Funds managed by Artemis, Lazard and GQG Partners are among those that investors could look to if they think emerging markets are poised for a rebound, fund pickers have said.

As Trustnet examined yesterday, a strong economic backdrop, stimulus in China, attractive valuations and a weaker dollar are some of the reasons why investors are starting to feel more confident in their outlook for emerging markets.

Below, we look at five funds the experts are tipping for investors looking to buy into emerging markets.

Artemis SmartGARP Global Emerging Markets Equity

We start with FE Investments, where emerging markets fund analyst Tahia Tahmin picked out Raheel Altaf’s £1bn Artemis SmartGARP Global Emerging Markets Equity fund.

She said the approach taken by the £1bn fund is not a conventional one but has proven to be successful with the fund outperforming over one, three and five years, as well as since its launch in 2015.

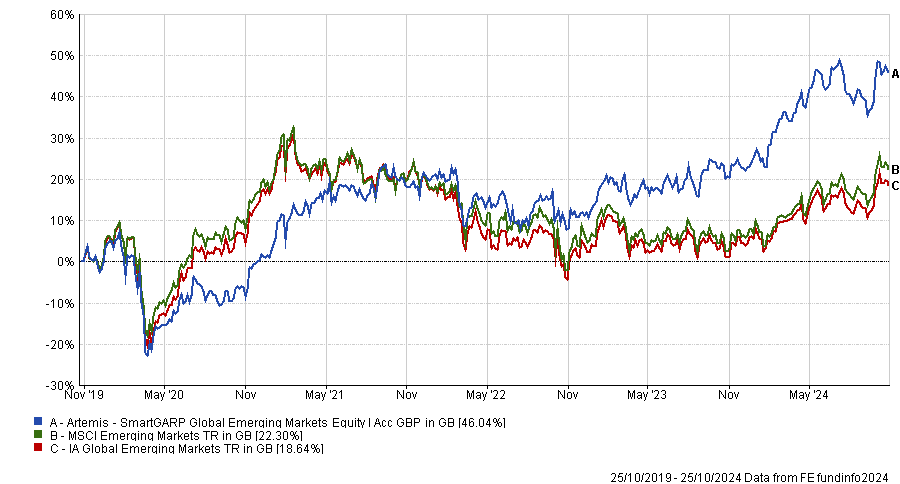

Performance of Artemis SmartGARP Global Emerging Markets Equity vs sector and index over 5yrs

Source: FE Analytics

“The manager incorporates both a systematic process from his quantitative tool SmartGARP to screen for stocks and eliminate the potential for any behavioural biases, as well as applying a qualitative layer to the process, which allows the manager to factor in top-down risks and carry out sanity-checks on all investment decisions,” Tahmin explained.

In looking for stocks that are growing faster than the market but trading on lower valuations, the fund ends up with a value tilt. Top holdings at present include Taiwan Semiconductor Manufacturing Company (TSMC), Tencent Holdings, Kia Motors and Petróleo Brasileiro.

GQG Partners Emerging Markets Equity

Darius McDermott, managing director at FundCalibre, thinks investors need to watch the strength of the US dollar and the impact of China’s stimulus package as both factors will influence the performance of emerging market equities from here.

To cope with this uncertain environment, McDermott highlighted the $3bn GQG Partners Emerging Markets Equity fund. It is run by Rajiv Jain, Brian Kersmanc and Sudarshan Murthy, all of whom hold FE fundinfo Alpha Manager status.

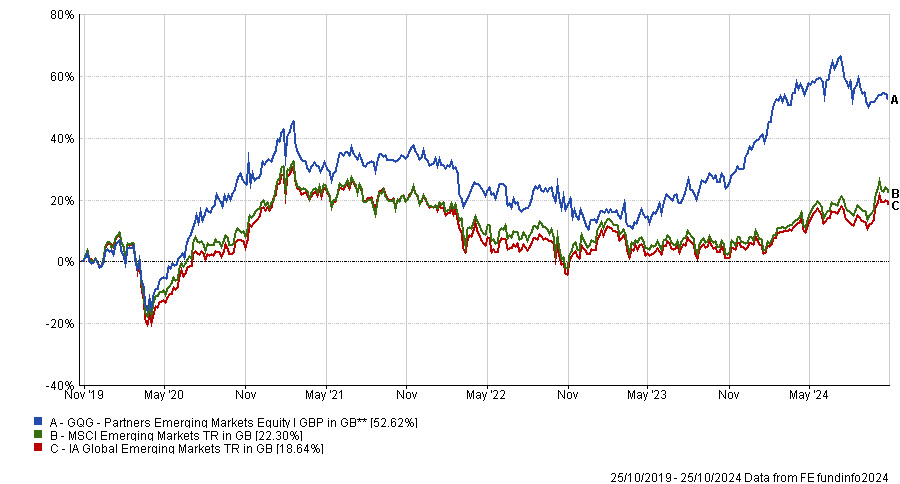

Performance of GQG Partners Emerging Markets Equity vs sector and index over 5yrs

Source: FE Analytics

“This fund benefits from inherent flexibility, allowing it to quickly adapt to market opportunities,” he explained. “Moreover, it is managed by a highly experienced team that has delivered stellar returns for investors since its launch.”

GQG Partners Emerging Markets Equity’s process seeks out companies with attributes such as stable financial and solid balance sheets, profitability, efficiency, sustainable businesses and liquidity, giving it a quality-growth bias. Top holdings include TSMC, Petróleo Brasileiro, TotalEnergies and Adani Enterprises.

Invesco Emerging Markets ex China

McDermott also suggested the Invesco Emerging Markets ex China fund for investors who want an emerging markets fund without exposure to China. This could be for several reasons, including scepticism about the outlook for China or because they already own a dedicated Chinese equity strategy.

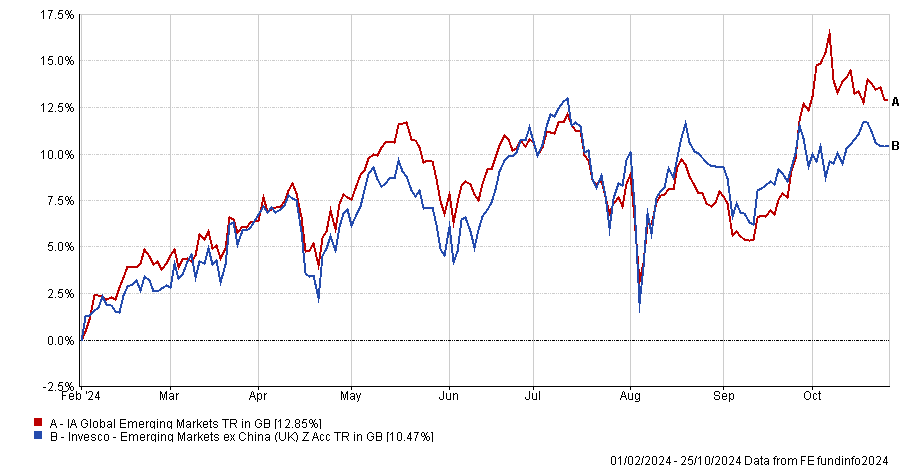

Performance of Invesco Emerging Markets ex China vs sector since launch

Source: FE Analytics

Managed by James McDermottroe and FE Alpha Manager Charles Bond, the £240m fund has a contrarian approach that looks for companies in unloved parts of the market. It’s another fund with TSMC in its top 10, which sits alongside the likes of Samsung, HDFC Bank and Naspers.

“The process adopts a value focus, with returns largely driven from stock selection. It is still relatively early days, but performance since launch has been very promising,” McDermott said.

Lazard Emerging Markets

Rob Morgan, chief analyst at Charles Stanley Direct, pointed out that the long-term opportunities of emerging markets are currently offset by high valuations in the Indian market and political and economic uncertainties in China.

“To balance the opportunities and the risks we favour an active approach that combines elements of quality and value to navigate this disparate sector. As such Lazard Emerging Markets is a good fit,” he said.

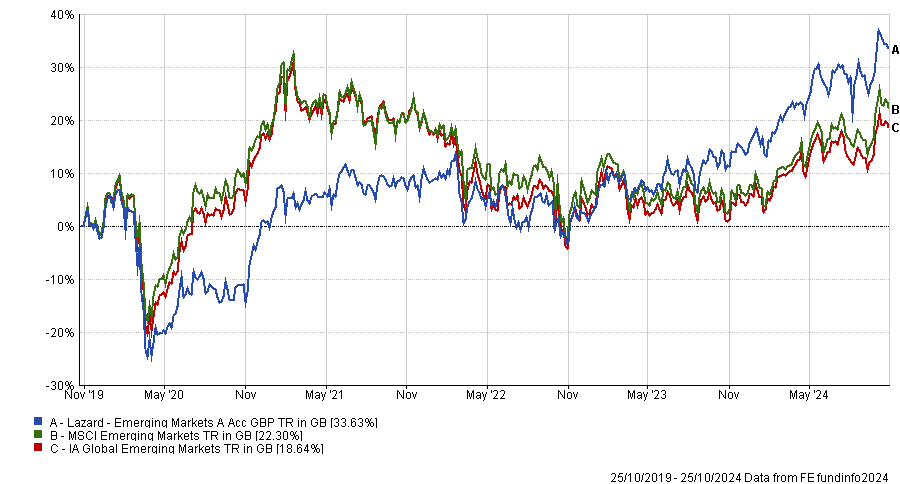

Performance of Lazard Emerging Markets vs sector and index over 5yrs

Source: FE Analytics

“The fund adopts a patient and strict ‘value’ approach, buying into shares in unloved companies at a significant discount to their true worth. However, James Donald’s philosophy could be better summed up as ‘quality at a discount’.

Morgan said the fund should appeal to those who believe an active manager can add value by prioritising quality and avoiding problem companies or those most adversely impacted by the political or regulatory landscape.

Lazard Emerging Markets’ largest holdings include TSMC, China Construction Bank, Alibaba and Indus Towers.

HC Sephira GEM Long-Only

Simon Evan‑Cook, manager of Downing Fox multi-asset funds, told Trustnet yesterday that active managers he invests with are optimistic about benign economic conditions, good companies and cheap valuations in emerging markets.

One lesser-known fund that Evan-Cook uses to play this space is HC Sephira GEM Long-Only fund, which is managed by Jason Mitra, the founder and chief investment officer of Sephira Investment Advisors.

“He runs a highly active strategy investing in high-quality businesses. He also focuses heavily on risk management of the portfolio, as he is aware that even the highest quality companies in emerging markets can face risks above and beyond those of more established markets,” he added.

“This can result in higher turnover, but we believe this is no bad thing if the manager can demonstrate that trading is adding value above its costs.”

HC Sephira GEM Long-Only uses a bottom-up approach that looks for high-quality, undervalued companies in the overlooked areas of emerging markets. Top holdings include DiDi Global, TSMC, Star Health and Allied Insurance.