Last year was a mixed bag for investors backing early-stage companies through initial public offerings (IPOs).

According to recent data from AJ Bell, 2024 was another year in which the number of IPOs in the UK declined, with just 16 new companies listing on the London Stock Exchange, down from 20 in 2023 and 42 in 2022.

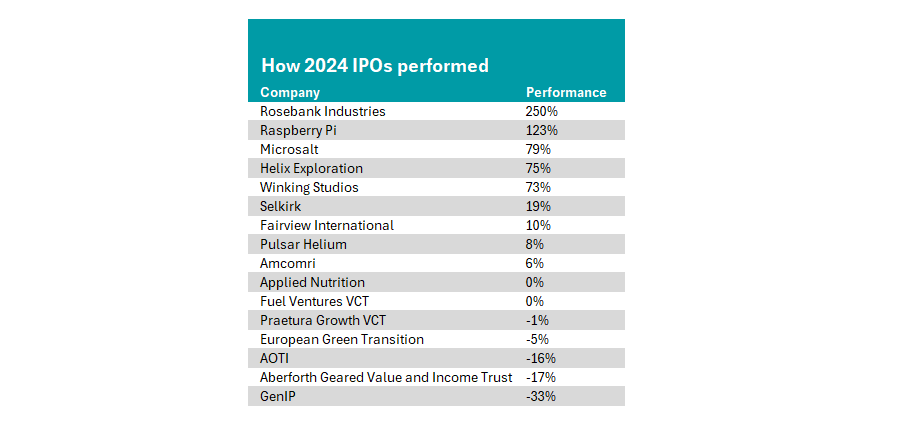

However, despite the low volume of stocks listing last year, performance of these new public companies proved significantly better than in 2023. Companies with an IPO in 2024 achieved an average return of 36%, carried by the supranormal returns of the top two companies.

Source: AJ Bell, LSE. Data is from IPO offer price until 31 Dec 2024 and excludes introductions and foreign companies with GDRs/ADRs.

Dan Coatsworth, investment analyst at AJ Bell, said: “UK IPOs may have been thin on the ground in 2024, but the average return was very tasty.”

Indeed, of the nine IPOs that achieved positive returns last year, two posted triple-digit results, with Rosebank Industries being the standout performer.

Following an initial valuation of £50m in July 2024, Rosebank surged to £175m by the end of the year, an increase of 250%. Coatsworth added that this was “quite astonishing”, given that it holds all its assets in cash.

The company is led by Simon Peckham and Christopher Miller, co-founders of the FTSE 100 aerospace company Melrose Industries, which was initially valued at £13m in 2003 and peaked at £12bn in 2020.

Coatsworth said: “Rosebank’s team are looking to emulate the ‘buy, improve and sell’ model of Melrose. Striking gold twice is not guaranteed, but investors are enamoured by the team’s past success.”

While he acknowledged that Rosebank has produced no news since its initial listing, making it difficult to discern if it has found a suitable acquisition, this has yet to deter investors.

Following this, Raspberry Pi Holdings, the low-cost single-board computer and compute module developer, was the second-best performing UK IPO in absolute terms last year. The stock rapidly climbed in value, with a share price performance of 123% compared to its initial listing, doubling investors’ money.

Even some later additions to the stock market did well. For example, Asian gaming company Winking Studios was listed on the London Stock Exchange on 14 November and investment acquisition firm Selkirk floated on 6 November. Respectively, these two companies returned 73% and 16% by the end of the year.

Coatsworth added: “This type of performance is exactly what is needed to tempt companies sitting on the fence over whether to list in London or not.”

He argued that these results indicated that investors were still keen to back UK businesses, provided they had a decent story and the qualities which would allow them to thrive over time. IPO performance in 2024 and changes to listing rules have provided a “strong sales pitch” to bring more companies to the UK market.

However, it was not all plain sailing for IPOs last year. Five newly listed stocks declined in value compared to their initial listing, with two more stagnating in performance.

At the bottom of the table was GenIP, which slid by 33% since listing in October, despite artificial intelligence being at the centre of its business model.

“The company might have missed the boat regarding investor frenzy around all things linked with artificial intelligence,” Coatsworth suggested. “While the shares have started to move higher since the start of 2025, revenue is tiny, so investors are having to buy on hope.”

In the investment trusts space, Aberforth Geared Value and Income Trust was listed on the UK stock market for the first time in 2024. It was one of the worst-performing IPOs last year, down by 17% compared to its initial floatation.

Other examples of stocks which fell into the red last year included US medical technology firm AOTI, renewable energy business European Green Transition and Praetura Growth Venture Capital Trust (VCT).

Last year also saw many formerly UK-domiciled businesses move their primary listing elsewhere.

According to EY, 88 companies delisted or transferred their primary listing away from London in 2024, including Flutter, Just Eat and Ashtead Group.