Bond and equity markets have been roiled by volatility since the start of US president Donald Trump’s second term and his stop-start announcements on tariffs are making it difficult for fund managers to make forecasts. The best course of action therefore is to avoid taking big bets, according to Bryn Jones, head of fixed income at Rathbones.

Last week there was a big shift in the rates market as Trump flip-flopped on policy, especially at the long end of the gilt and treasury yield curves, which the Rathbone Greenbank Global Sustainable Bond manager described as “quite alarming to see”.

“The 50 basis point moves in long bonds in a week is something I haven’t seen much in my career before. But my experience tells me, you don’t panic in those periods. While last week was a weak week for us, in the context of rates and credit moves, you can gain that back in the space for a couple of days.”

Trump’s “headline bingo” continued this week. The president’s verbal attacks against US Federal Reserve chair Jerome Powell, who he called “a major loser”, shook up credit and equity markets until Trump reversed course and said he had no intention of firing Powell – prompting a market rally on Wednesday.

Treasury secretary, Scott Bessent and Trump also “backtracked a little by saying ‘we’re going to be nice to China’,” Jones added, but warned that “come tomorrow the news will be different.”

Selling on Monday and buying back on Wednesday would have been far riskier than standing pat this week, he pointed out. As such, he said doing nothing “is actually quite important”.

“You don’t want to get whipsawed in these environments from the whack-a-mole politics that’s coming out of Washington. My experience tells me, if you trade reactively, you end up on the wrong side of both trades,” said Jones.

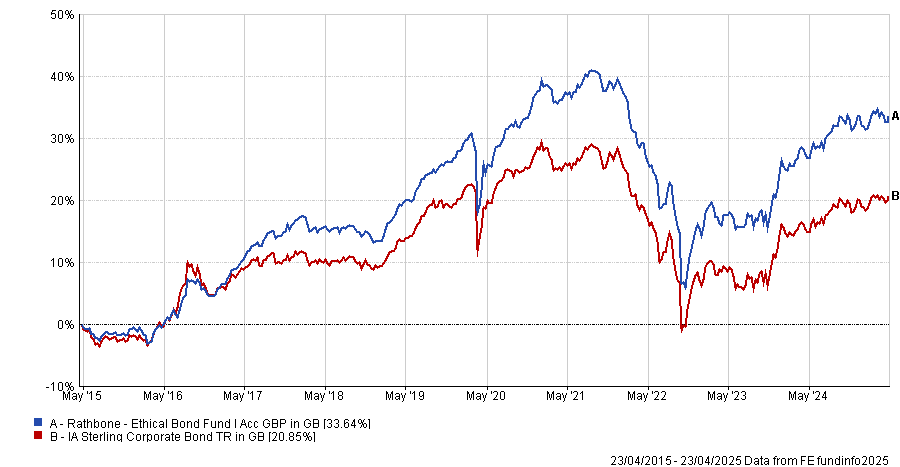

His patience has been key for investors over the years. His Rathbone Ethical Bond fund made 33.6% over the past decade – a top-quartile return in the IA Sterling Corporate Bond sector, while his Rathbone Strategic Bond fund has made 30.4% over the past decade, an above-average performance in the IA Sterling Strategic Bond sector.

Performance of fund vs sector over 10yrs

Source: FE Analytics

The former was added to AJ Bell’s favourite funds list this week with Paul Angell, head of investment research at the firm, describing it as “a highly credible sterling corporate bond offering, with a long-established approach to ethical investing”.

“In Jones, the fund has an extremely experienced lead manager, who’s supported by a small but dedicated team of fixed income investment analysts. The fund usually takes on more credit risk compared to others in its sector, while interest rate risk is actively managed within two years of mainstream indices,” he continued.

AJ Bell removed the CT Responsible Sterling Corporate Bond fund to make room for Rathbones, noting the Columbia Threadneedle fund’s duration and credit risk are “managed within much narrower bands versus a mainstream index”.

“This conservative approach has led the Threadneedle fund to post some underwhelming relative returns over time,” Angell explained.

Rathbone Greenbank Global Sustainable Bond is Jones’ newest venture. Launched in 2023, it has beaten its average peer over the past 12 months. In this portfolio, Jones is sticking with long-term positions.

One of his higher-conviction ideas is to be prepared for weaker dollar assets. To do this, he is underweight US treasuries and overweight German bunds. “Clearly the US is in a framework of trying to weaken the dollar and reduce its borrowing costs,” he observed.

However, he recently “locked in some outperformance” by slightly reducing the US underweight, as the fund has “significantly outperformed its benchmark as a result of being underweight the US”.

Jones also has a substitutes bench of names he is waiting to buy when market weakness offers an opportunity. But things are moving too quickly at present, as the manager found this week, when he began to pick off some of these names. The swing to a risk-on mood on Wednesday meant that liquidity rapidly dried up in the high-yield market and prices quickly rose to a level he felt was too high.

“At some point, the weakness will throw up cheap valuations and we await further news on tariffs, counter tariffs and negotiations before formulating a view to unwind our low-risk bucket and get more aggressive with any risk taking,” he added.

For now, it is still difficult to read whether yields will rise, whether the economy will enter stagflation or whether weak growth will lead to interest rate cuts, so “I can’t be taking huge bets”, he concluded.