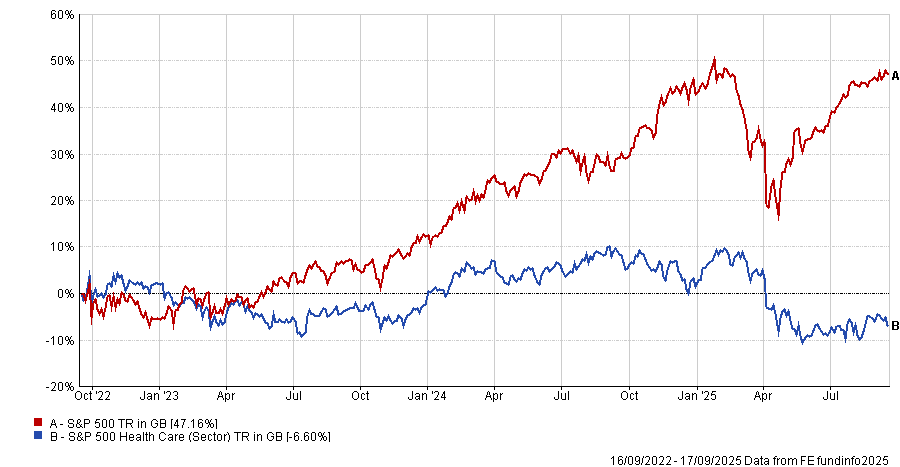

Healthcare has underperformed for more than two years, squeezed by policy headwinds and overshadowed by investor enthusiasm for technology and artificial intelligence (AI).

As such, the healthcare sector is cheaper than it has been in decades following a significant drop in valuations, with the sector trading at an 25% discount to the broader market.

S&P 500 Health Care vs S&P 500 over 3yrs

Source: FE Analytics

Gareth Powell, lead manager of Polar Capital Healthcare Opportunities, said: “Healthcare has been rubbish since 2023, with better-than-expected US economic growth pushing investors to put money into areas like technology, financials and industrials.”

The shift in investor sentiment is further compounded by political uncertainty, particularly in the US, where healthcare policy has become a flashpoint.

The sector is dealing with uncertainty over Medicare/Medicaid policies, tariffs on pharmaceutical companies and pressure from US president Donald Trump to cut drug prices for Americans.

Robert F. Kennedy Junior’s appointment as head of the US Department of Health and Human Services – a man who is sceptical of vaccines – also “freaked everyone out”, Powell added, prompting very weak performance from the healthcare sector in November and December last year.

Despite the recent pain, Powell sees echoes of past cycles, likening 2023 with the environment in 2006-2007, when “healthcare bottomed out on a relative basis before staging a recovery”.

As such, today’s “dire” sentiment toward healthcare and depressed valuations are a potential inflection point.

He expects policy overhangs in the US to clear in the next few months, although he noted that “you have to be an optimist to invest in healthcare”.

“Policy certainty should clarify the earnings potential of healthcare stocks, allow valuation multiples to recover and lead to sector growth,” he added.

Navigating uncertainty

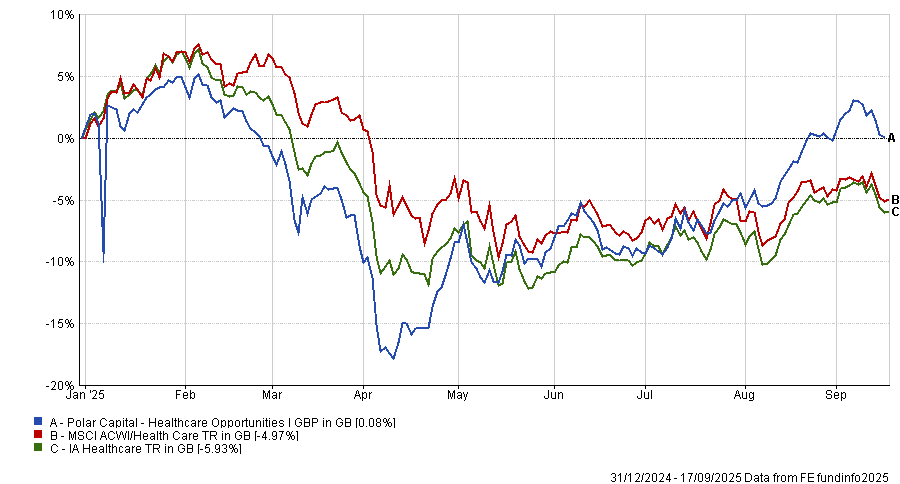

To manage the sector lag, Polar Capital Healthcare Opportunities has leaned heavily on small- and mid-cap healthcare stocks.

“We were aggressive in April, following the Trump [tariff] scare,” said Powell. “We did a tactical shift by selling out of all mega-cap pharma exposures, bought some mid-cap in and added to some small-caps. We have no mega-cap pharma or biotech in the portfolio at the moment and now have around 60% in small- and mid-caps.”

Performance of fund vs sector and benchmark YTD

Source: FE Analytics

Small- to mid-caps have performed well, Powell argued, although he acknowledged they remain vulnerable to interest rates as the cost of capital rises.

This includes Merus, a clinical-stage oncology company headquartered in the Netherlands. The mid-cap specialises in the development of bispecific antibody therapeutics targeting cancer. The company’s share price is up 62.1% year-to-date.

Not all large-caps are underperforming in the space, however. Powell pointed to another top 10 holding, Innovent Biologics, a China-based biotech company that he said has demonstrated “strong financial performance, pipeline development and product approvals”.

The company’s share price is up 172.2% year-to-date.

Stock price performance YTD

Source: Google Finance

The future of the healthcare sector

Although discounted valuations in recent months have increasingly enticed value hunters, Powell said healthcare remains a growth sector.

“Ultimately, I think healthcare is a growth sector. Investors in healthcare make the best returns if they invest in a company that can develop products and bring them to market and generate decent margins – and therefore strong earnings power,” he said.

The integration of AI-based innovation into the sector specifically could further propel healthcare forward, he added. Benefits include better and cheaper medicines, earlier diagnosis, personalised therapies, boosts in medical technology development and more streamlined digital processes in hospital operations.

This should free up capital for companies to invest where it is most needed – in building an innovative product pipeline.

“One thing that has been consistent throughout my investment career in healthcare is that the need for companies to be innovative has only increased,” said Powell.

“The value companies must bring with their products has also only grown over time, and the appetite for ‘me too’ products has decreased. That will continue.”