Manager moves always conjure up the same questions in investors’ minds – was this a good move, is the new manager suitable and, ultimately, is the fund a buy, a hold or a sell?

Two weeks ago, Royal London Asset Management hired a trio of fund managers from Aviva Investors and changed the leadership of the Royal London Global Equity Income fund, now under Richard Saldanha, and the Royal London Global Equity Select fund, which was taken over by Francois de Bruin, as we reported on Trustnet.

The team they replaced had only been in charge for six months, as an interim solution after the departure of Peter Rutter, who left the firm this summer.

Following this flurry of changes, we asked fund pickers what they make of the moves, whether this is the time to buy, hold or fold the two Royal London strategies, and which funds would make good alternatives for investors who decide to sell.

We begin with the more sceptical view, which came from Fairview Investing director Ben Yearsley, who said investors are left with a quandary.

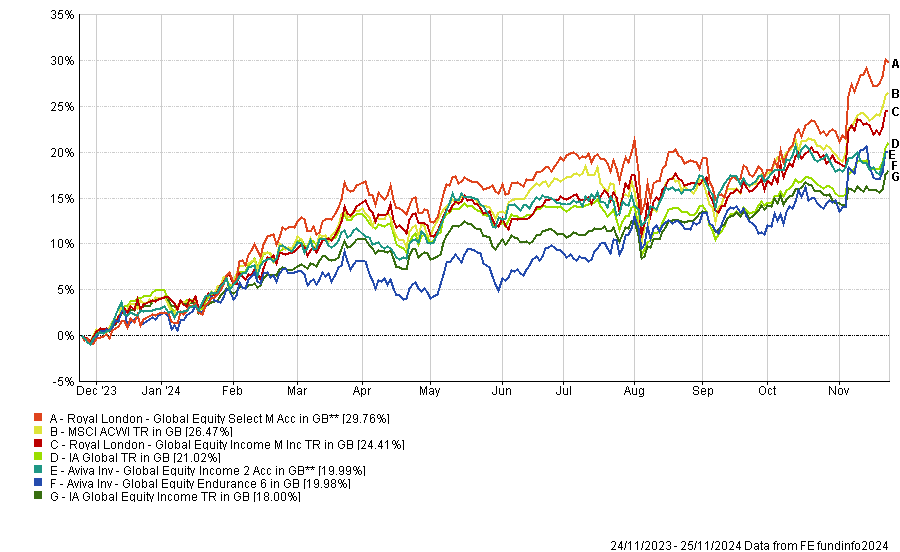

Saldanha and de Bruin are stepping in as the Royal London funds have been delivering “excellent performance”, both under Rutter and the temporary management team; however at the same time, their own funds at Aviva haven’t done as well, as the chart below shows.

Performance of funds against sectors and indices over 1yr

Source: FE Analytics

“This is a slightly odd one,” Yearsely admitted. “Do you stick with Royal London, knowing the process has worked but the members utilising it have changed, or do you seek pastures new?”

His recommendation was to let the dust settle first and not buy them for now.

“Regardless of process remaining intact, the team has changed, therefore you need a period of time to see how they adapt to their new environment,” he said. “They might not gel with their new colleagues, for example.”

For those who already own the funds, sticking with them is the more sensible move, as the new managers have proved they can manage money successfully and “Royal London wouldn’t have hired them if they didn’t think their style wasn’t complementary”.

But for those choosing to cash in and reinvest the money elsewhere, Yearsley suggested the Artemis Global Income as the “obvious” alternative for the income fund and Blue Whale Growth or Rathbones Global Opportunities instead of the select fund.

FundCalibre managing director Darius McDermott stressed how the interim appointments made after Peter Rutter's departure were always intended as a temporary solution and, according to him, Royal London has done “an excellent job” securing the Aviva team. Of the two Royal London strategies, he was particularly positive about Saldanha’s income fund.

“We’re especially familiar with Richard Saldanha, who has delivered top-quartile returns over three, five and 10 years in his previous income fund range at Aviva,” he said.

“Investors can therefore feel confident their money is in capable hands and we view this fund as a definite buy.”

Finally, Joe Richardson, discretionary investment manager at Dennehy Wealth, highlighted that having a solid investment process and staying disciplined in the execution of the fund’s process is much more important that the mangers themselves, their reputation and the incidental team changes.

“Most fund managers are very impressive with strong conviction in their approach, but none are infallible,” he said. “Do not be too influenced or place too much reliance on any fund manager or team.”

That said, both Royal London’s Global Equity Income and Global Equity Select are part of Dennehy’s Vintage funds list for having been among the top 40% of performers for at least 60% of the time.

“It will be interesting to see if the new team can maintain their Vintage status from our ratings in the years ahead,” Richardson said.

Interestingly, he also noted that the top fund in the Vintage Global Equity Income list is no other than the Aviva Global Equity Income fund, formerly managed by Saldanha.

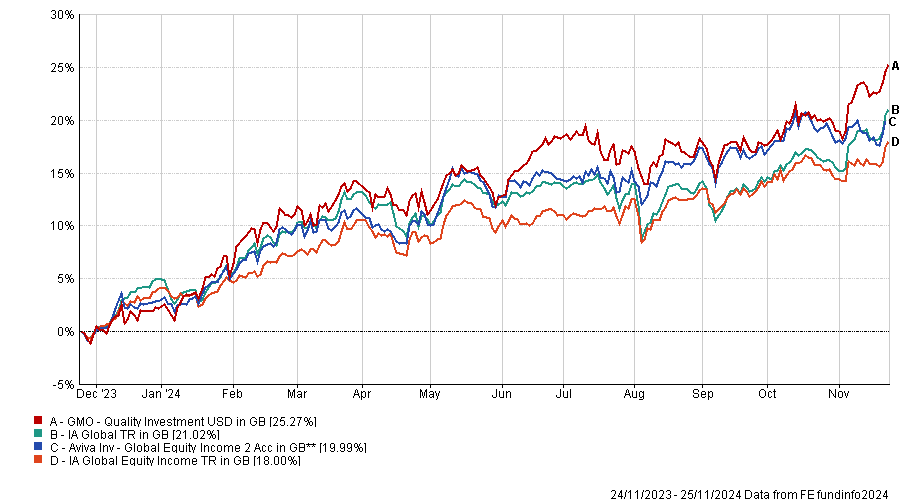

For investors looking for an alternative for Royal London Global Select, he suggested the GMO Quality Investment fund as one worth considering.

Performance of funds against sectors over 1yr Source: FE Analytics

Source: FE Analytics