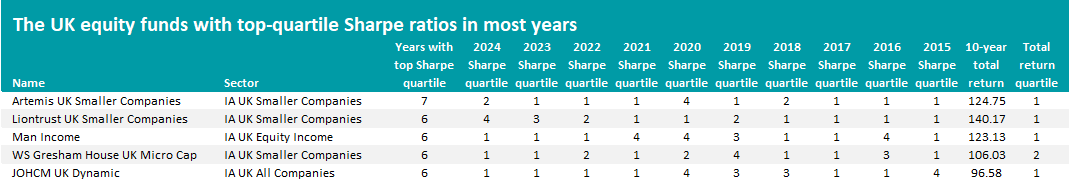

There are five funds in the IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies sectors that have generated top-quartile Sharpe ratios for most of the past decade, according to Trustnet research.

The Sharpe ratio evaluates how much return an investment generates relative to the risk it takes by comparing its return above the risk-free rate to its volatility. A higher Sharpe ratio means the investment has delivered more return for each unit of risk, making it a valuable measure of performance efficiency.

In this series, Trustnet examines the Sharpe ratios of funds over the past 10 years to identify those that have ranked in their sector’s top quartile for six or more of those years on this key risk-adjusted return measure.

Source: FE Analytics. Total return in sterling between 1 Jan 2025 and 31 Dec 2024.

When it comes to the IA UK All Companies, IA UK Equity Income and IA UK Smaller Companies sectors, there are 266 funds with track records spanning 10 years but only five funds have posted first-quartile Sharpe ratios in six or more of them.

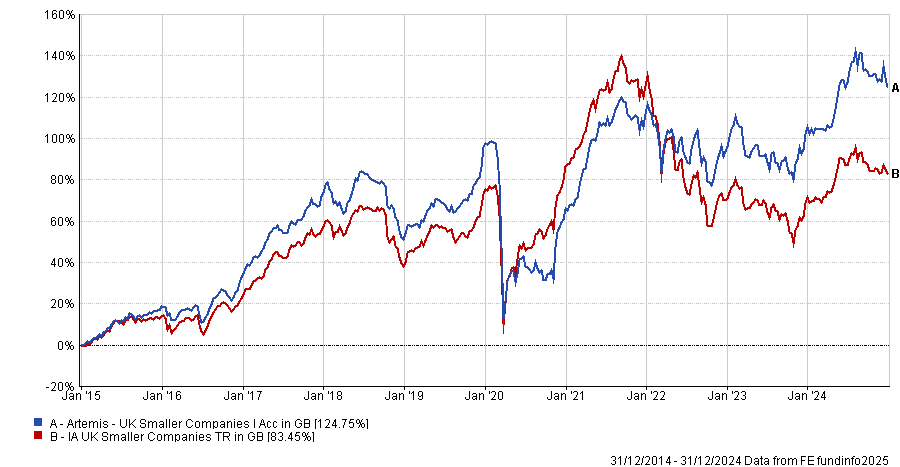

As can be seen in the above, Artemis UK Smaller Companies came in first place – it is the only UK equity fund that has been in the top quartile of its sector in seven of the past 10 years. It also made a 124.8% total return over this period, which is the eighth highest return of all UK equity funds.

Mark Niznik has run the fund since 2007 with William Tamworth joining him as co-manager in 2016. The managers invest in undervalued companies with predictable, growing cashflows and follow a three-pillared approach that looks at firms’ positions in their industries, financials and valuations.

Analysts with Rayner Spencer Mills Research said: “The fund has developed its strong track record over a variety of market conditions. Performance over discrete periods tends to be strong but not spectacular, but builds over time to produce strong returns.

“The value bias within the fund is likely to lag in markets where momentum is building to a point where it ignores fundamentals – such conditions are likely to be short term in nature and the fund usually does well in the correction that follows. The focus on valuation, self-funded growth, and the predictability of future cashflows represents a cautious approach and avoids speculative growth situations that risk disappointment.”

Performance of Artemis UK Smaller Companies vs sector between 1 Jan 2015 and 31 Dec 2024

Source: FE Analytics. Total return in sterling between 1 Jan 2015 and 31 Dec 2024

The other four UK equity funds on the shortlist have been in their sectors’ first quartiles for Sharpe ratio in six of the 10 years examined in this research.

Of these, Liontrust UK Smaller Companies made the highest total return with a 140.2% gain over the decade. It is managed by Anthony Cross, Alex Wedge, Matthew Tonge, Natalie Bell and Victoria Stevens.

It follows Liontrust’s Economic Advantage investment process, identifying UK companies with durable competitive advantages, particularly those underpinned by intangible assets such as intellectual property, strong distribution networks and recurring business. The process emphasises rigorous qualitative analysis, seeking businesses with high barriers to entry and capable management teams to deliver sustainable long-term returns.

Analysts at Square Mile Investment Consulting & Research said: “The investment approach is very well considered and clearly defined, which steers the team towards relatively steady businesses that are gradually growing and generating high levels of cash.

“The emphasis here is very much on a firm's intangible strengths, which by their very nature are difficult to assess using more traditional analytical techniques and therefore are often overlooked by many market participants.”

Man Income, which was the only constituent of the IA UK Equity Income sector to be top quartile for Sharpe ratio in six years and made a 123.1% total return over the decade, is managed by Henry Dixon. He seeks out both undervalued companies whose share prices are at distressed levels and more stable companies that have notably strong balance sheets and greater potential to grow their dividends.

FE Investments analysts said the fund’s outperformance stems from strong stock selection and income generation. They added: “[Dixon] is very disciplined in his approach, which has meant that, despite being often out of favour, he has generated strong capital appreciation, as well as delivering high levels of income.”

Ken Wotton’s WS Gresham House UK Micro Cap fund is another that FE Investments analysts praised for strong stock selection, highlighting its “notable outperformance” in 2015, 2017 and 2018, along with a record of protecting capital in challenging markets. It is up 106% over the 10 years we examined, with six of those years in the top quartile for Sharpe ratio among its IA UK Smaller Companies peers.

The analysts said Wotton’s thorough research process, which comes from his time at private equity firm Livingbridge, and extensive network of industry contacts is a strength when investing at the smallest end of the UK market.

Lastly, from the IA UK All Companies sector, JOHCM UK Dynamic is the final fund to make the shortlist, returning 96.6% over the decade to the end of 2024 with a track record of six years sat in the top quartile of its sector for Sharpe ratio. The process behind the fund looks for “business transformation opportunities”, arguing that companies are dynamic and not static.

It’s worth noting that the majority of this track record was built under Alex Savvides, as Vishal Bhatia, Tom Matthews and Mark Costar took over the fund in 2024 after Savvides’ departure. Bhatia and Costar had worked closely with the UK Dynamic team since its inception in 2008, while Matthews spent eight years as the fund’s senior analyst.