While most markets have done quite well this year, there is reason to be cautious moving into 2025. Geopolitical uncertainty still looms, with France and Germany expecting elections early next year and president-elect Donald Trump’s second term promising a potentially disruptive ‘America First’ agenda.

Given this backdrop, Trustnet asked expert fund selectors for their defensive fund picks in 2025, encompassing several different sectors and markets.

Evenlode Income

David Lewis, investment manager on Jupiter’s Merlin multimanager funds, identified the £3bn IFSL Evenlode Income fund led by Hugh Yarrow’s team as an attractive opportunity for cautious investors in 2025.

“Equities can be volatile, so cautious investors have to choose the strategies they invest in carefully,” Lewis explained.

The portfolio primarily invests in UK companies with a global reach and prefers cash-generative businesses that “have the potential to mitigate some of the downsides during challenging periods”.

This emphasis means Evenlode's portfolio provides access to globally exposed companies at discounted UK valuations.

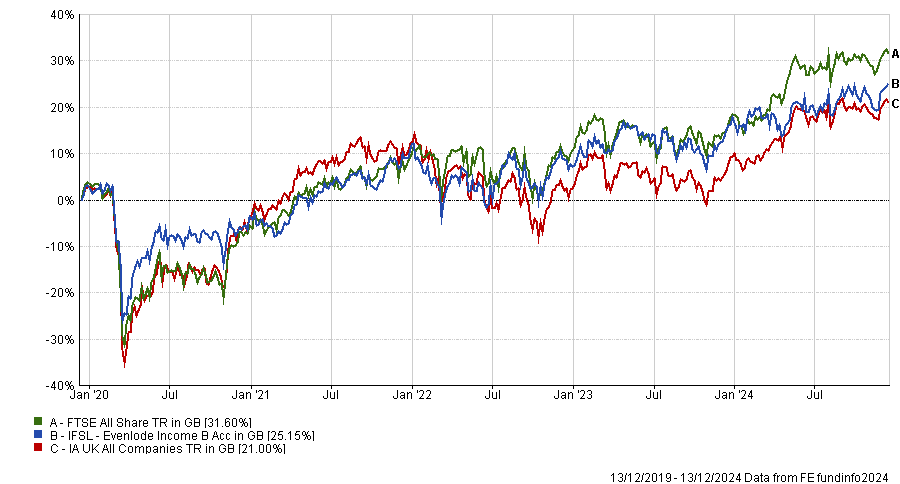

Over the past five years, the fund returned 25.2%, a second-quartile performance in the IA UK All Companies sector.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Over the same time frame, the portfolio also ranked within the top quartile for maximum drawdown, loss and volatility, indicating that it was a resilient fund even in troubled circumstances such as the pandemic.

Lewis concluded: “As the price paid for an investment has a large bearing on the long-term returns it can generate, we believe that the UK is an attractive place to seek exposure at the moment and that the Evenlode Income fund provides a thoughtfully managed, downside aware method of doing so."

Fidelity European Trust

For the Winterflood team, the £1.4bn Fidelity European Trust is a good opportunity for cautious investors.

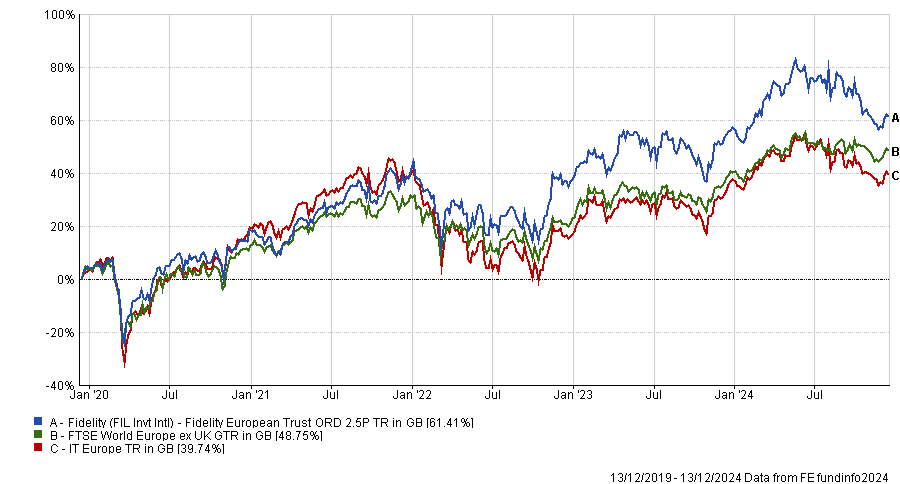

The trust, which has an FE fundinfo Crown rating of four, has posted top quartile returns over three, five and 10 years. Its 61.4% return over five years is the best result in the peer group.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

Emma Bird, head of investment research at Winterflood, said this outperformance was due to the experienced management team.

She explained that FE fundinfo Alpha Manager Samuel Morse and his co-manager Marcel Stotzel focus on “high-quality companies with good-dividend growth prospects at appealing valuations”.

Moreover, she said that the trust has benefitted significantly from the support of Fidelity's board of directors and research team.

She said: “Fidelity European Trust’s discount now stands at 9%, which is wider than its one-year average (6%). We believe that downside discount risk is mitigated by the board’s commitment to maintaining the discount in single digits in normal market conditions.”

This gave it an attractive risk-reward profile that would likely prove attractive for more defensively minded investors.

Personal Assets Trust

Paul Angell, head of investment research at AJ Bell, tipped the £1.6bn Personal Assets Trust, led by Alpha Manager Sebastian Lyon.

Described by Angell as a “defensively managed multi-asset trust”, Lyon’s main emphasis is on capital preservation by holding high-quality, cash-generative businesses over the long term.

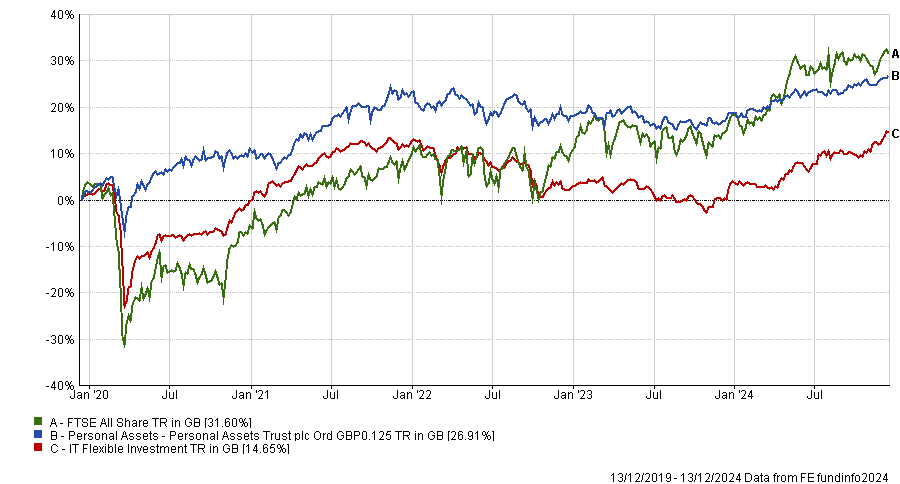

The five crown rated trust made a 26.9% return over the past five years, outperforming the IT Flexible Investment sector.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

While Angell reminded investors that the trust still takes on market risk and cannot guarantee capital protection, he argued it was significantly less volatile than many competitors. Over the past five years, the trust had the lowest maximum drawdown in the sector at just 8.8%. As a result, it was also the second least volatile portfolio in the whole sector at 7.8%

Angell concluded that this made the trust highly suitable for a “defensive role in investor’s portfolio, holding up when riskier assets, such as equities and credit sell-off”. For example, the trust held up well during 2020, when it had the fourth-best annual returns in the sector.

WS Canlife Sterling Liquidity

For Charles Younes, deputy chief investment officer at FE Investments, the £992m WS Canlife Sterling Liquidity fund is an appealing defensive play.

Younes said: “In the context of declining inflation, slow pace of interest rate cuts and positive bond-equity correlation, money market instruments sound like the perfect instrument.”

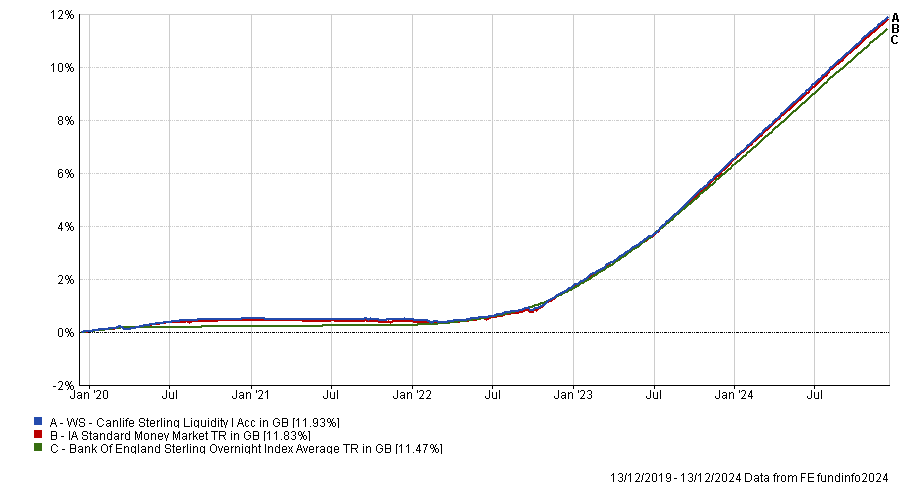

Launched in 2017, the fund benefits from an experienced management team, including Alpha managers Andy Head and Steve Matthews. Over the past five years, the portfolio has made 11.9%.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics.

Younes added that the team had built a repeatable process running cash mandates across several countries by defining the liquidity profile first and foremost. Indeed, he explained the fund has a maximum maturity of roughly 180 days but tends to be run on a 60–90-day time horizon.

Moreover, the fund holds 100 holdings on average and is restricted to investing entirely in “issuers that have been approved by their internal credit team”, giving it a predictability that investors may appreciate.