European equities are labouring under a cloud of pessimism but much of the bad news is well known and priced in, potentially presenting investors with a buying opportunity.

The bad news includes tariffs, modest earnings forecasts, the German economy hovering on the cusp of recession and, most recently, political upheaval in France. Prime minister Michel Barnier’s government faces a vote of no-confidence today, following his attempts to cut government spending and bring down France’s colossal deficit.

At the time of writing, French government bond yields had risen above Greece but European equity markets, which have slipped in recent months, remained relatively calm, according to Lindsay James, investment strategist at Quilter Investors.

Chris Metcalfe, chief investment officer at IBOSS, said: “We share much of the market's pessimism about the outlook for European assets. However, when specific markets fall and are still out of favour, it can throw up opportunities, especially in the active management space.”

Karen Ward, chief market strategist for EMEA at JP Morgan Asset Management, said there are reasons to believe Europe might surprise on the upside next year. “The European Central Bank is expected to continue easing, encouraging consumer spending, and European leaders have fiscal tools to counter aggressive trade policies. Efforts to deploy the remaining EU Recovery Fund may also accelerate,” she said.

Industrials, in particular, could do well. “There is a growing recognition that European industry needs more support to compete in a world in which other industrial companies do not face the same regulatory and energy cost pressures. This is where support could surprise to the upside and is likely to be focused,” Ward explained.

Below, Trustnet asked a range of fund selectors which European funds they favour given current market conditions.

Liontrust European Dynamic

IBOSS holds Liontrust European Dynamic. Managers James Inglis-Jones and Samantha Gleave have “a strict investment discipline and avoid investing in companies with excessive and potentially unserviceable debt loads”, Metcalfe explained.

“A key factor for consideration is the return on equity. We would summarise their approach overall as forensic, concentrating on balance sheets and accounts. Over the past 15 years, the fund has top decile Sharpe and Alpha ratios.”

BlackRock European Dynamic and Barings Europe Select Trust

Anthony Chemla, a fund manager in Liontrust’s multi-asset team, blends Liontrust European Dynamic with BlackRock European Dynamic. Both have unconstrained investment styles but the former tends to have a value tilt, whereas the latter has a quality-growth bias.

“The sheer size of the team allows for real depth of analysis in idiosyncratic investments and ensures continuous idea generation – particularly during times of market rotations,” he said.

To provide some diversification from large-caps, Liontrust holds the Barings Europe Select Trust, which pursues a core GARP (growth at a reasonable price) style. “The team’s approach is to remain invested as they believe the longer-term prospects for profit and sales growth are not currently reflected in the share price across a range of their companies,” Chemla explained.

“The long-term benefits of European small-caps once again come to the forefront: faster growth prospects, stock selection opportunities, cheap valuations and the potential for longer-term outperformance,” he added.

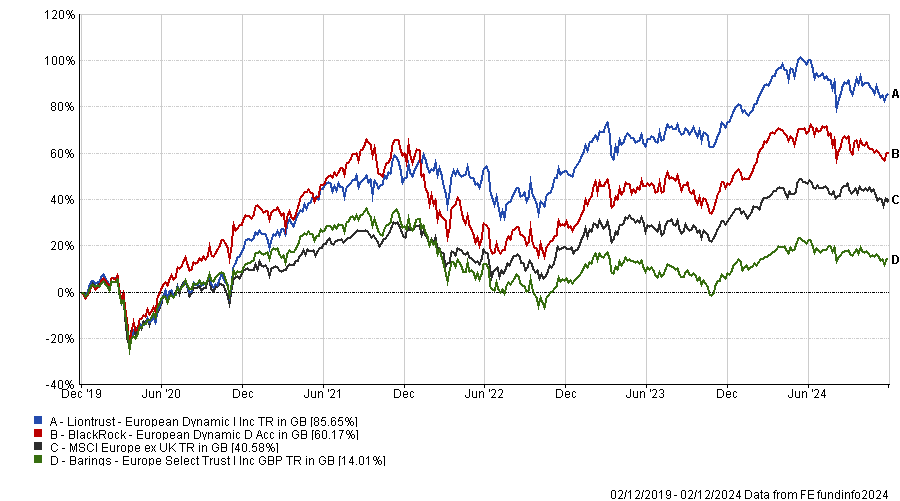

Performance of funds vs MSCI Europe ex UK over 5yrs

Source: FE Analytics

Premier Miton European Opportunities

Ryan Paterson, a portfolio manager at Schroder Investment Solutions, said European small- and mid-cap valuations are trading at historic lows, which offers “a compelling opportunity to invest in high-quality companies, misunderstood or ignored by the market”.

“Our ‘go to’ manager in this space is the Premier Miton European Opportunities fund. The managers have a sharp focus on a high return on capital, barriers to competition and balance sheet strength,” he said.

Lightman European

The European large-cap space is highly concentrated and the MSCI Europe index’s large-cap leaders make the benchmark look expensive in aggregate, said Daniel Lockyer, a senior fund manager at Hawksmoor Investment Management.

However, “there are plenty of attractively valued companies below the mega-caps that have been ignored and which have single digit price-to-earnings ratios and high dividend yields, providing fertile ground for active managers”, he said.

One such manager is Rob Burnett who, in his Lightman European portfolio, is able to look below the index level and build portfolios that he claims to be the best value relative to quality in his career.

“No longer does he have to stretch down into troubled companies and industries that are potential value traps for such value,” said Lockyer.

“It is more likely that a new right-leaning German or French government would be more protective of its national champions and that, along with the record low valuations, offers us sufficient margin of safety.”

Utilities, infrastructure and financials make up a large part of Burnett’s fund.

TM Lansdowne European Special Situations

Billy Ewins, a fund research analyst at Quilter Cheviot, chose the Lansdowne European Special Situations fund, which invests around capital cycles and focuses on structural demand-side and supply-side opportunities.

It has been managed since 1 September 2023 by Daniel Avigad at Lansdowne Partners, which acquired CRUX Asset Management that month. The fund has a concentrated portfolio of 30 stocks and aims to be style neutral.

Avigad and his colleagues monitor stocks for one of four catalysts: changes in regulation, the cost of capital, technological disruption or consumer habits.

“They believe that while Europe is not an especially exciting place to invest from a macro point of view, the region has many structural problems such as population demographics, anti-immigration sentiment and lack of efficacy of fiscal stimulus. The team buys the solution providers,” Ewins explained.

Holdings include the industrial gases and engineering company Linde; information and software solutions provider Wolters Kluwer; Italian bank Intesa Sanpaolo; energy management specialist Schneider Electric; and the bank-insurance group, KBC.

The portfolio is relatively cheap today given its internal rate of return of 12%, he added.

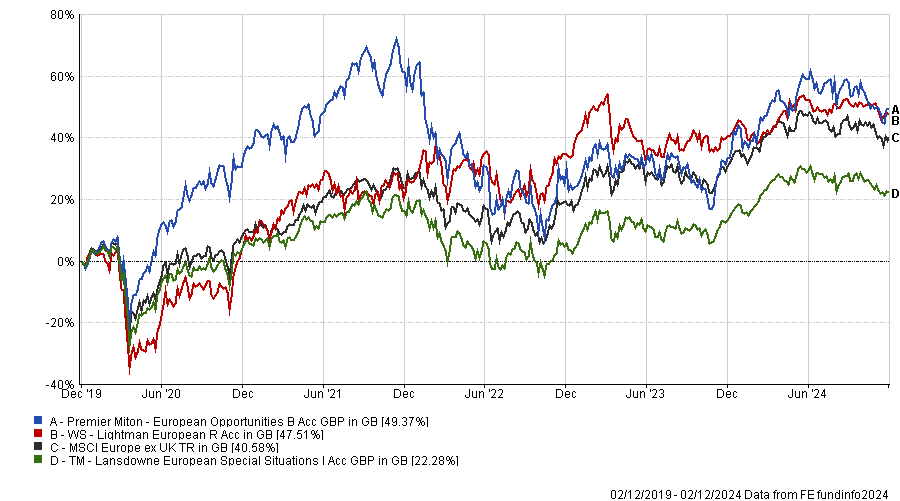

Performance of funds vs MSCI Europe ex UK over 5yrs

Source: FE Analytics

Berenberg European Small Cap and ARGA European Equity

Adam Norris, an investment manager in Columbia Threadneedle Investments’ multi-manager team, thinks the best opportunities are in fast-growing small and mid-size companies or in large-cap value names. Both areas have been “victims of the interest rate and economic cycle” but they offer compelling value going forward, he said.

Norris holds Peter Kraus’ Berenberg European Small Cap fund. “Valuations in his portfolio have de-rated considerably since 2021, yet earnings growth expectations remain strong at 30% p.a.,” Norris said.

Columbia Threadneedle also recently invested in ARGA European Equity, which has exposure to lowly-rated European cyclical sectors such as financials and industrials, which could do well if the European economy rises from the doldrums.