In a year characterised by millions of people taking to the polls, ongoing geopolitical instability, and surges in market volatility, some may have turned to familiar and popular names to help guide them through what appeared to be a tumultuous year heading into January.

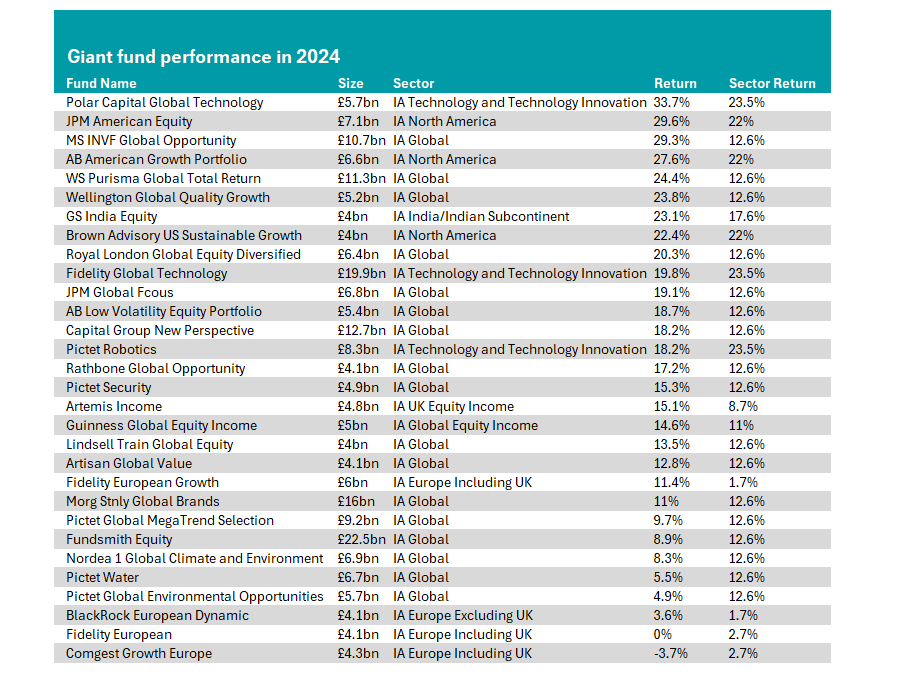

However, not all large funds thrived in 2024. Of the 30 largest equity funds highlighted below, 10 failed to beat the sector average last year. Nevertheless, several popular funds did well for investors last year. Below, Trustnet looks at the performance of some of the Investment Association's largest and most popular funds in 2024.

In the below list we have removed passive vehicles as well as those that are benchmark-aware, known as smart-beta products.

Source: FE Analytics

Global

For the global giant funds, results in 2024 were mixed. Of the 17 global funds among the 30 largest in the Investment Association universe, five failed to beat the sector average.

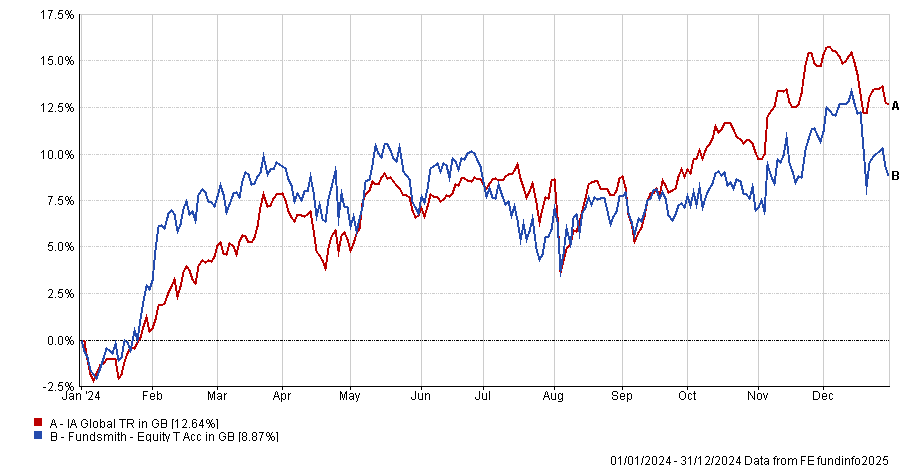

The largest and most well-known of this group was Fundsmith Equity, the flagship strategy of FE Fundinfo Alpha Manager Terry Smith. This strategy has underperformed in recent years and 2024 was no different, with a total return of 8.9%, compared to the IA Global sector average of 12.6%.

Fund performance in 2024 vs sector

Source: FE Analytics

Despite recent underperformance, the portfolio remained highly popular with investors and analysts due to its quality-growth approach. For analysts at Square Mile, this strategy should still lead to long-term outperformance. Indeed, its 10-year returns remain stellar despite the short-term relative underperformance.

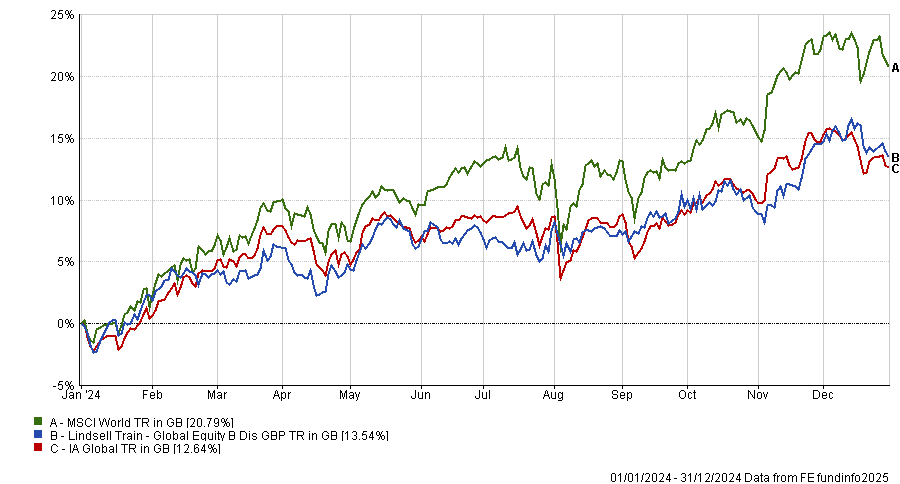

Another favourite for global investors is Alpha Manager Nick Train’s Lindsell Train Global Equity. This fund employs a similar quality-growth style to its Fundsmith competitor and has also struggled in the post-Covid period, with bottom-quartile results in the past five years.

However, in contrast to its competitor, it returned 13.5% in 2024, a second-quartile result, beating the average global peer by 0.9 percentage points.

Fund performance in 2024 vs sector and benchmark

Source: FE Analytics

This is despite admitting that he was “not enjoying the current performance” at the halfway stage of 2024 and has in the past repeatedly apologised for his funds’ returns.

US

Passive index funds remained popular last year,

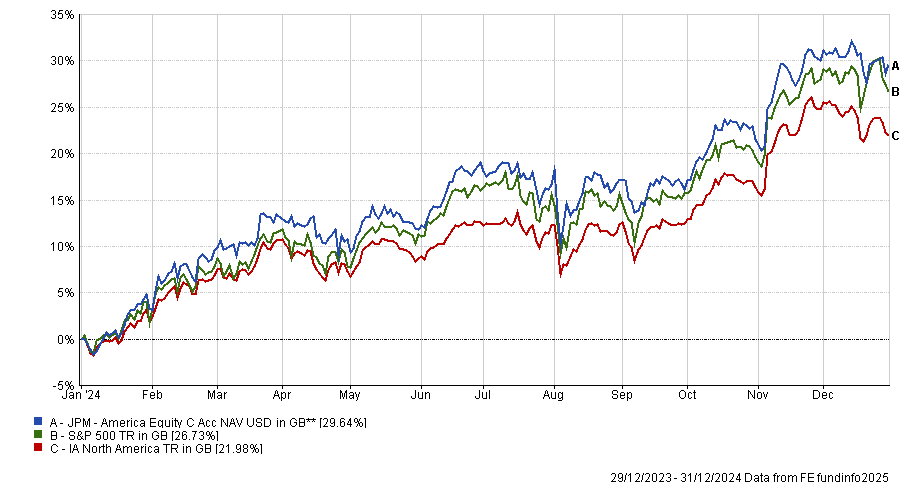

The standout North American giant fund was JPM America Equity, managed by Jonathan Simon and his team. It surged 29.6% last year, placing it within the first quartile of the sector and surpassing the performance of the S&P 500. In absolute terms, this also made it the second best-performing giant fund overall in 2024.

Fund performance in 2024 vs sector and benchmark

Source: FE Analytics

With major holdings in five of the Magnificent Seven, including Nvidia and Microsoft, the fund benefitted from those stocks' continued success over the past 12 months.

Other notable US giant funds in 2024 included the Brown Advisory US Sustainable Growth Portfolio and the AB American Growth Portfolio, which outperformed the average North American fund by 0.4 and 5.6 percentage points, respectively.

UK

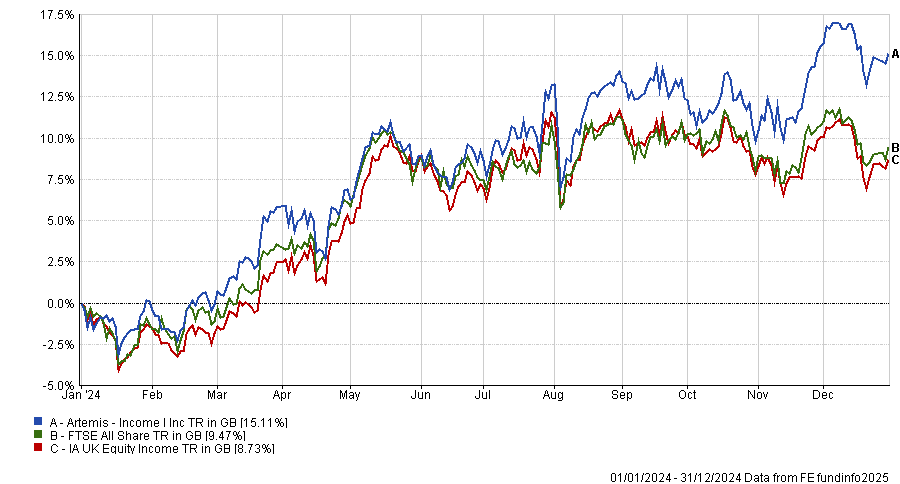

Meanwhile, in the home market, just one fund matched our criteria in 2024 – the £4.8bn Artemis Income fund, led by Alpha Manager Adrian Frost since 2002.

It delivered a top-quartile result of 15.1% in 2024 versus the IA UK Equity Income sector average of 8.7%. Consequently, the strategy has ranked as one of the top UK Equity Income funds over one, three and five-year periods.

Fund performance in 2024 vs sector and benchmark

Source: FE Analytics

For the team at Square Mile, Frost’s experience has led to an emphasis on “sustainable and durable free cashflows”, which means the portfolio holds businesses with strong balance sheets.

The analysts added: “The fund has been designed to generate a yield in excess of the market, but the managers will not unnecessarily place capital at risk to achieve this, which is in keeping with the managers' total return aspirations.”

Europe

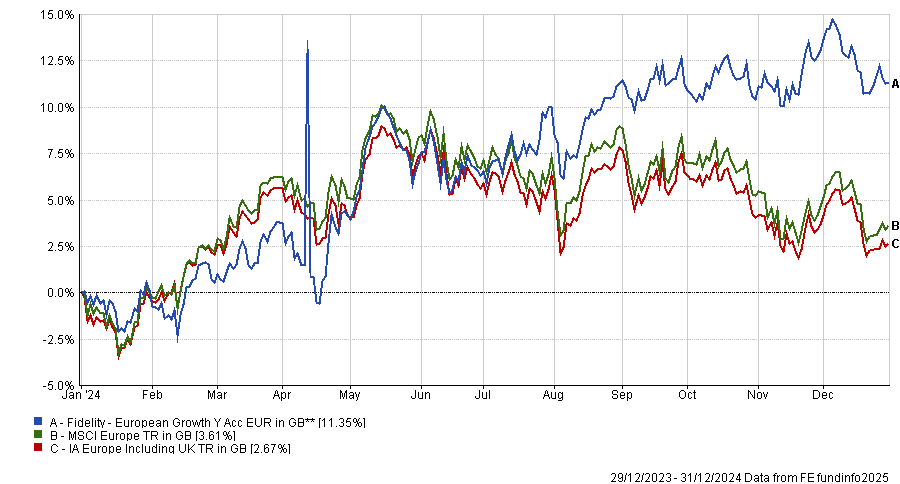

In Europe, the results of the largest funds were more mixed. Ongoing war in Ukraine and a lack of post-election stability in countries such as France and Germany continued to drag down European businesses last year.

As a result, of the four giant European funds on our list, just two made positive returns last year. The standout fund was Fidelity European Growth, which was up 11.4% last year, the 10th-best result in IA Europe Including UK sector.

Fund performance in 2024 vs sector and benchmark

Source: FE Analytics

The fund was overweight some of Europe's top-performing stocks last year. For example, 3i Group's stock price climbed by 58% in 2024 but it represented just 0.4% of the MSCI Europe index. In the Fidelity strategy, it is the highest conviction holding, representing 4.6% of the total portfolio.

The £4.1bn BlackRock European Dynamic was up by 3.6% in 2024, surpassing the IA Europe Excluding UK sector and the MSCI World ex UK index.

However, Comgest Growth Europe and Fidelity European failed to beat the benchmark. With combined assets under management of £8.4bn, these funds lagged for many investors. Comgest was down 3.7% while the Fidelity fund was flat on the year.