Some of the largest and best-known investment trusts are on the cusp of events that could boost their share prices, narrow their discounts and reward shareholders, including Scottish Mortgage and Pershing Square Holdings.

From portfolio companies about to list or undergo a revaluation event, to new investment managers, mergers, tender offers and share buybacks, the investment trust sector is rife with activity. This is all happening against a backdrop that looks more favourable going into next year, with interest rates on the way down and fee disclosure rules finally resolved.

A significant catalyst for Scottish Mortgage could be its 4.8% allocation to Space Exploration Technologies (SpaceX), which is in talks to sell shares owned by employees and other insiders. The transaction is expected to value SpaceX at about $350bn according to Bloomberg News – a huge jump from the $255bn valuation estimate Bloomberg published in November.

Darius McDermott, managing director of Chelsea Financial Services, said SpaceX’s upcoming tender offer, expected to occur later this month, could turn it into one of the world’s most valuable unlisted companies.

“This is excellent news for Scottish Mortgage as it will provide a sizable boost to the net asset value (NAV), yet the trust remains at an almost 10% discount,” he said. The discount was 8.1% as of 4 December 2024.

Peter Hewitt, who manages the CT Global Managed Portfolio trust, recently added Scottish Mortgage to his portfolio in anticipation of a significant uplift when SpaceX’s tender materialises. Furthermore, SpaceX might IPO in the next couple of years, he added.

Scottish Mortgage’s discount has already narrowed significantly since it announced an ambitious share buyback programme in March but Hewitt believes its share price still has a decent runway ahead, especially with the tailwinds of artificial intelligence and growth in the US tech sector.

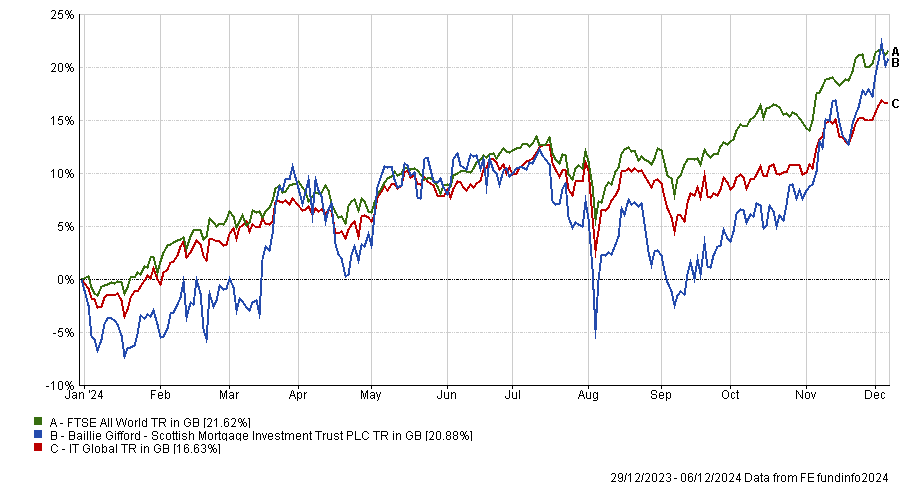

Performance of trust in total return terms vs benchmark and sector ytd

Source: FE Analytics

Several other trusts managed by Baillie Gifford have significant stakes in SpaceX, including Edinburgh Worldwide and the Baillie Gifford US Growth trust, although unlike Scottish Mortgage they are trading at slight premiums.

Edinburgh Worldwide has additional catalysts of its own. It announced plans on 20 November to return up to £130m to shareholders next year. The trust is also changing the investment process and team composition, restructuring the portfolio to reduce holdings to 60-100 companies from 75-125, and buying back shares.

Following this announcement, the trust went from a discount of 7.6% on 31 October to a premium of 1.2% by 5 December.

Chrysalis Investments is another trust that could be on the cusp of a re-rating. Buy-now-pay-later company Klarna, worth 14% of its NAV, has filed for an initial public offering, which is likely to take place early next year.

Deutsche Numis estimates Klarna's valuation to be $14.6bn but there has been speculation it could reach $15-20bn. Joe Bauernfreund, who manages AVI Global (which holds Chrysalis), said: “At these figures, a full exit from Klarna would realise between 24% and 32% of Chrysalis’ current market cap.”

Another well-known trust – Finsbury Growth & Income – made headlines last week when its investment manager Nick Train announced a continuation vote, which will take place after the trust’s financial year ends in September 2025. The trust’s discount has doubled in a year to 8.7% from 4.4%.

Hewitt thinks the vote will be a non-event and said Train is under no pressure from shareholders.

More significantly, Finsbury Growth & Income’s performance has begun to turn around after several tough years of underperformance. It is third-best performing trust in the AIC IT UK Equity Income sector in the past six months to 6 December 2024.

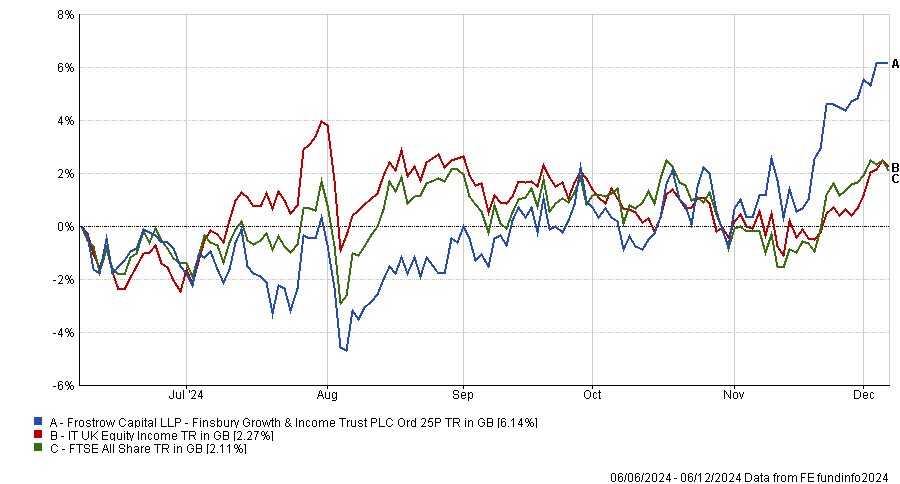

Performance of trust vs benchmark and sector over 6 months

Source: FE Analytics

Train has built “a very different portfolio from anybody else” and holdings such as Sage are performing well, Hewitt said.

Finsbury Growth & Income is the second-best performer in its sector over 10 years but the worst over five years. For shareholders such as Hewitt who have endured a fairly lengthy period of underperformance, this would be the wrong time to get out, he said.

Train himself is optimistic about the unrealised value of UK-listed companies and has reduced the trust’s overseas exposure to less than 3% from almost 16% in 2023. He has also been buying shares to increase his personal stake in the trust to 3.5%.

Analysts at interactive investor said the continuation vote seems “a prudent and well-timed opportunity to determine if investors feel the same way regarding the trust’s prospects”.

Another company with a potential catalyst is Oakley Capital Investments, which invests in private equity. It is mulling a main market listing, which ought to help trigger a re-rating closer to peer HgCapital Trust, according to James Carthew, QuotedData’s head of investment company research.

Oakley Capital is trading on an approximately 30% discount to its NAV whereas HgCapital has a 0.7% premium.

Finally, Pershing Square Holdings (PSH) announced its intention to delist from Euronext Amsterdam last week. The trust also updated its UK key information document to show that no fees are deducted from a shareholder’s investment and stated that its ongoing charges figure (OCF) is zero.

Chairman Rupert Morley said: “We concluded that delisting from Euronext Amsterdam and consolidating trading on the London Stock Exchange would reduce regulatory complexity and improve liquidity of PSH’s shares, which would be to the benefit of PSH shareholders.”

A financial adviser who declined to be named said: “Collapsing the Amsterdam listing into the UK, buying back stock, zeroing the OCF, these are catalysts for people to buy. If you want to close a discount, you just need more people to buy and fewer people to sell.”

During the first half of the year, Pershing Square’s discount narrowed from 28.7% to 22.7%. Morley attributed this to the trust’s marketing efforts and its investment manager’s commitment to reducing the 16% performance fee.