At the start of the year I made a set of bold predictions, noting that, while unlikely, the five suggestions were very possible. But perhaps I was not bold enough and should have backed myself as the next Nostradamus.

It has taken just four months for the first of my suggestions to come true: at least three of the Magnificent Seven members have already dropped 30% or more.

At the time I thought the US dominance would start to unravel and highlighted Nvidia as my pick to be one of the worst performers of the group.

This may seem obvious now, but back then – all four months ago – many were predicting another comfortable year for the artificial intelligence (AI) players, with US president Donald Trump expected to be pro-business. Fast forward to today and we know this has not been the case.

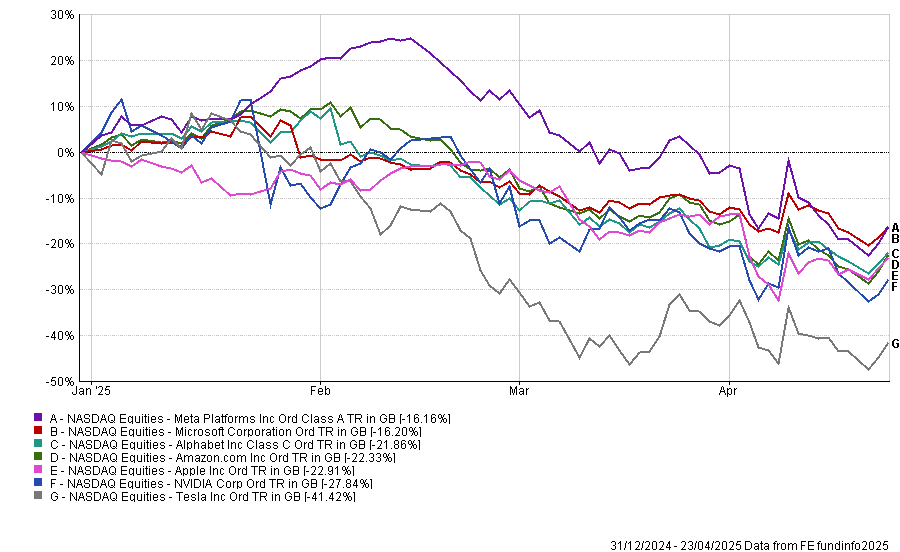

As things stand, Tesla is at the bottom of the pile, making a loss of 41.4% so far in 2025. Nvidia is second at 27.8%, while Apple, Amazon and Alphabet are all down more than 20%, as the below chart shows.

That doesn’t look like my prediction has come true, I admit, but diving into the numbers shows that things have indeed been as bad as I feared.

Looking at the maximum loss an investor could have made since the start of the year if investing at the worst possible time in each of these stocks, Tesla (down 44.8%), Meta (33.1%), Alphabet (30.9%) and Amazon (30.9%) have all now achieved the suggested 30% drop from peak to trough predicted at the start of the year.

Performance of Magnificent Seven shares over YTD

Source: FE Analytics

Before you fear my ego is so large that the entire Trustnet website could not contain it, allow me to take myself down a peg.

I did not see Trump’s tariffs coming, nor did I think the first-third of the year would be as volatile as it has been. My suggestion was based on valuations and the belief that, at some point, any earnings disappointment would be pounced on by the market, taking the shine off the Magnificent Seven.

While the latter point was right, I did not expect it to happen so soon.

To knock myself further, three of my other predictions are to do with the end of the year: emerging markets will end 2025 as the best performing equity region; the US will end down; and active managers will beat passives.

None of these look particularly likely at present, although the US one seems my most likely winner.

Nor does the idea that UK interest rates will fall to 3.5%, although there is still some hope for this if the UK economy is rocked by tariffs, causing growth to suffer while inflation holds steady. In this scenario, the Bank of England could see fit to prioritise growth and cut rates more aggressively.

Admittedly, this prediction may have been borne more out of hope than expectation, considering I have a mortgage renewal coming up in 2026.

Finally, there was a sixth idea that I mooted to the team but was shot down for being too farfetched: the return of Neil Woodford running money for investors.

While this is still a long way off, his latest W4.0 venture – allowing subscribers to invest alongside the disgraced former fund manager for a fee – is certainly along those lines. I could have chalked that prediction up as a success as well. If only I had been bolder!