The Santa rally failed to deliver in December, FE fundinfo data shows, as most fund sectors made a loss over the course of the month.

US markets had rallied in November after Donald Trump won the US presidential election and investors looked to his ‘America First’ agenda of deregulation and tariffs as a source of optimism for stocks.

However, Fairview Investing director Ben Yearsley said: “In December the Trump trade that greeted the re-election of the US president showed signs of fading; investors becoming concerned that his intended policies will lead to a widening budget deficit, higher inflation and increasing global trade tensions.

“As a result, there was little sign of a ‘Santa rally’ but it is unsurprising that investors were taking profits after a strong year for equities driven by AI-inspired US tech stocks.”

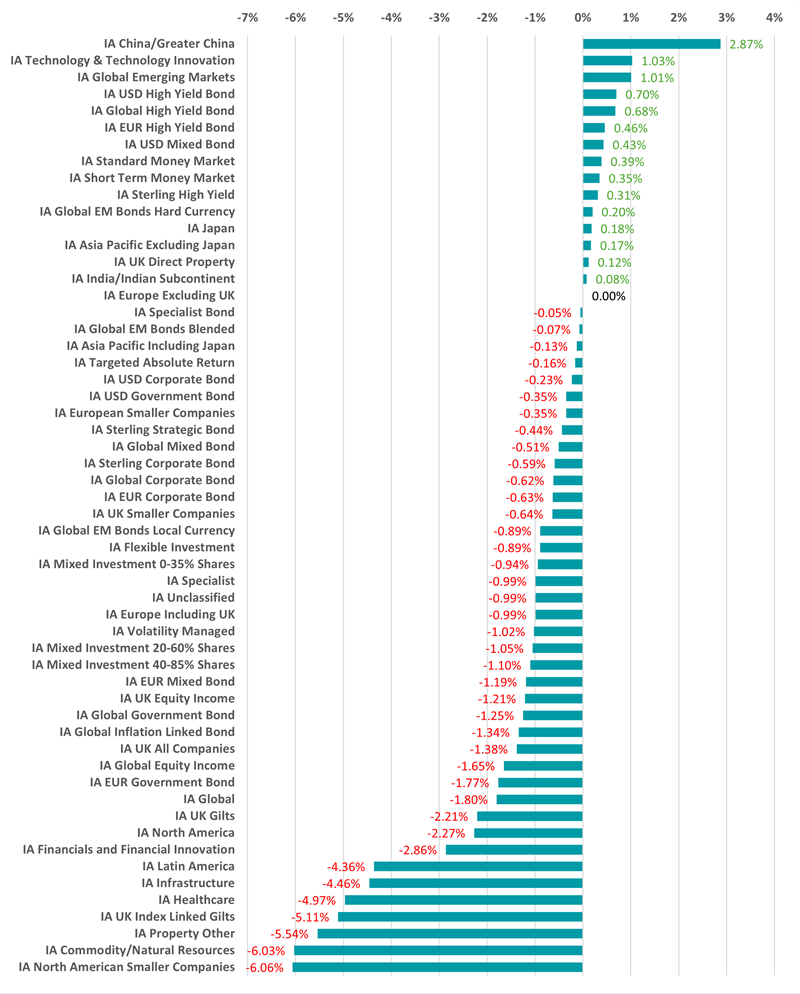

Reflecting this, the IA North American Smaller Companies sector – which had surged in November on the back of Trump’s election victory – was the worst performer in December with its average member losing 6.1% (in sterling terms),

IA North America and IA Financials and Financial Innovation, other key beneficiaries of November’s Trump trade, also lost money, with average losses of 2.3% and 2.9% respectively.

The bulk of Investment Association fund sectors posted a loss last month: just 15 of the 56 peer groups show a positive average return. Those that were in the black tended to invest in Asian equities or bonds.

Performance of fund sectors in Dec 2024

Source: FE Analytics

When it comes to the best performing sector in December, IA China/Greater China leads by a clear margin as the average fund made a 2.9% total return.

Yearsley said: “China remains unloved due to economic headwinds, but in December president Xi Jinping pledged that China would meet its 5% GDP target and continue to be an engine of global economic expansion. Xi also pledged more stimulus in 2025.

“During the month Chinese policy makers changed their stance on monetary policy from ‘prudent’ to ‘moderately loose’ for the first time in 14 years, which helped improve investor sentiment that 2025 could see a recovery in the world’s second largest economy.”

The IA Technology & Technology Innovation and IA Global Emerging Markets sectors were the only other Investment Association peer groups to make a higher average return than the two cash sectors in December.

Indeed, seven of last month’s 10 highest-returning sectors focused on cash or fixed income: IA Standard Money Market and IA Short Term Money Market sectors are joined by the likes of IA USD High Yield Bond, IA Global High Yield Bond, IA EUR High Yield Bond, IA USD Mixed Bond and IA Sterling High Yield at the top of the leaderboard.

Source: FE Analytics

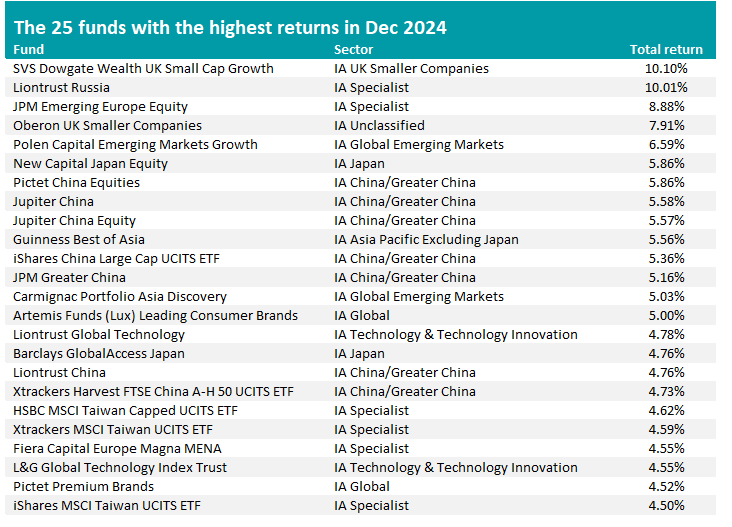

Turning to individual funds, December’s best performer was SVS Dowgate Wealth UK Small Cap Growth, with a total return of 10.1%. This £4.9m fund, which is managed by Laurence Hulse, looks for high-quality UK small-caps with attractive valuations, accelerating business fundamentals, durable competitive advantages and management teams with ‘skin in the game’.

Last month was a good one for several of its biggest holdings: packaging automation firm Mpac was up around 15% as chief executive Adam Holland plans to double sales by 2028, security software company Synectics gained 20% thanks to better than expected profits and digital marketer Mission Group jumped 30% after selling part of the business and announcing an updated capital allocation strategy.

Oberon UK Smaller Companies – formerly known as TM CRUX UK Smaller Companies – is another UK-focused fund among December’s best performers while two eastern Europe funds are in the second and third place (although the very heavy losses they faced following Russia’s invasion of Ukraine means they are coming off a low base).

However, the dominant theme in last month’s highest-returning funds was Chinese equities. Seven of the month’s 25 best funds are from this sector, including the £1.2bn JPM Greater China, £490m iShares China Large Cap UCITS ETF and £318m Pictet China Equities funds.

Asian and emerging markets funds, which also invest in China, are found among the best performers. Polen Capital Emerging Markets Growth and Guinness Best of Asia are examples.

Source: FE Analytics

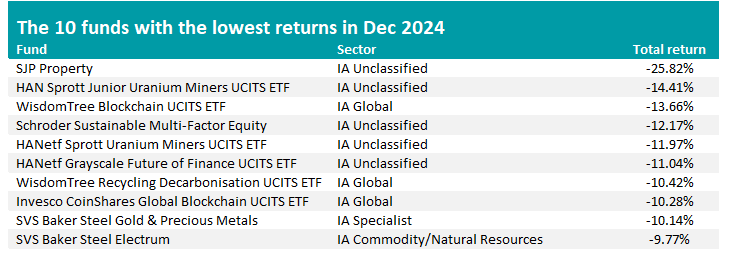

December’s worst performer was SJP Property; at the end of November, St. James’s Place announced it would close all of its open-ended property funds and wind them down.

The other funds with the heaviest losses in December tend to be specialist ETFs, with several focusing on uranium miners and blockchain technology.

The losses in these areas could be down to the pullback in Trump trades: both rallied in November thanks to the president-elect being pro-nuclear and pro-cryptocurrency.