Investors who have become wary of their traditional (market-cap weighted) S&P 500 exposure could rejoice this October at the abundance of launches of S&P 500 equally-weighted index funds.

In the past month only, Trustnet reported of two new strategies that have come to market, the Legal & General S&P 500 US Equal Weight and the HSBC S&P 500 Equal Weight Equity index fund. On top of that, the Invesco MSCI World Equal Weight UCITS exchange-traded fund (ETF) was launched in Europe at the start of September.

These strategies work differently compared to a more common market-cap weighted index tracker. While the latter attributes larger index positions to larger companies, equal-weighted S&P 500 trackers have a neutral weighting of 0.2% in each of the stocks in the S&P 500.

Because the index is typically rebalanced every quarter, no single company will make a meaningful contribution to returns, but investors are still getting directional exposure to the broad US market.

The aim is clear – to offer an investment vehicle for cheap and broad US exposure while avoiding the concentration risk in the top seven companies that make up one third of the whole 500-strong index, commonly referred to as the Magnificent Seven – Nvidia, Apple, Microsoft, Alphabet (Google), Amazon, Meta Platforms (Facebook) and Tesla.

Their dominance might just be starting to wane, and investors would be right to look elsewhere, according to Duncan Lamont, head of strategic research at Schroders.

This year “a significant proportion” of global companies have outperformed most of the Magnificent Seven, as is shown in the chart below.

Magnificent Seven performance against MSCI ACWI companies

Source: LSEG Datastream, MSCI, Schroders. Data to 30 September 2024, in US dollars.

“Don’t get me wrong, many of the Magnificent Seven are fantastic companies,” he said. “The theme here is one of broadening out. Whereas last year, returns outside of the Magnificent Seven were mediocre in comparison, this year there has been a wealth of often overlooked opportunities,” he said.

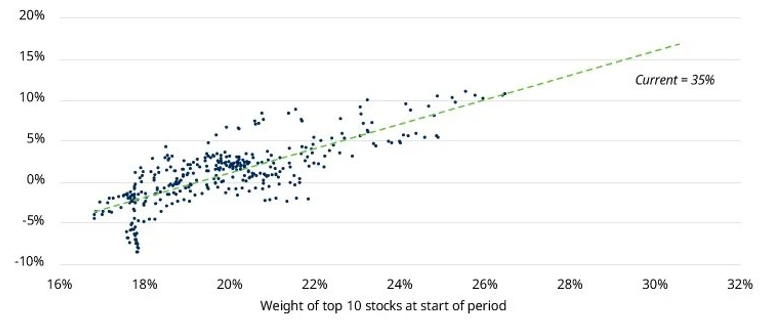

“There are opportunities away from the mega-caps, but portfolios have a shrinking allocation to them. Historically, periods of high index concentration have foreshadowed periods when the bigger companies went on to underperform the average company.”

Greg Hirt, global multi asset chief investment officer at Allianz Global investors, agreed with Lamont that the earnings growth gap between the Magnificent Seven and the remaining 493 companies “is expected to narrow”.

Concerns over their “outsized” influence make the equal-weighted approach in the US stock market “compelling, offering diversification that reduces single-stock risks”.

“It is true that US equities, mainly driven by growth stocks, appear quite richly valued. But given that we prefer value compared to growth and equal-weighted versus market-capitalisation weighted, broad equities in general do not appear overly rich,” he said.

“In the US, we have seen that high valuations can last longer than anticipated. We think technical conditions are still supportive of equity markets and we see potential for further gains.”

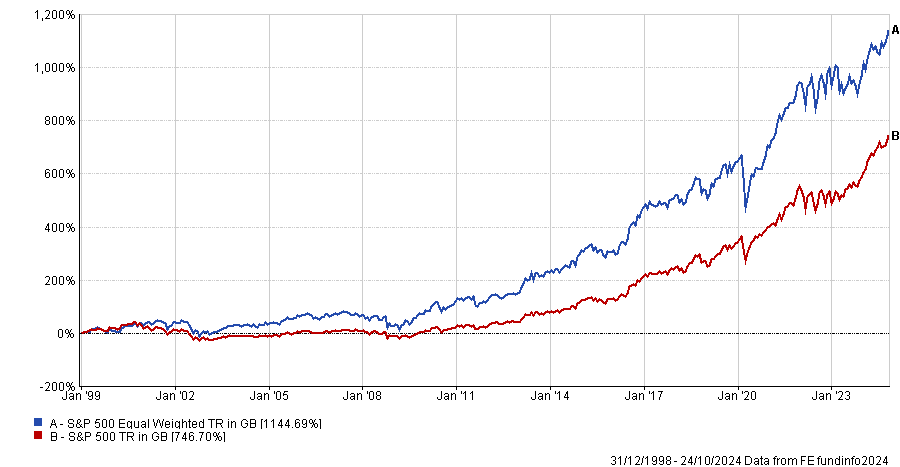

In addition to the short-term reasons for backing an equally weighted tracker, there are long-term ones too. The equal-weighted version of the S&P 500 has outperformed the typical market-cap weighted version historically.

This is highlighted by the charts below, showing the returns of the two types of indices over the past five years (positive means equal-weighted outperforming) and 20 years (the S&P 500 Equal Weighted index was launched in 1999), respectively.

Five-year outperformance of equal-weighted S&P 500 versus market-cap weighted

Source: LSEG Datastream, S&P, Schroders. Data as 31 December 1989 to 31 October 2023.

Performance of indices over 20yrs

Source: FE Analytics

So what are the options for investors who are growing increasingly uncomfortable with their exposure to US mega caps?

Jason Hollands, managing director of Bestinvest, said the Xtrackers S&P 500 Equal Weight UCITS ETF is worth considering – especially for its ongoing charges figure (OCF) of only 0.20%.

However, an alternative option to an equal-weighted tracker for those worried about overvaluation in parts of the US market and seeking exposure to a broad basket of US equities, would be the Invesco FTSE RAFI US 1000 ETF.

This ETF has outperformed the equally-weighted S&P 500 over one, three, five and 10 years and it provides “wider exposure to include mid-cap names”.

It is a factor fund that owns the 1,000 largest US companies – double the number of the S&P 500 – whose position size is determined by four fundamental factors: sales and cash flow (both averaged over the prior five years), book value at the review date and total dividend distributions averaged over the past five years, Hollands explained.

“These factors give a slight value tilt that favours more defensive companies. Unlike an equally weighted index fund, where position sizes are tiny, the largest holding in this ETF [currently Apple is 2.4% of the portfolio] can make a more meaningful contribution,” he said.

The ongoing costs are at 0.39%, however, “much higher” than the 0.20% which is typical for the S&P 500 equally weighted ETFs.

An alternative is to eschew passive funds altogether and pick active managers who do not have overweight positions to the Magnificent Seven.

Lamont said: “The proportion of assets managed passively around the world has never been higher. The reasons for this are well known and understandable. But it is worth investors at least pausing to reflect on what that really means in today’s market.

“There are tremendous opportunities across global stock markets today but passive portfolios have rarely had so little exposure to them. Individual decisions may be understandable but I do worry that the precise timing of the influx may be inopportune.”