the S&P 500 was up 16.7%.

“When we look back in 20 years, I don’t think the discussion will be about whether Harris or Trump won the election. It is going to be more to do with who put in place the infrastructure necessary to take on board trends such as the AI [artificial intelligence] paradigm shift.” Gibson concluded.

Sherlock added: “While there may be a move to the left or a move to the right on particular policies with a short-term effect, really the capitalist juggernaut will keep on trucking.”