Value investing has been the way for investors to lose less money so far in 2025, but over the past decade picking growth stocks has been the clear winner.

This year, the MSCI World Value index has lost 1.1% in sterling terms, beating the MSCI World Growth index (down 4.1%). It comes on the back of two straight years where growth stocks were the clear winners and on the back of a decade where value has been the inferior investment strategy.

While some think value investing has emerged from its slumber, others are less convinced and believe growth is still the best way for investors over the long term.

FE fundinfo Alpha Manager Gerrit Smit said that despite recent poor performance “growth as an investment style can be trusted to continue delivering the best result.”

Ben Seager-Scott, chief investment officer at Forvis Mazars, added: “Growth investing has performed well for years and, while there have been challenges more recently, there are still markets where growth looks very appealing”.

Having previously highlighted the experts’ favourite value funds, here Trustnet asks fund pickers for their favourite growth portfolios, covering technology specialists, global markets, the US and Japan.

Charlie McCann, investment analyst at Square Mile, favoured the Rathbones Global Opportunities fund as a growth play.

Led by Alpha Manager James Thomson, the fund aims to find “under-the-radar growth opportunities with high barriers to entry”. These are disruptive and durable companies with pricing power and a “history of under-promising and overdelivering”, which should be able to provide sustained growth even in difficult conditions.

McCann praised it for a well-diversified approach, with the managers refusing to allocate more than 4% to any single stock. While it owns the likes of Nvidia, this lower allocation towards the mega-cap technology names has been a tailwind this year, with the fund down just 1.5% over the past six months, compared to a sector average drop of 4.3%.

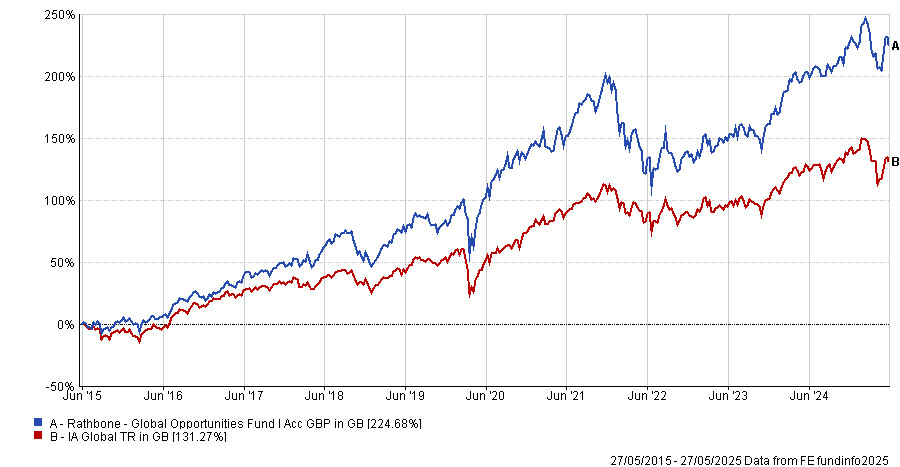

Although the fund can prove volatile in the short term, the strategy will reward investors over longer timeframes, making it a strong option for growth investors, he said. Indeed, over the past decade, the fund is up 224.7%, the 10th best result in the IA Global sector.

Performance of the fund over the past 10yrs

Source: FE Analytics

Another option for investors aiming to double down on growth is the T.Rowe Price US Large Cap Growth Equity fund, which Seager-Scott described as a “star of growth investing”.

The strategy is more than just a “momentum play” because the managers buy companies that can attempt to grow their bottom line and justify stretched US valuations rather than just “buying whatever is currently doing well”.

While the portfolio does hold six of the Magnificent Seven (Apple, Nvidia, Microsoft, Amazon, Alphabet and Meta), it also maintains exposure to other tech businesses, such as Visa and Mastercard, that can grow over the long term.

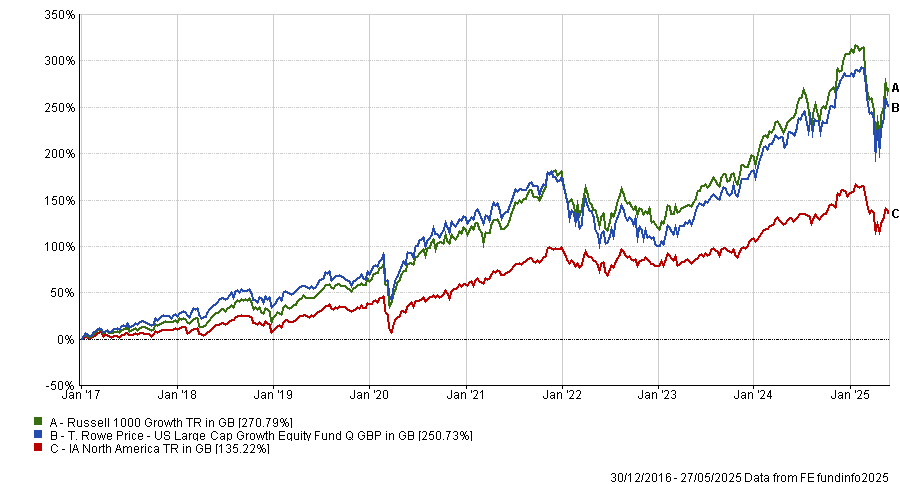

This fund has delivered top-quartile results in the past one, three and five years versus its IA North American peers, and since the manager took over in 2017 it is up 250.7%, nearly double the sector average.

Performance of the fund since manager start

Source: FE Analytics

For thematic investors, Daniel Lockyer, senior fund manager at Hawksmoor Fund Managers, said the technology wave that has dominated markets over the past several years still has more to run and highlighted William De Gale’s Bluebox Global Technology fund as his preferred choice.

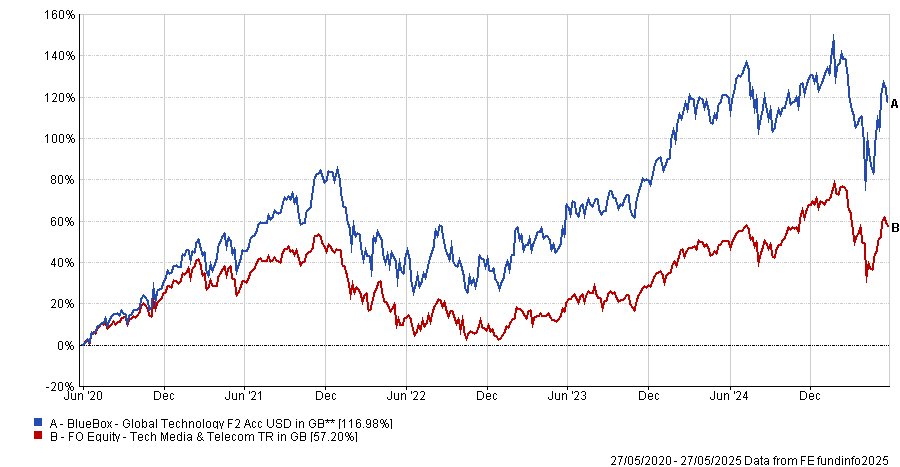

Over the past five years, the fund has surged 117% compared to a sector average of 57.2% while holding just two members of the Magnificent Seven, Apple and Nvidia.

Performance of the fund vs the sector over the past 5yrs

Source: FE Analytics

Instead of favouring the typical US mega-cap tech companies, the fund focuses on “enablers of technology” who provide the components of the wider supply chain. For example, the manufacturing company Applied Materials, which provides the equipment for the creation of semiconductors, is the fund’s third largest holding.

De Gale firmly believes these tech companies could sustain annual earnings growth of 15%, which would “mitigate any short-term concerns over valuations or [Donald] Trump tariffs,” said Lockyer.

There are growth opportunities outside of the more traditional markets as well. While many investors will point to the US, the tech sector and the global market as happy hunting grounds for these specialists, James Goodrich, fund manager at JM Finn, pointed to the JP Morgan Japanese Trust as an interesting growth strategy.

Japan has generally underperformed traditional growth markets such as the S&P 500 but is home to some of the most technologically advanced businesses in the world. As such, while a Japanese trust “may seem odd at first glance”, there is a “great opportunity for growth in Japan", he said.

Additionally, having underperformed other growth markets for decades, valuations in Japan are incredibly low, while healthier levels of inflation, increasing interest rates and wage growth, suggests the country is poised for a period of more sustained growth, Goodrich added.

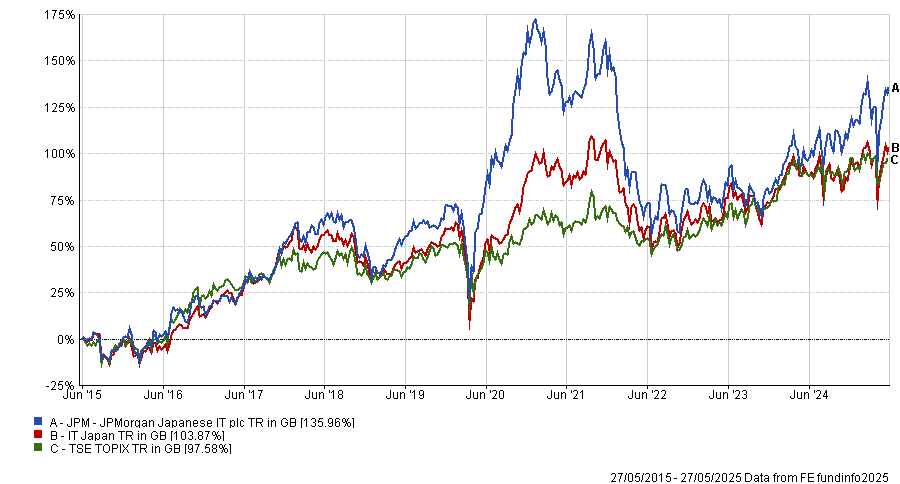

Performance of the trust vs the sector and benchmark over 10yrs

Source: FE Analytics

The JP Morgan Asset Management investment trust could be a good way to get exposure to this theme, with the trust posting the best performance in the sector over the past year. Over the past 10 years it is up 136%, another top-quartile performance within the sector.