Following Nvidia’s remarkable performance this year, it may surprise investors to hear that top-performing investment trust Scottish Mortgage has reduced its position in this tech darling.

According to Hamish Maxwell, investment specialist at Scottish Mortgage, the concern about Nvidia was its symmetrical returns. He concluded that because it has done so well in recent years, the chances of it delivering multiples of upside have been reduced.

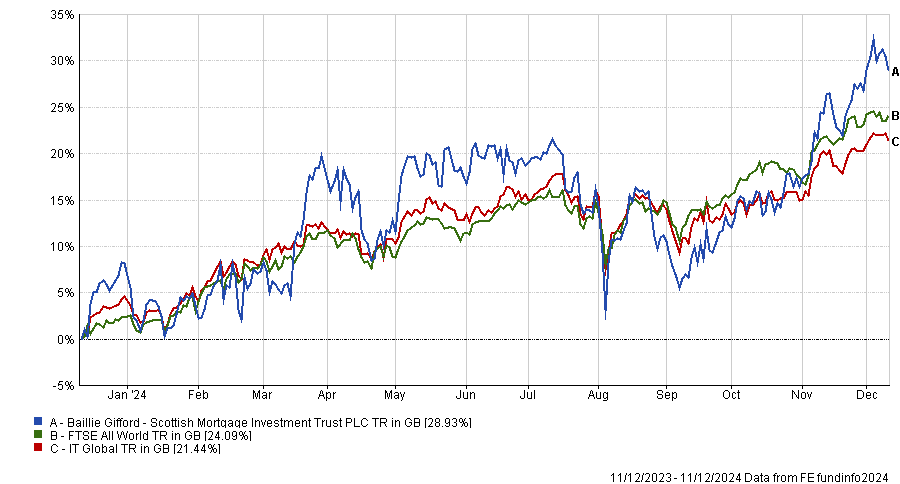

Performance of Scottish Mortgage vs sector and benchmark over 5 years

Source: FE Analytics

As such, Hamish highlighted the range of trailblazing businesses beyond Nvidia that are poised to “change the world and redefine industries or even economies”.

SpaceX

Firstly, Maxwell identified SpaceX as one of these trailblazing opportunities. At a 4.8% stake, this is currently the third largest holding in Scottish Mortgage’s portfolio, above graphics processing unit leader Nvidia.

The appeal of SpaceX is that it’s a "company with imagination", which has radically changed “how you put a rocket into space and get it back to Earth”. As a result, it is a business that has essentially developed a monopoly on space travel and represents an exciting opportunity from a private equity perspective that the market has underappreciated.

Maxwell said this underappreciation is partly a consequence of investors' short-termism and obsession with quarterly earnings. He argued that sentiment-driven investing has prevented investors from thinking about where companies such as SpaceX could end up in five or 10 years.

“We are excited to own SpaceX because it is not just changing the sector, it is creating a new one,” he added.

Moreover, SpaceX’s status as a privately listed company brings unique benefits. Maxwell argued that businesses have begun to stay private much longer, with companies spending more than a decade in the private market on average. Private companies in this late-stage growth, such as SpaceX, have enormous growth potential that investors will miss out on by focussing entirely on the public market.

Maxwell added: “We see ourselves as long-term holders of SpaceX. We do not necessarily see an IPO or a rights issue as a reason to exit.”

PsiQuantum

For another opportunity within the private market, Hamish highlighted computer producer PsiQuantum.

He said “private companies are inherently a form of the future” and PsiQuantum was a great example.

The company aims to build the first commercially available quantum computer, which Hamish concluded could have enormous implications for the wider market.

He explained that a more sophisticated computer had enormous long-term growth potential due to how ubiquitous modern computers have become. “Think about how much computers have already changed the world,” he commented.

For the Scottish Mortgage team, PsiQuantum’s product could cause innovations in any number of industries, with the capacity to solve problems and carry out tasks beyond what most computers are currently capable of.

“It is essential to our view of the future that we worry about lacking exposure to the next big trends," Hamish said.

Moreover, the business has significant long-term growth potential, demonstrated by its recent partnerships with local and global governments.

For example, earlier this year, the Australian government committed $620m for PsiQuantum to build one of its first quantum computers in Brisbane. Similarly, the state of Illinois committed over $500m to PsiQuantum earlier this year.

Joby Aviation

Shifting the focus to the public sector, Maxwell identified the electric aircraft company Joby Aviation, which the Scottish Mortgage team has previously described as the "Uber of the skies".

The company aims to create a global air taxi service by producing sustainable electrical take-off and landing aircraft.

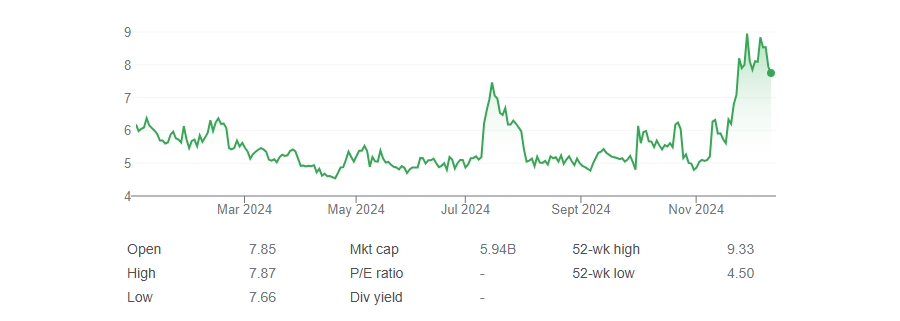

Year-to-date, the business has performed well, with the share price up by around 28.5%, but it remains relatively unknown, with an average stock price of around $8. However, Maxwell added: “It is in these smaller positions that we hope to see the companies of tomorrow come from.”

Share price performance of Joby Aviation YTD

Source: Google Analytics

Indeed, he argued that Joby Aviation has attractive long-term growth potential, demonstrated through a recent partnership with the Dubai government. This deal granted it an exclusive contract to operate its air taxi service in the UAE for the next six years to deal with the country's congestion problems.

Hamish said: “How interesting and exciting is that going to be for a population that is used to over an hour of traffic to get to work? That is the kind of thrilling investment we look for.”

Moreover, the business has expanded internationally, due to increased interest from larger firms and government organisations. For example, it received a $500m funding round from leading car manufacturer Toyota earlier this year. Additionally, it recently completed its second high-speed air taxi in partnership with the US Air Force, demonstrating that its product is developing a broadening appeal.