Emerging market income stocks are becoming some of the best-positioned stocks to handle trade volatility this year, according to JP Morgan and other asset managers.

In a year where global stock markets have been whipsawed, some investors have turned to income strategies, favouring dividends for a consistent yield in a period of uncertainty.

While global equity income and UK equity income strategies have both performed well year-to-date (up 7.2% and 10.8% respectively), emerging markets have also rallied.

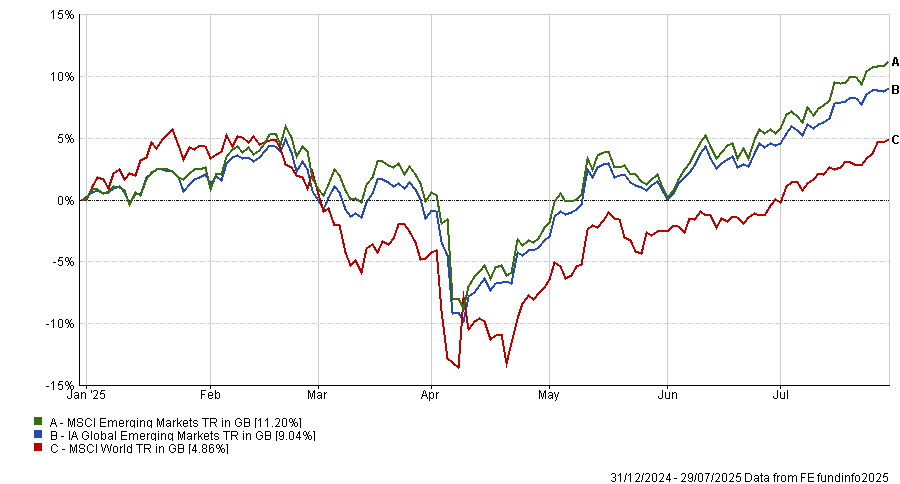

The average fund in the IA Global Emerging Markets sector is up 9%, while the MSCI Emerging Markets is up 11.2%, more than double the return of MSCI World, as demonstrated by the chart below.

Performance of sector and indices YTD

Source: FE Analytics.

However, investors may be concerned about allocating towards the region given worries over tariffs from US president Donald Trump ahead of the 1 August deadline.

Omar Negyal, manager of the JPM Global Emerging Markets Income trust, noted that investors need to be “realistic” about their emerging market allocations.

Company revenues and exports are closely linked in emerging markets, meaning that “if we are entering into a world where trade is harder, that will have consequences”. Yet he argued that many emerging market companies are in much better positions than they may initially appear.

Firstly, unclear economic policy from the White House has shaken investors' confidence in the dollar. This allows central banks in emerging markets to take a “looser approach to monetary policy”, which can provide a stimulus for their domestic economies.

This should encourage investors to diversify and turn to quality stocks in emerging markets and the surest way to determine what these quality stocks are, he continued, is to follow the dividends.

In a market where corporate governance is a “real issue”, a company that proves it can pay out a dividend to its shareholders “year in and year out” is a signal of a business quality and resilience.

These companies generally have solid long-term fundamentals and great capacity for growth that can continue even if tariff volatility remains, he explained.

For example, Negyal pointed to TSMC as “the best example of a progressive dividend stock in emerging markets”.

Despite being one of the primary manufacturers of semiconductor chips, tied to the development of megatrends, such as artificial intelligence (AI) and tech, it pays a dividend.

“That’s pretty different from a developed market investor, who usually cannot buy high-growth tech as an income investor,” Negyal added.

For more than 20 years, TSMC has grown its dividend culminating in a 5% yield. While this has now fallen to around 2% as the share price has risen, it remains a highly attractive income stock, with “long-term fundamentals we still really like”, he said.

Matthew Williams, manager of the Abrdn Emerging Markets Income Equity fund, added that despite emerging market income stocks disappointing investors over the past few years, they have entered 2025 in a “position of strength”.

He agreed that tech stocks such as TSMC are great examples of this, paying a solid yield while providing the “basic building block for digitising the economy” that other countries will need.

In Mexico, industrial and manufacturing stocks such as mining company Grupo Mexico, one of their top holdings, also look well-positioned. It’s one of the lowest-cost and largest copper producers in the world, responsible for products such as copper wiring, which will remain important for things such as modernising electrical grids worldwide, he said

“I think these will continue to go upwards, regardless of what the health of the overall global economy looks like,” Williams added.

Robert Holmes, manager of the Pacific North of South EM Equity Income Opportunities fund, noted that this is a major change for emerging markets.

“Traditional preconceptions about the emerging market asset class have started to change. Companies have matured to the extent that global investors can now make an attractive return and an attractive yield in their local currency from emerging markets,” Holmes said.

In a period where global trade is uncertain and with questions over US exceptionalism, it investors may wish to look further afield for their returns. For investors hoping to play on the recent emerging market rally, “income has become an obvious trade.”