It’s that time of year again. Holiday shoppers know the secret: start with a primary meaningful gift that makes an impression. Add smaller delights for a personal touch. Asset allocators can do the same – anchor portfolios with a broad emerging market (EM) core and use dynamic tilts for the perfect stocking stuffers.

The broad EM equity rally has now entered a more structurally supportive phase rather than a pure sentiment bounce. Emerging market equities have advanced for 10 straight months, now up more than 32.3% year to date, outpacing US large-caps, which returned slightly more than 14.6% over the same period.

We believe this outperformance is likely to continue through year-end amid a weaker US dollar, improving earnings and growing demand for geographic diversification.

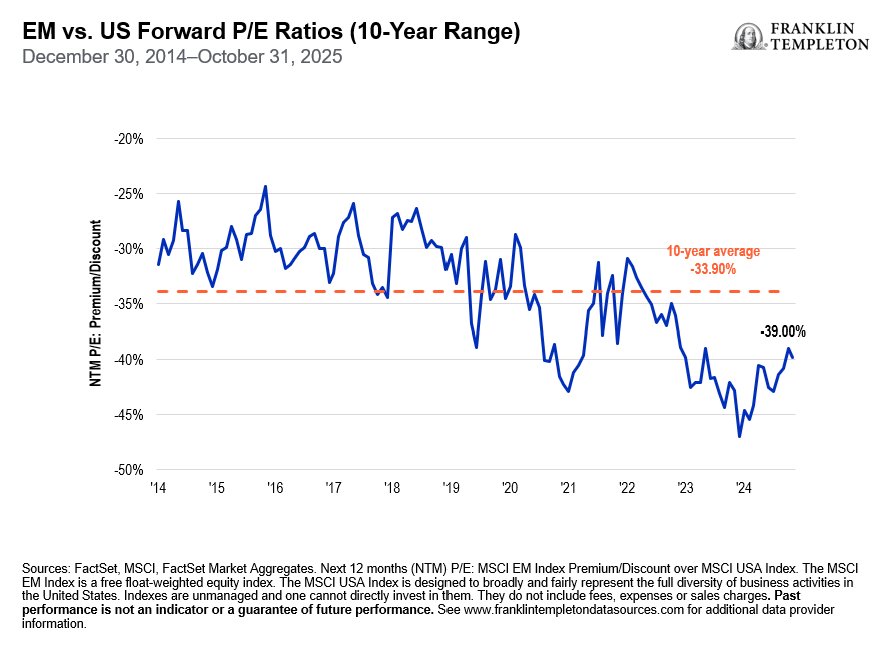

Valuation gaps remain wide: emerging market equities recently traded at nearly a 40% discount versus US peers – one of their lowest forward price-to-earnings (P/E) differentials in over a decade. Meanwhile, early macro indicators suggest modest expansion among EM manufacturing sectors.

Adding to this tailwind, the recent decline in the US dollar is easing financial conditions across emerging markets. The weaker greenback makes it cheaper for EM borrowers to service dollar-denominated debt, while the Federal Reserve’s pivot toward interest rate cuts is fuelling renewed demand for local currency bonds that still offer attractive real yields.

Meanwhile, deepening trade and manufacturing linkages between the United States and Mexico underscore how supply-chain rerouting is boosting multiple EM hubs – not just one market – reinforcing the case for a broad emerging market core.

These forces of less dollar pressure, falling US rates and stronger regional trade flows are creating what we see as a more favourable backdrop for EMs.

In terms of portfolio construction, a diversified emerging market allocation anchors exposure to global easing, demographic growth and digital transformation, while selective country tilts reflect conviction-driven opportunities.

Such an approach helps investors look beyond short-term noise and stay invested through the macro cycle. With valuations still moderate, we believe the risk-reward for EMs broadly remains compelling.

Broad core + dynamic tilts

Global supply-chain remapping triggered by tariffs has created more stark standouts and laggards across the EM universe and we believe a broad emerging market core can help capture the multiplicity of growth vectors, while dynamic tilts allow investors to capture standout growth pockets when dispersion widens.

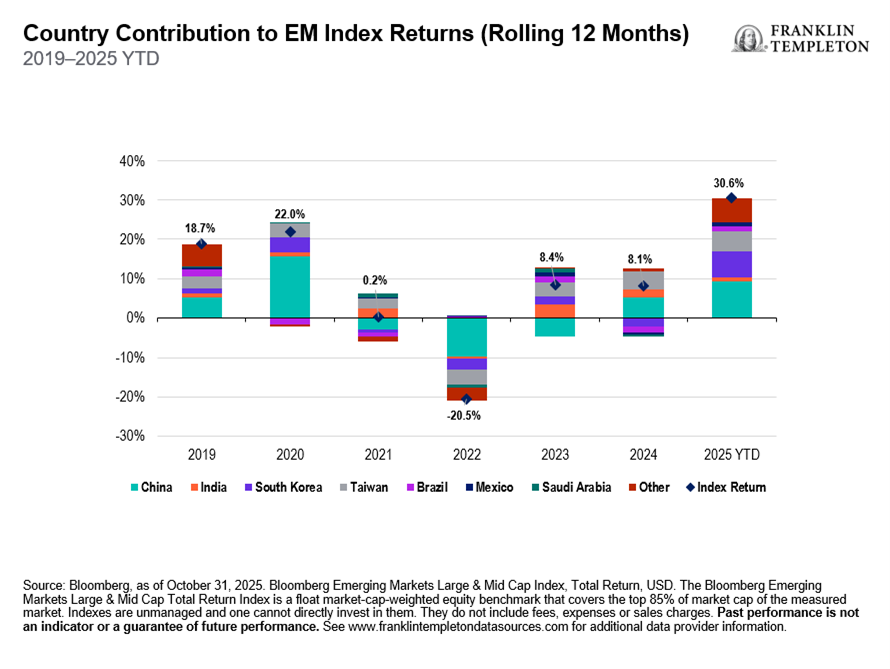

South Korea’s equity market, for example, has emerged as a clear leader this year, with the Korean Composite Stock Price Index (KOSPI) rising nearly 70% year-to-date – the strongest returns for any major market globally.

This surge has been powered by a combination of artificial intelligence (AI)-driven demand for memory chips, foreign-investor inflows returning after years of under-allocation, and corporate-governance reforms that are helping erase the long-standing ‘Korea discount’.

By contrast, China’s contribution has moderated, reflecting slower post-Covid normalisation and softer capital inflows. Based on estimates derived from the Brookings/Haver Analytics dataset covering 25 emerging markets, China’s share of total emerging market portfolio inflows appears to have fallen sharply – from roughly 40–50% before the pandemic to below 20% by mid-2025.

This suggests a reallocation of capital toward faster-growing, reform-oriented economies such as India, Mexico and Brazil. Nonetheless, we believe Beijing’s support of the country’s real-estate sector and injections of liquidity into its equity markets have been notable.

Its leaders have adopted a more measured, targeted stance in supporting businesses and consumers, while gradually rebuilding investor confidence. The contribution to returns from China – which holds the largest weighting at 32% vs. 10% for South Korea –within the Bloomberg EM Large and Mid Cap Index has turned positive year-to-date, adding 9.3% through October 2025, suggesting that improving earnings sentiment and valuation support are beginning to reassert China’s role within the broader emerging market complex.

In markets, as with the holidays, balance matters: A broad EM core potentially provides staying power, while thoughtful tilts can deliver the finishing touch. Together, we believe this approach may help investors turn dispersion into opportunity for the year ahead.

Dina Ting is head of global index portfolio management at Franklin Templeton ETFs. The views expressed above should not be taken as investment advice.