Value investing is stirring back to life. Long considered out of favour, the style wasn’t dead, it was just in an extended slumber, according to experts.

After years of trailing flashier growth stocks, value strategies are regaining momentum, supported by higher interest rates, persistent inflation and a shift in market sentiment.

Investors are once again seeking quality companies trading below their intrinsic worth, with solid fundamentals and the potential for long-term gains - the whole point of investing.

This shift reflects a broader recalibration in markets according to Joe Richardson, discretionary investment manager at Dennehy Wealth.

“It’s a tougher backdrop – possibly the biggest market shift in a generation – and value is generally better suited to navigating that than the high-growth, speculative areas,” he said.

John MacTaggart, senior fund analyst at FE Invest, also believes value’s resurgence is here to stay. He said: “The past few months [of value outperformance] haven't necessarily been a blip. Growth's long-term outperformance was fuelled in part by a policy mix – most notably quantitative easing – which kept liquidity high and interest rates low” but has slowed recently.

While the outlook remains uncertain, many argue that value investing is better equipped for today’s more volatile, less speculative environment.

Below, the experts highlight funds that stand out for their disciplined approach to finding undervalued opportunities.

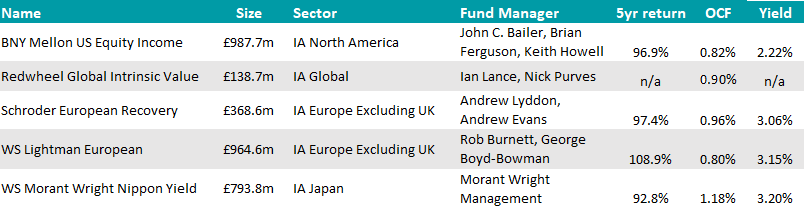

Richardson went for two funds in Europe, Lightman European and Schroder European Recovery.

Performance of funds against index and sector over 1yr

Source: FE Analytics

Both tap into “the huge value” still on offer in Europe, he said.

“There’s the tariff noise from the US of course, but underneath that you’ve got some very strong companies trading at very attractive levels.”

The former has a FE fundinfo Crown Rating of five and its strategy is proving very popular this year, having been picked on Trustnet by different fund selectors in February as a perfect fund to hold alongside a global tracker, in March as a perfect diversifier from a US sell-off and earlier this month as a way to play Europe's resurgence.

It is co-managed by Rob Burnett and George Boyd-Bowman, who apply their own discretion to come up with a portfolio concentrated on approximately 40 to 50 holdings.

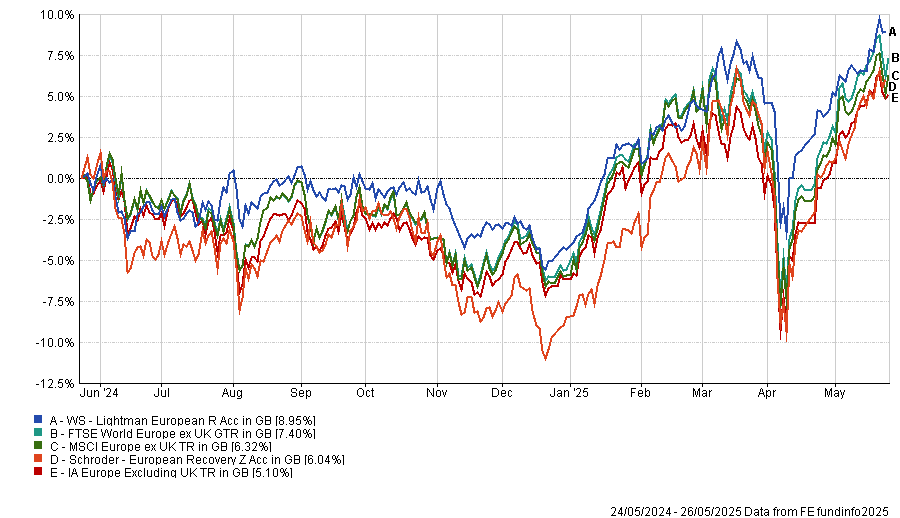

Asia also looks great on a value basis, according to Richardson – in particular China and Japan. In the latter region, he chose the Morant Wright Nippon Yield fund.

“This fund is tapping into the broader value in Japan while still giving some income on the side,” he said.

Performance of fund against index and sector over 1yr

Source: FE Analytics

He wasn’t the only fan of this strategy, however. Several managers have been making profits from Japan’s recovery this year, and the Morant fund was the best pick of multi-manager David Lewis from the Jupiter Merlin team, as he recently told Trustnet. Square Mile analysts also rate the portfolio.

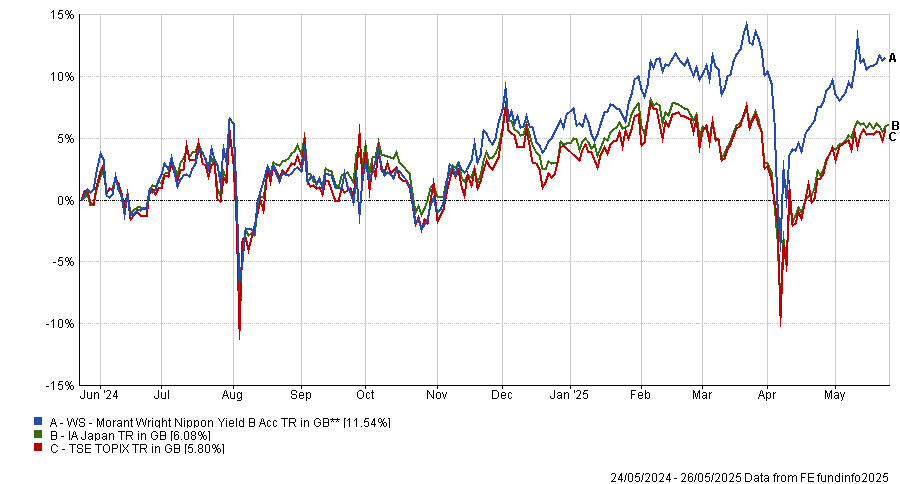

For investors preferring a global approach, Ben Yearsley, director of Fairview investing, selected the Redwheel Global Intrinsic Value portfolio.

Performance of fund against index and sector over 1yr

Source: FE Analytics

“Value was never dead, it just had an extended nap. What’s not to like about cheap stocks (as long as they aren’t value traps) and often a good starting yield?” he asked.

The Redwheel strategy is managed by longstanding managers Ian Lance and Nick Purves, who the fund selector described as “a great double act – think Laurel and Hardy, Dick and Dom, Rush and Dalgleish”.

“They have adapted their very successful UK franchise for a global stage. This is a low-turnover, long-term fund with a low US weight – very helpful in today’s climate,” he noted.

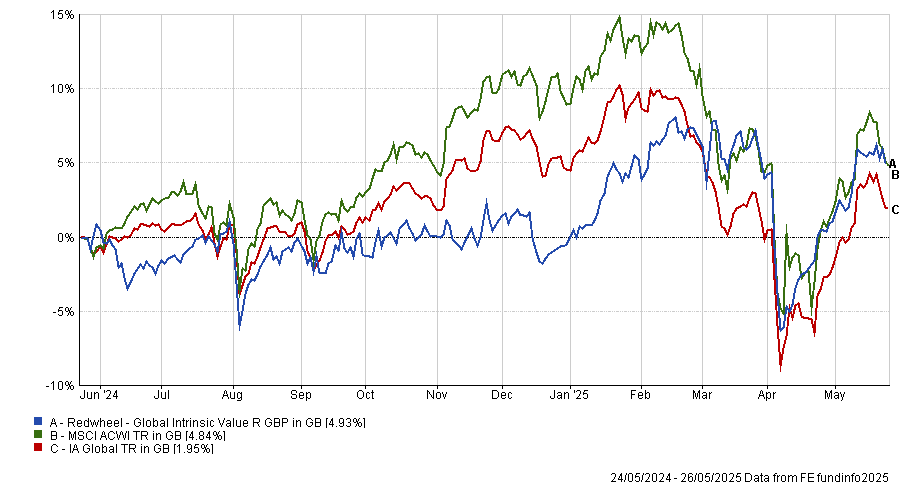

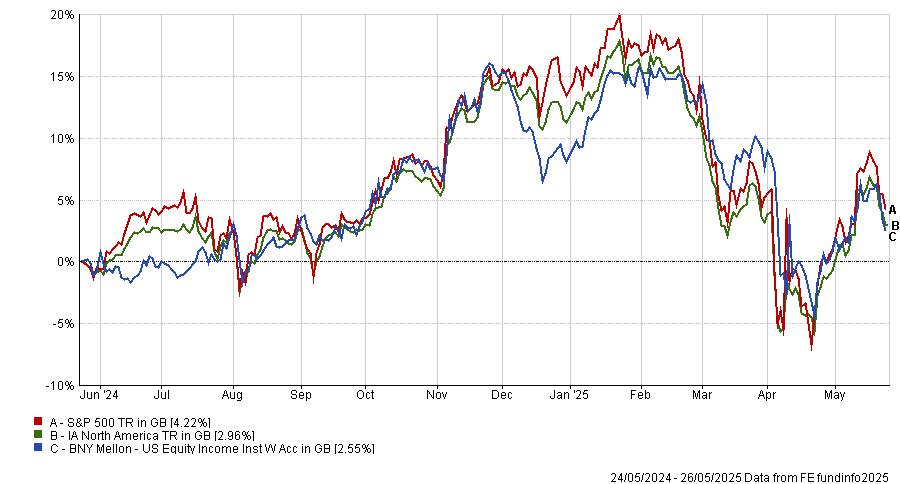

While Yearsley’s pick is underweight the US, MacTaggart went straight to the US market with his selection: BNY Mellon US Equity Income. He described the fund as a “solid” value option.

“Our view is that fiscal policy will continue to keep inflation volatile and elevated in the US, which in turn will translate into higher for longer rates in the US. Less speculative stocks with lower valuations are better placed to perform in this environment,” he said.

Performance of fund against index and sector over 1yr

Source: FE Analytics

Run by a team led by John Bailer, this strategy provides “exposure to the value style and diversification away from the growth-oriented US market and average peer,” he said.

The portfolio consists of between 30 and 60 holdings, with positions having to meaningfully contribute to income generation – “a clear positive” for the senior analyst, as it makes the fund “a pure-play on the value style that is also able to avoid businesses that are in structural decline”.