The number of investment managers who are “unwilling or unable to disclose their personal shareholdings” in their respective investment trusts has been “frustrating” for analysts at Investec.

In the firm’s ‘Skin in the Game’ report produced by Alan Brierley, Ben Newell and Elliott Hardy, they said: “While there is no regulatory requirement for managers to make such statements, we find this frustrating.

“For those who do not disclose, if they were to at least acknowledge that they have an unspecified investment, this would at least be a step in the right direction.”

The report features 249 trusts across the Association of Investment Companies universe, highlighting the remuneration packages for board members and shining a spotlight on how much boards and managers ‘eat their own cooking’ by investing in their own companies.

The trust backed the most by its board and fund managers was Pershing Square Holdings, with some £1.8bn invested. This was followed by those at Caledonia Investments (£1bn), RIT Capital Partners (£593m) and Tetragon Financial (£338m).

In total, 87 management teams had more than £1m invested in their own trust, while 40 had more than £10m.

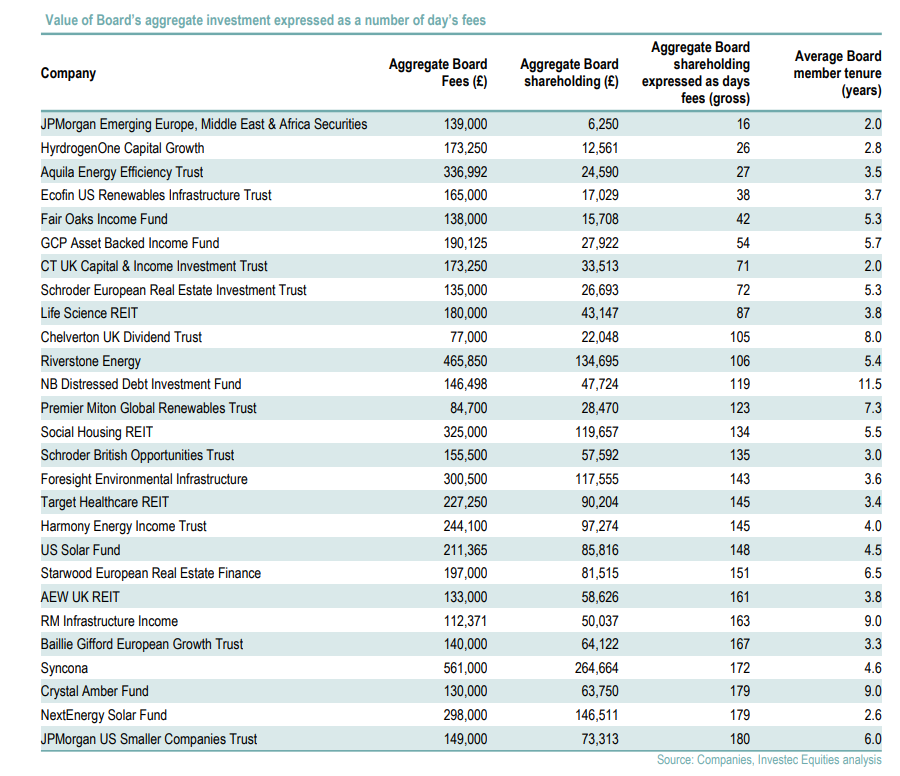

Not all came out well from the report, however. There were 27 investment companies where the aggregate shareholding of the board was worth less than the total fees received over six months. These firms were tagged as having ‘room for improvement’ and are listed in full below.

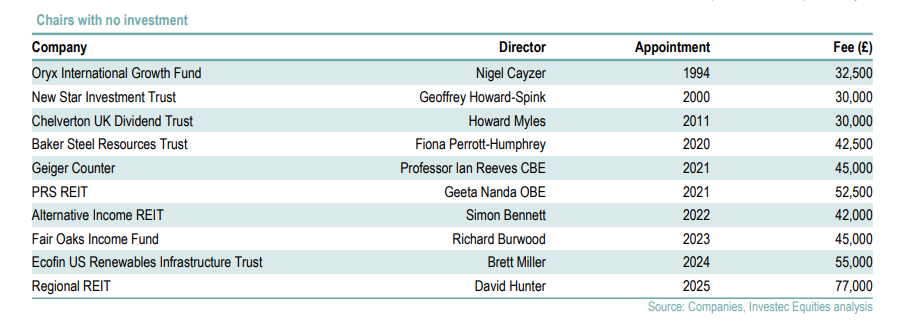

Additionally, while 51 chairs had more than £1m invested in their own trust, there were 10 with no investment at all and 45 chairs had a smaller holding than their annual fee.

Just 7.2% of boards (or 18 companies) were made up of directors who all took a stake in the trust. Meanwhile, 13.4% of directors had no money in the trusts of which they were members.

Although some will be disappointed in the trusts where the board and managers have failed to eat their own cooking, the Investec analysts also warned that those with too much skin in the game are also a problem.

This can lead to a power dynamic that makes it difficult to oust poor-performing managers, particularly when compounded by weak corporate governance. This can ultimately result in “poor outcomes for shareholders”.

This has been the case for shareholders of Boussard & Gavaudan Holdings, Gabelli Merchant Partners, JZ Capital Partners, Manchester & London Investment Trust, the report said.

The analysts also highlighted Third Point Investors, which last week announced the outcome of a strategy review, which included the merger with a reinsurance platform and a potential tender offer for at least $75m of shares at a discount of 12.5%. The manager, who owns around 25% of shares, has said it will vote in favour.

“Given the fundamental change in the investment proposition and the related party nature of the transaction, we find it deeply disappointing that shareholders have not been offered an exit at NAV [net asset value] less costs,” they said.

Remuneration

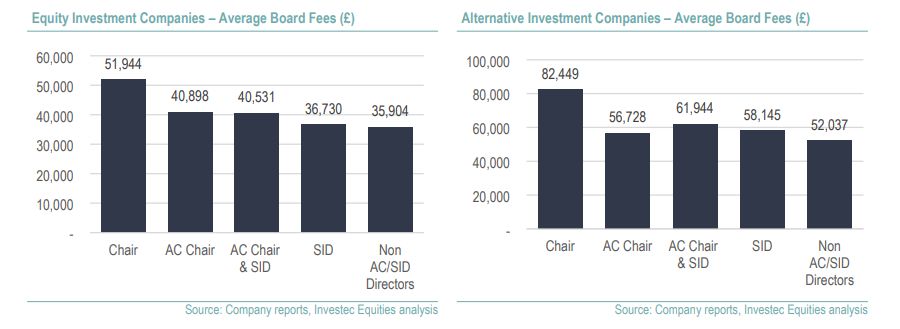

On average, alternative trust boards are compensated better than their equity peers. The average annual chair fee is £82,400, while fees for directors of alternative trusts without senior roles (£52,000) is more than chairs of equity trusts (£51,900).

The average fee for audit committee chairs at alternative trusts is £56,700, while senior independent directors are paid £58,100. The average fee for those directors performing the roles of both audit committee chair and senior independent directors is £61.9k.

These figures drop to £40,900, £36,700 and £40,500 respectively for equity trusts, as the below table shows.

Naguib Kheraj, chair of Petershill Partners, was the highest-paid investment trust chair in the report with a salary of £475,000. This was almost three times more than the next-highest paid, Rónán Murphy of Greencoat Renewables (£169.377).

David Stewart (Caledonia Investments), Laurence Hollingworth (Molten Ventures), Philippe Costeletos (RIT Capital) and Nick Hewson (Supermarket REIT) were the only other chairs paid more than £150,000 last year.

Diversity

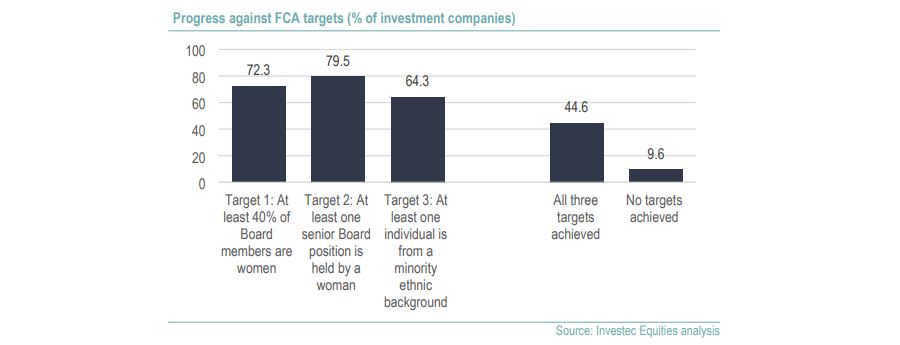

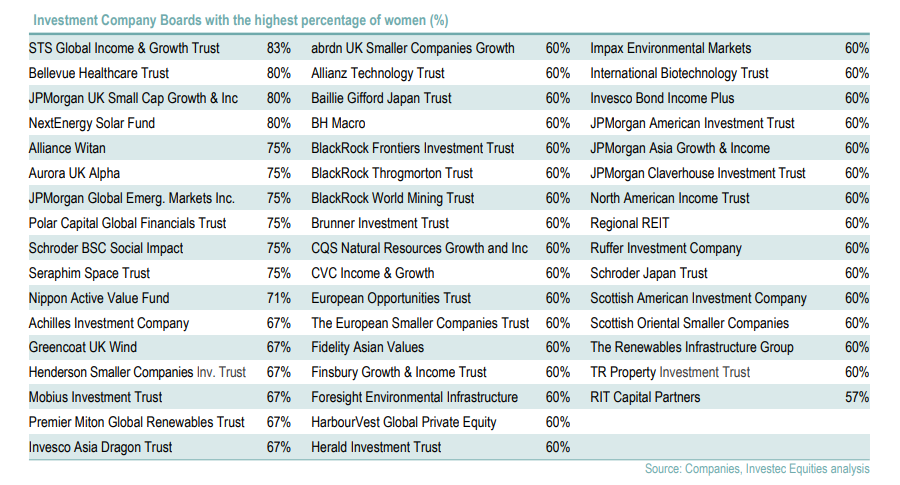

The report also looks at diversity and how investment companies are working towards meeting the Financial Conduct Authority’s (FCA’s) diversity and inclusion targets.

Some 43.8% of investment company directors are women, compared to just 8% in 2010. Additionally, 72% of investment companies now comply with the City watchdog’s target, which aims for boards to be at least 40% female. In conjunction with this, the number of all-male boards has fallen from 159 in 2010 to just 12.

Around 41% of senior board positions are held by a woman, with 80% of investment companies now meeting the FCA target that at least one of the senior board positions should be held by a woman. The number of women chairs has also risen to 59 out of 249 (23.7%), from 9 out of 238 (3.8%) in 2010.

“Looking forward, we expect further progress as directors from the more mature and male-dominated vintages retire and through new appointments; since the beginning of last year, 46% of new directors have been women,” the analysts said.

Away from gender, 64% of investment companies now have at least one individual from a minority ethnic background, compared to 29% in May 2023.