The Henderson Opportunities Trust’s (HOT) board will offer shareholders an unlimited cash exit at net asset value (NAV) or the chance to roll over their investment into Janus Henderson UK Equity Income & Growth, an open-ended fund.

Meanwhile, the board of the European Smaller Companies Trust, which is also managed by Janus Henderson Investors, has proposed a performance-conditional tender offer and a new discount management policy.

But to take advantage of these options, shareholders would first need to vote against Saba Capital’s resolutions at general meetings on 22 January for HOT and 5 February for European Smaller Companies.

Shareholders who hold the trusts via a platform such as AJ Bell or Bestinvest need to vote through their platform in advance of the general meeting; a guide to voting is available on the Association of Investment Companies’ website.

Activist investor Saba is proposing to replace the trusts’ entire boards with two of its own nominees. Paul Kazarian, principal executive officer of Saba’s publicly traded investment trusts, has been put forward for both trusts, accompanied at HOT by Simon Reeves, managing partner at Pasadena Private Financial Group, and at European Smaller Companies by Doug Hirsch, founder and former managing partner of Seneca Capital Investments.

If appointed, the new directors would consider changing the trusts’ mandates to investing in other discounted trusts and replacing Janus Henderson Investors with Saba.

HOT’s board said these resolutions “will effectively give Saba executive control of your company, enabling it to steer and repurpose your company in a manner designed to serve its own interests”.

If the new, non-independent boards select Saba to become the trust’s investment manager, shareholders might not be offered a vote on the terms of Saba’s appointment, including any fees.

Furthermore, HOT shareholders’ opportunity for a full cash exit at NAV or a suitable rollover option is at risk of being cancelled by Saba. “The board believes that Saba aims to keep as much of shareholders' capital as possible to enable it to earn ongoing and possibly higher management fees whilst potentially denying shareholders a full cash exit at NAV,” the board stated in a circular this morning.

“Any potential exit opportunity under Saba, if one is offered at all, may be at a worse price and restricted to only a partial exit.”

Henderson Opportunities has a £93m market capitalisation and has delivered top-quartile performance within the IT UK All Companies sector over one and five years. Over three years however its performance is fourth quartile owing to its style (the trust focuses on small- and mid-cap companies as well as AIM-listed stocks) being out of favour.

Meanwhile, the European Smaller Companies Trust’s (ESCT) board intends to introduce a three-yearly performance conditional tender offer for up to 15% of the company’s issued share capital at a 2% discount to the NAV after costs.

The tender would be triggered if the trust’s NAV total return does not exceed its benchmark over each three-year period. The first performance period will start after the general meeting next month and will continue until 30 June 2028.

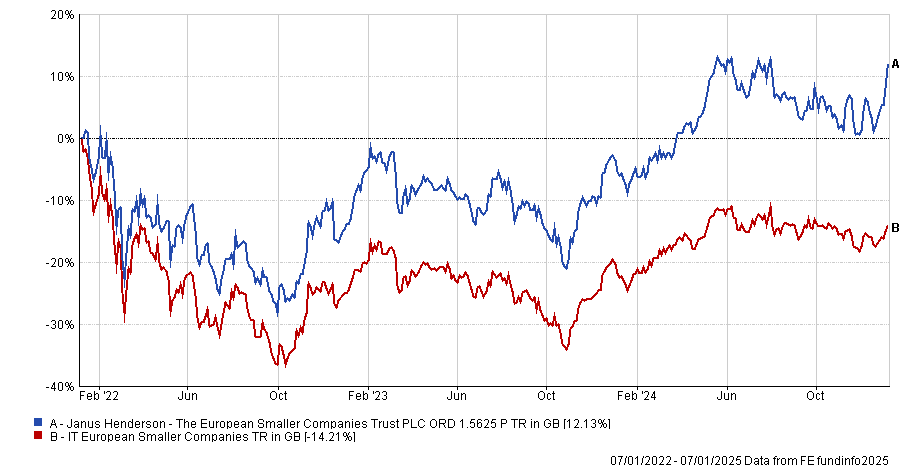

The trust is the best performer in the four-strong IT European Smaller Companies sector and is the only member of the quartet with a positive three-year return. It has a market capitalisation of £717m.

Performance of trust vs sector over 3yrs

Source: FE Analytics

The board also plans to introduce a target mid-single-digit discount in normal market conditions and will continue buying back shares to achieve this. Since October 2023, it has bought back £12.2m of its own shares. Its three-year average discount to NAV was 13.5% as of 13 December 2024, according to Saba and Bloomberg.

However, the board does not intend to buy back shares while Saba continues to hold a significant stake because to do so would reduce the trust’s issued share capital and increase Saba’s 29.1% interest.

The company already holds a continuation vote every three years at its annual general meeting and the next vote will take place in November 2025.

Chairman James Williams said: “It's clear that Saba's motives are self-serving. It would like to install directors who would not be independent of the company's largest shareholder and has indicated that it may appoint itself as investment manager. This could endanger shareholder protections, radically alter the company's investment risk profile and deny investors the opportunity to benefit from the proven European small-cap investment strategy.”

A spokesperson for Saba responded: “Over the past three years, Janus Henderson’s ESCT and HOT have both traded at a disappointing c. 13.5% average discount to NAV. These respective double-digit discounts demonstrate that the trusts’ boards and portfolio managers have failed shareholders.

"During Chair Wendy Colquhoun’s tenure, HOT shareholders have suffered -40% cumulative underperformance. This disastrous track record is the result of poor investment decisions by the manager and negligent oversight by the board.

"Janus Henderson’s proposed reconstruction scheme for HOT is inferior to our nominees’ plan and the claim that Saba would seek higher fees at shareholders’ expense if selected as investment manager is made up. Do not be fooled – this scheme is simply a last-ditch attempt to protect the underperforming board, continue lining their own pockets with shareholder capital and distract from an indefensible track record.”