Markets were on the rise yesterday as US president Donald Trump seemingly reconsidered his positions on Federal Reserve Chair Jerome Powell and on tariffs, but this won’t be enough to spare us from an impending bear market if these experts are right.

Bear markets can last years but recoveries happen quickly and investors who run for the exits could get left behind when things turn.

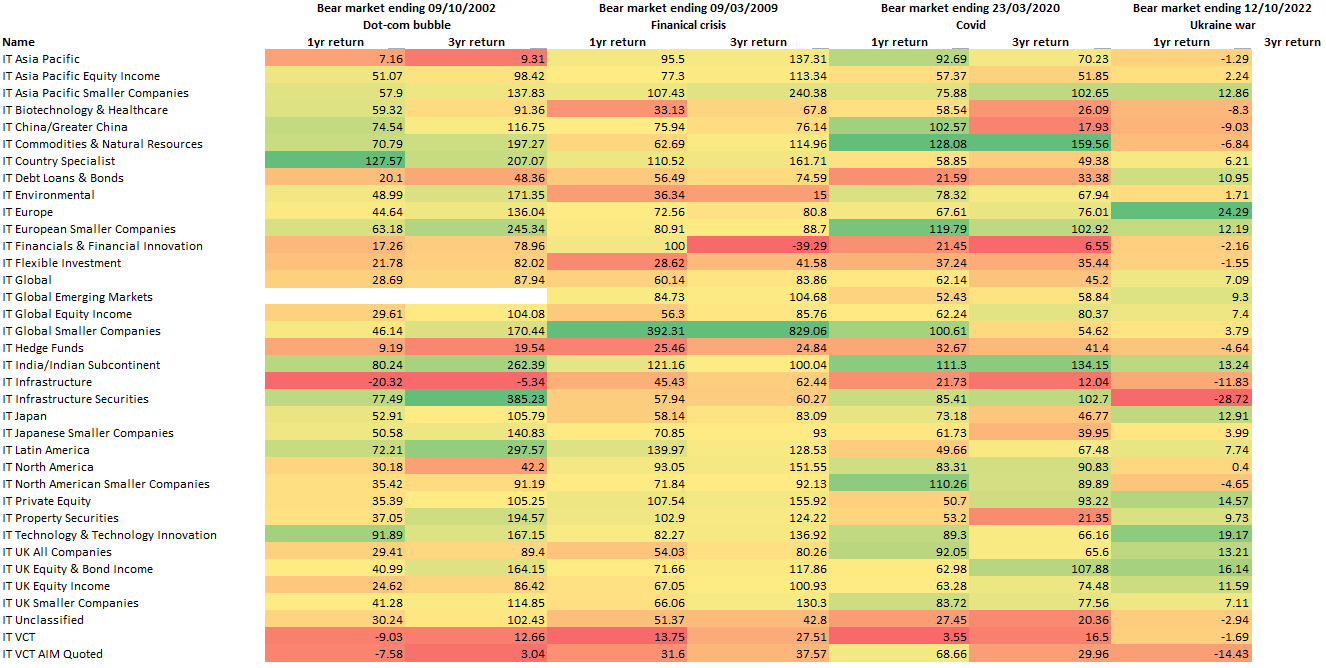

On Monday, we revealed the best and worst Investment Association sectors to own after a bear market, highlighting those that topped the charts in the 12-month and three-year periods after the latest bear markets finished. The study spanned from the Ukraine war of 2022 to the dot-com bubble of 2002.

Today, we publish the same study applied to the investment trusts universe and highlight similarities and differences to the open-ended side of the market.

As per the previous instalment, we defined a bear market as those periods when the S&P 500 hit losses of at least 20%, we excluded the sectors without a long enough track record as well as the IT Not Yet Assigned and IT Unclassified sectors, and colour-coded the average returns of those that remained by quartile.

Source: Trustnet

Bonds

The most evident trend in the Investment Association version was the underperformance of fixed income, but this wasn’t evidenced here as clearly because the asset class isn’t one that people usually access through investment trusts.

The IT Debt Loans & Bonds sector, whose nine constituents invest in general loans and bonds, didn’t stand out particularly either positively or negatively, with a worse-than-average performance before and during the Covid recovery and a slightly more positive period after the supply-chain shocks cause by Russia’s invasion of Ukraine.

The other two debt-focused peer groups, IT Structured Finance and IT Direct Lending, haven’t gone through a pre-2020 bear market and were therefore excluded from the analysis.

Vehicles in the IT UK Equity & Bond Income sector can only invest up to 20% in bonds and have most likely been propped up by the equity allocation, which can go as high as 80%, making it one of the better sectors to invest in during the three years following Covid and between October 2022 and October 2023.

Alternatives

Instead of bonds, the worst investment company sector has been venture capital trusts, IT VCT and IT VCT AIM Quoted. The companies they invest in – young, innovative and often privately-owned UK companies – might be more exposed to shocks and take longer to recover. Both sectors have been among the worst to invest in as the bears have turned to bulls.

Another bet that hasn’t played out historically has been hedge funds, whose use of derivatives and short positions makes them riskier and not as steady in post-bear market scenarios when stocks rise.

Still within alternatives, infrastructure trusts have taken a bigger hit than infrastructure funds, with the IT Infrastructure sector among the worst performers in four recovery periods out of the seven analysed.

This might be because these managers can split their portfolios between debt and equities. The IT Infrastructure Securities sector, which only includes infrastructure shares, has done much better and was the best performer in the three years following the dot-com bubble.

IT Financials & Financial Innovation trusts took longer to recover after the 2008 financial crisis, making a 39% loss in the three-year period between 2009 and 2012 and also disappointed in the three years after Covid.

One of the few alternative investments that did well more often than not was commodities and natural resources, which had a particularly good run after Covid and the dot-com bubble.

Equities

Most equity sectors had up years and down years, showing how there is no one-size-fits-all when it comes to investing in different backdrops.

That said, the IT UK Equity & Bond Income, IT Technology & Technology Innovation and IT India/Indian Subcontinent sectors have been above-average more than they have been below it. However, smaller companies proved the most successful in consistently navigating recovery periods.

The IT Global Smaller Companies sector shot the lights out with 392% and 829% returns after one and three years post-financial crisis, which no other asset class has been able to match.

European and Asia-Pacific smaller companies also remained above-average in most time frames, while the IT UK Smaller Companies didn’t keep up as well when compared to other smaller companies across the globe.

Contrary to funds, trusts with a focus on Asia Pacific more widely didn’t hold up particularly well, especially in the early 2000s.