Investing is a delicate balancing act. Many investors try to walk a careful tightrope between risk and reward, but for Shaniel Ramjee, co-head of multi-asset at Pictet Asset Management, the balance has tipped too far in one direction.

For Ramjee, investors have become too cautious and unwilling to take the chances necessary to thrive in difficult environments. As investors continue to search for greater returns, they will find themselves struggling if they continue to avoid the more volatile sectors.

“Investors need to be aware that investing for real returns is the only way to secure long-term financial security, and being too defensive will hinder that,” he said. “We do think that investors, by and large, have become too risk averse.”

He attributed this caution to several factors, particularly people’s fixation with cash.

Rising interest rates have made cash more attractive in recent years, but interest rates will dampen the returns available, Ramjee commented, making other asset classes far more appealing.

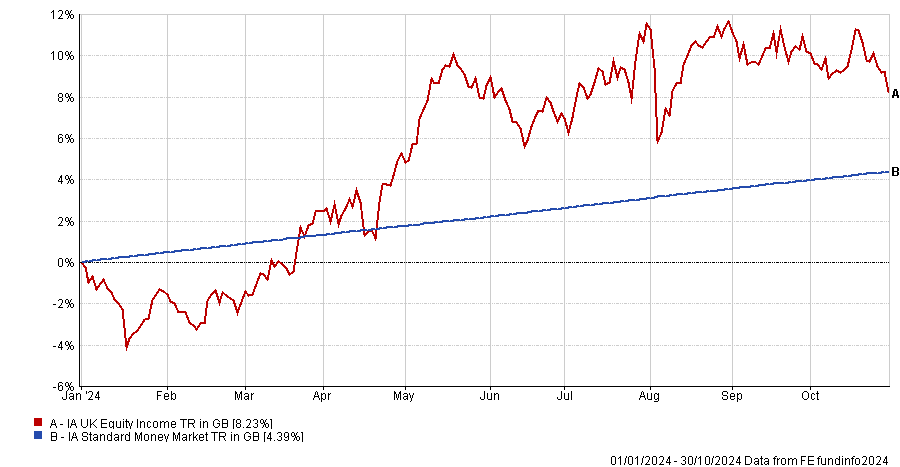

Indeed, while funds in the IA Standard Money Market sector have seen modest growth year-to-date (YTD), rising by an average of 4.39%, other asset classes have enjoyed similar or even better growth, with the IA UK Equity Income sector up by 8.2%.

Performance of sectors YTD

Source: FE Analytics

For Ramjee, overreliance on cash has blinded investors to the significant opportunities available from other, more volatile asset classes.

“While cash rates may have looked appealing, it was not the best decision for many investors, who should have been looking at investing in the wider financial markets and across the capital structure,” he said.

“Not only is cash not king, but it could also prove to be the joker in the pack”.

What other asset classes should investors turn to?

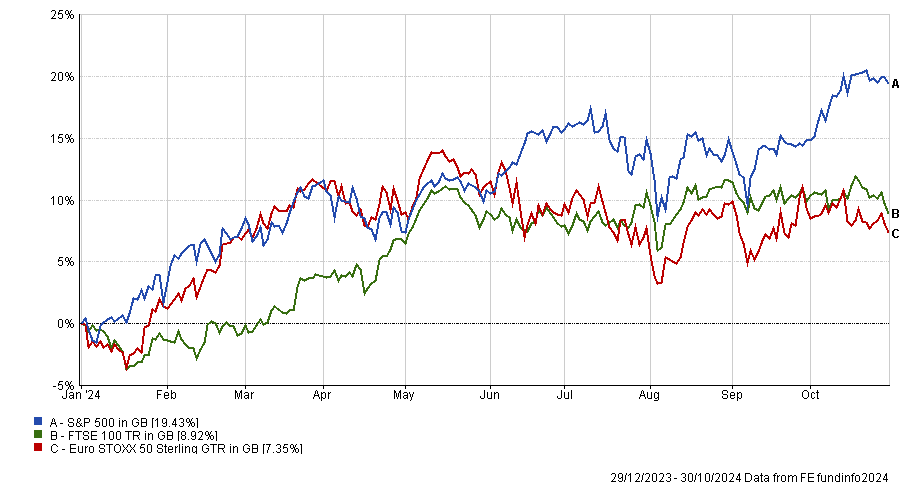

Despite recent surges in volatility, it has been a good year to be an equity investor. The S&P 500 is up by 19.4% despite experiencing one of the largest sell-offs on record in August.

Performance of indices YTD

Source: FE Analytics

Additionally, with further rate cuts expected from central banks this year, Ramjee expects a wider variety of companies to benefit, leading to more varied long-term opportunities for investors willing to venture into the stock market.

Moreover, for Ramjee, equities provide investors with exposure to the “real economy” and serve as an essential diversifier despite being relatively high-risk. As he puts it, returns from equities reflect real market activity and developments.

For example, if inflation is persistently high, that will be reflected in dividends, earnings and capital appreciation of companies. Similarly, when inflation declines, returns on equities will shift in response.

“We think all investors, over the long run, should have some exposure to the real economy. Equities are still one of the best places for long-term savers to invest their money,” he stated.

Ramjee also drew attention to the fixed income market, in particular corporate bonds. As a higher-risk asset than cash, bonds remain a great diversifying addition to a portfolio, providing market exposure without taking on too much risk.

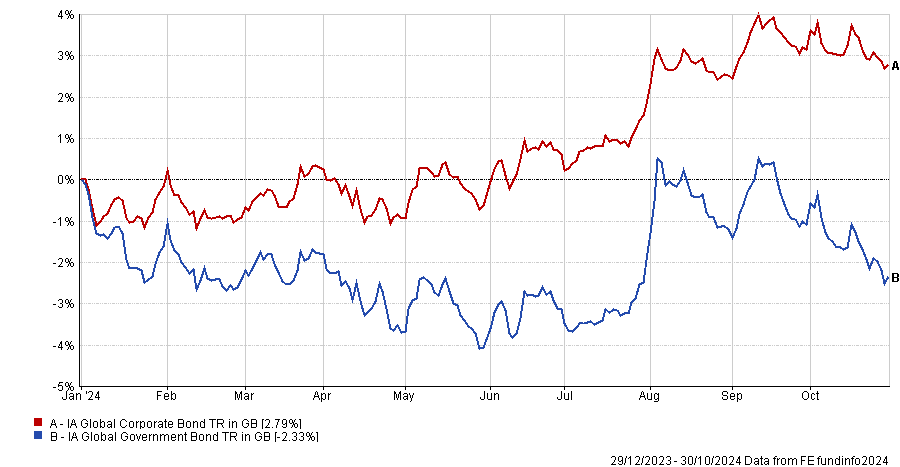

Spreads (the additional yield on corporate bonds compared to government bonds) are tight but nonetheless, corporate bonds have still outperformed government debt this year.

Funds in the IA Global Corporate Bond peer group enjoyed growth of 2.8% YTD, while portfolios in the IA Global Government bonds sector slid by 2.3%.

Performance of sectors YTD

Source: FE Analytics

Ramjee attributed this to corporations’ fiscal caution compared to governments, which have accrued significantly inflated balance sheets. Take for example the US, which is facing a national debt of over $35.8trn.

“The creditworthiness of corporates we believe, will remain much stronger than that of governments around the world,” he added.

Ultimately, higher returns can only be achieved by taking more risks and diversifying away from cash. "Investors just don't invest enough," Ramjee concluded.