Goldman Sachs caused shockwaves recently by forecasting that the S&P 500 would return 3% per annum over the next decade – the consensus estimate is about 6% – but Peter Spiller, who manages the Capital Gearing Trust, thinks even 3% is optimistic.

“It might be much worse than that,” said Spiller, who founded CG Asset Management, which manages Capital Gearing. “The US market is in the 98th percentile of its valuations historically.”

Starting valuations tend to be a good indicator of future returns over the long term and when valuations are excessively high, losses are statistically more likely than future gains.

Corporate profits are at the top end of their historical range as a percentage of GDP so he does not expect margins to grow much further from here. He is agnostic about whether artificial intelligence (AI) will be stimulatory but believes it will take longer than many people think for AI to be integrated into the real economy.

Despite his pessimism, Spiller concedes that the US bull market could run up further. “When the milk is brought to the boiling point there’s no saying how high the froth will go,” he said. Expensive markets can become more expensive.

Nonetheless, US equity valuations are high and risk is elevated, so he prefers not to “play for the last 5%” and instead has opted to be defensive now “to make sure when the big correction happens, we’re not standing in the way”.

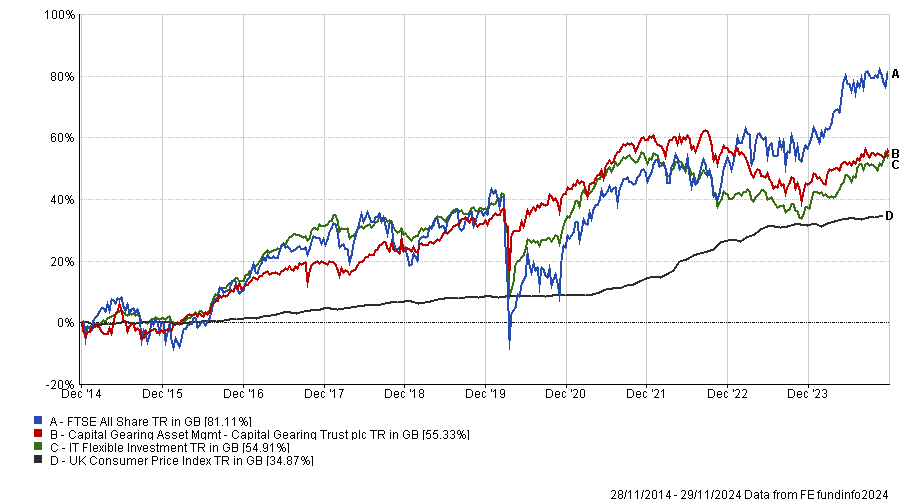

Performance of trust vs sector, inflation and FTSE All Share

Source: FE Analytics

He has every sympathy for fund managers whose results are measured quarterly and who feel obliged to own US equities, otherwise they “look extremely foolish” as the S&P 500 continues to head skywards. “I don’t mind looking foolish so long as in the end, I’m proved right,” he added.

Spiller freely admits that he has been cautious for too long and has missed out on gains. The trust is equally split between risk assets, index-linked bonds and dry powder at present. “We’ve had not enough in risk assets and too much in dry powder,” he said.

He has been too early in similar past situations, such as the dot-com bubble of the late 1990s and the run-up to the global financial crisis, but the key for Spiller is not to lose money and then, when the bubble eventually bursts, to have “plenty of dry powder to take advantage of depressed prices”.

He has heard commentators say there is no catalyst for a correction, but he believes the “unsustainable path” of US government debt could trigger an equity market correction or a recession.

Having said that, he is pleased that Scott Bessent is set to become the next treasury secretary because he eventually wants to bring down the US deficit down to 3% of gross domestic product (GDP) by 2028.

This is part of Bessent’s 3-3-3 plan, inspired by former Japanese prime minister Shinzo Abe’s three arrows. Bessent also wants to boost GDP growth by 3% through deregulation and pro-growth policies, and increase energy production by the equivalent of three million barrels of oil a day.

Meanwhile, if US equities sell off, the response of the Federal Reserve will be “immediate and unstinting”, he said. If the Fed cut rates sharply, the prices of treasury inflation-protected securities (TIPS) would rise steeply, which is why Spiller holds TIPS as an insurance policy.

“Until we have a crisis they probably don’t earn very much,” he pointed out, but for long-term investors, the most important thing is to protect against downside risk.

“Compound interest is the eighth wonder of the world. If you don’t lose money in a downturn, it’s working in your favour,” he said.

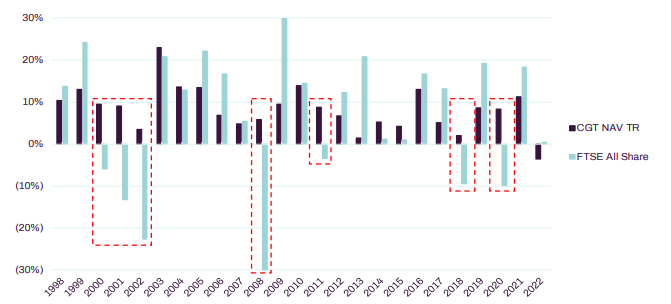

Annual NAV returns from Capital Gearing vs FTSE

Sources: Datastream, Peel Hunt

Capital Gearing has produced positive returns during several years when the FTSE All Share index fell, as the chart above illustrates.