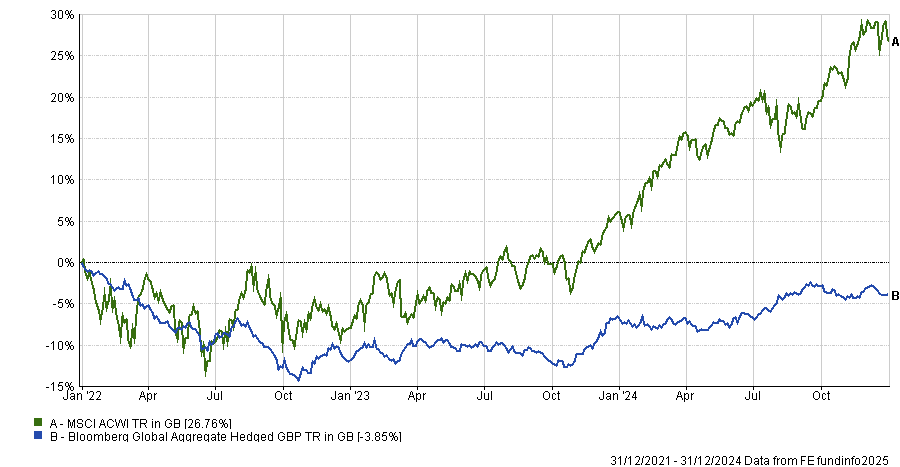

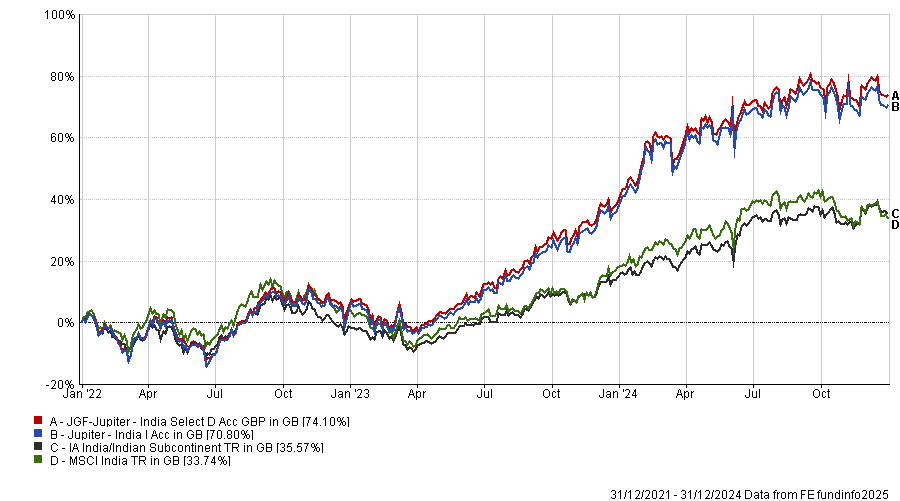

Fund managers have had to contend with vastly different investment environments during the past three years, from high inflation and interest rate hikes in 2022, causing bonds and equities to plummet, to the recovery in 2023 and the bull market of 2024 – punctuated by a bout of volatility last summer.

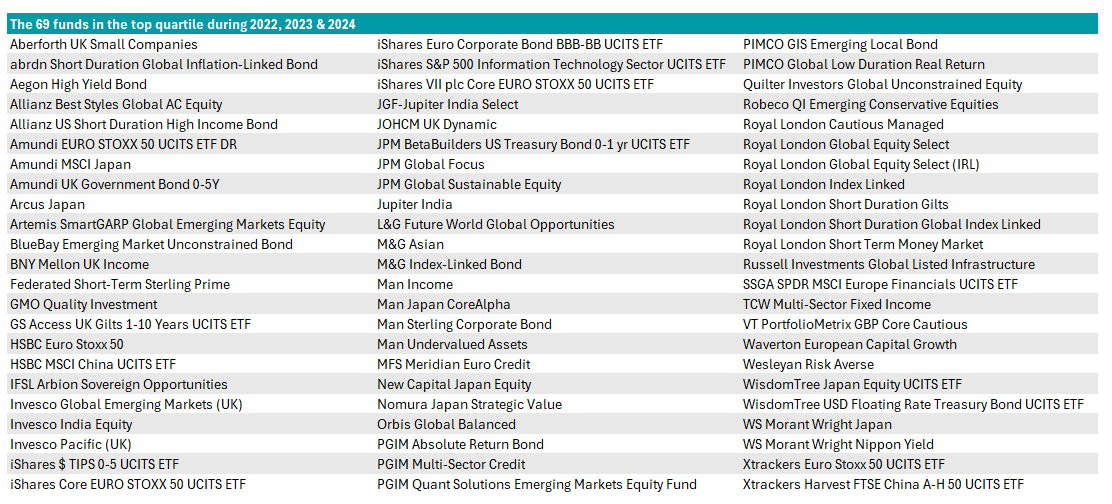

Amidst mounting geopolitical tension, macroeconomic uncertainty, an artificial intelligence boom and a tumult of elections, 69 funds in the Investment Association (IA) universe managed to consistently beat their peer groups and deliver top-quartile returns in each of the past three calendar years.

This represents 2% of the 3,358 funds in the IA universe with three-year track records, where quartile rankings were available.

These figures exclude the IA Unclassified, Specialist, Volatility Managed, Targeted Absolute Return and Property Other sectors, for which quartile rankings were not attainable.

A larger cohort of 374 funds were top quartile in both 2023 and 2024, when markets were driven by similar factors, such as the AI exuberance and the dominance of the Magnificent Seven.

To some extent, 2023 was a transition period with interest rate hikes throughout the first half before a fourth-quarter relief rally once the market became convinced that rates had peaked.

Nonetheless, the investment environment of 2022 and the factors that drove performance were dramatically different to the following two years, as the chart below shows, which is why so few funds outperformed in all three years.

Performance of global equities and bonds, 2022-24

Source: FE Analytics

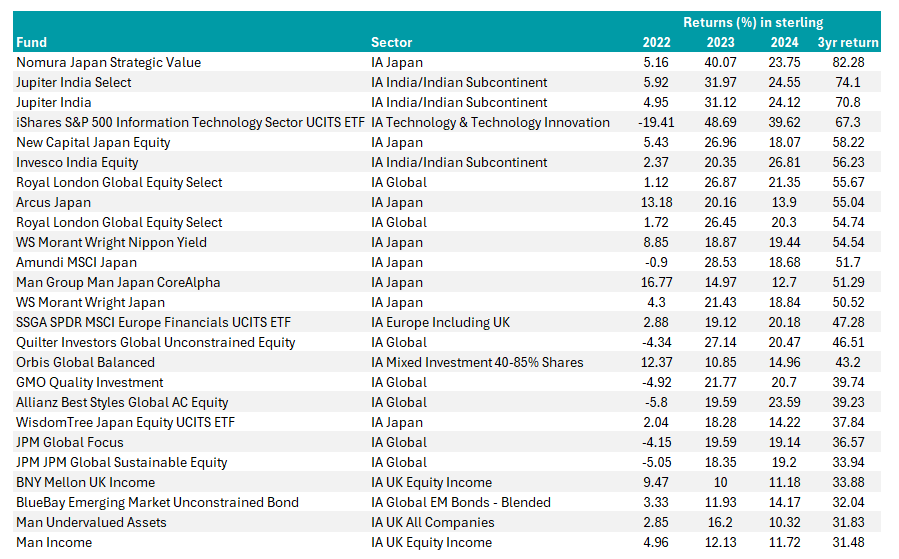

Amongst the 69 top-quartile funds in three back-to-back years, Japanese and Indian equity funds achieved some of the best overall performance, as the table below shows.

Japanese equities surged on the back of corporate governance reforms, economic modernisation and the return of inflation, while India’s exponential economic growth delivered compelling returns for investors.

The 25 consistent outperformers making the highest three-year returns

Source: FE Analytics; performance data is for the funds' main share class in FE Analytics

Nomura Japan Strategic Value, Jupiter India Select and Jupiter India delivered the highest returns over the three-year period.

The iShares S&P 500 Information Technology Sector UCITS ETF pipped them to the post in 2023 and 2024, as AI exuberance propelled chip designer Nvidia and other tech giants to ever greater heights. However, it made a thumping loss of -19.4% during the bear market of 2022, even though it was still within the top quartile of the IA Technology & Technology Innovation sector.

Tech stocks were pulled downwards in 2022 as demand fell off a cliff following the Covid-19 lockdown spending splurge and as interest rate hikes increased the discount rate used to value growth stocks.

The $1.8bn Nomura Japan Strategic Value fund takes the top spot for three-year performance and has beaten its sector and benchmark by a wide margin. Manager Yoshihiro Miyazaki uses quantitative screens combined with bottom-up fundamental research to find stocks priced below their intrinsic value, where corporate restructuring can unlock returns.

The fund's main share class - used above - hedges currency risk, which added significantly to performance. When the fund's unhedged returns are considered, it remains in the top quartile over the past three years but falls behind the likes of New Capital Japan Equity, Arcus Japan, Man Japan Core Alpha and WS Morant Wright Japan.

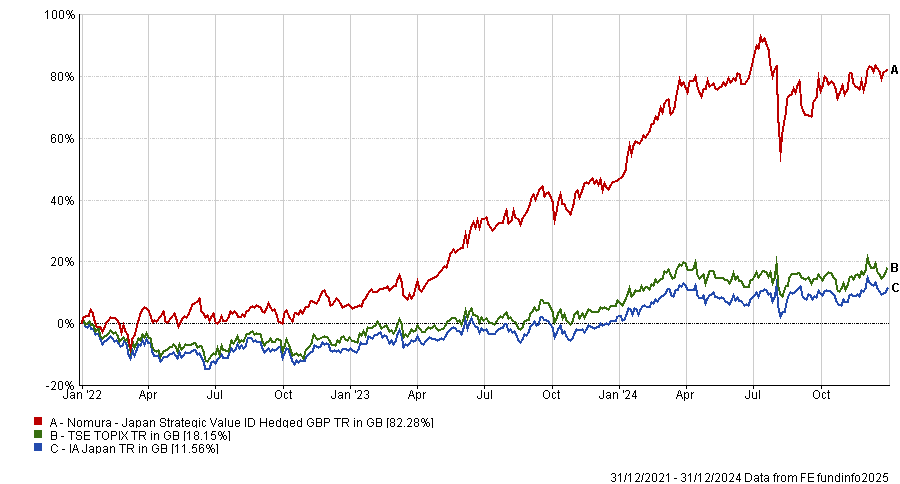

Performance of funds vs sector and benchmark, 2022-24

Source: FE Analytics

Eight Japanese equity funds attained top-quartile performance in three back-to-back years – slightly more than in the IA Global and IA Europe Excluding UK sectors (seven funds apiece, making them the next-best sectors for consistency).

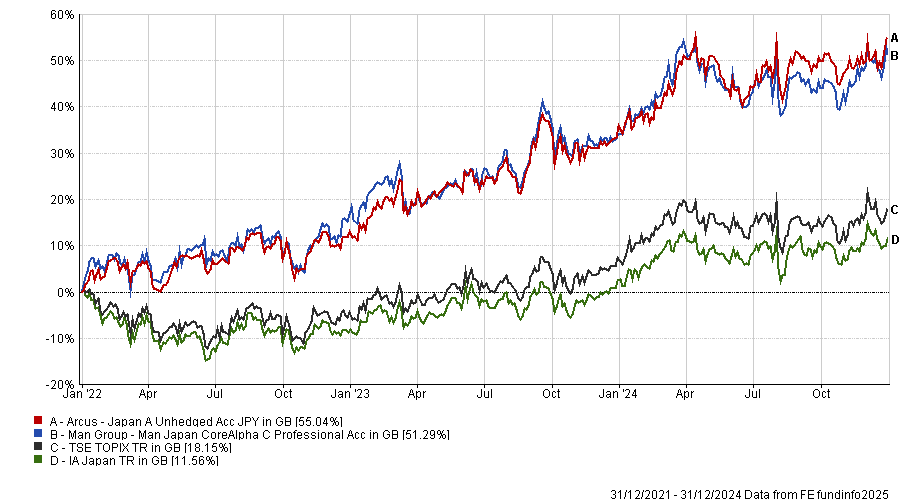

Man Japan CoreAlpha and Arcus Japan deserve honourable mentions for being the top and fourth-best performers of all 69 reliable funds in the difficult market of 2022.

Performance of funds vs sector and benchmark, 2022-24

Source: FE Analytics

India was another sweet spot, where the £2bn Jupiter India fund proved popular with investors and was one of the most-bought funds during the first half of 2024. Managed by Avinash Vazirani, it has greater exposure to small- and mid-cap stocks, which are geared into India’s domestic growth story, than many of its peers.

Jason Hollands, managing director of Bestinvest, said: “The fund is managed by a well-regarded and stable team who have delivered very strong returns.”

Performance of funds vs sector and benchmark, 2022-24

Source: FE Analytics

A full list of the 69 top-quartile funds in three back-to-back calendar years is below.

Source: FE Analytics