AJ Bell has dropped alternatives from its model portfolios, arguing they do not provide enough diversification. The firm had previously held property and infrastructure funds and investment trusts as alternatives, but have removed these from their portfolios following a review.

Both asset classes will remain viable to be invested in as a tactical shift, the firm said, but would no longer be a core part of the strategies.

Its model portfolios have been growing in popularity in recent years, with assets under management rising to £6.8bn over the past 24 months. Below Trustnet takes a look at some of the other major changes made at the start of 2025.

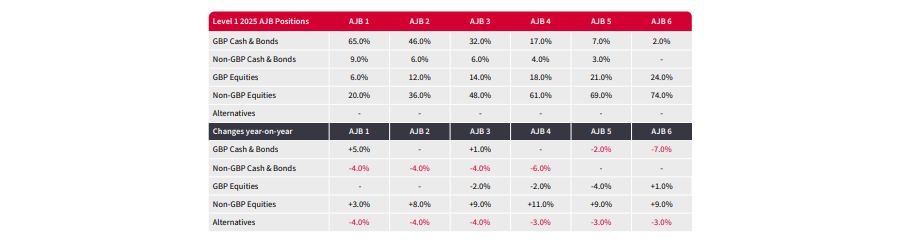

Source: AJ Bell Investments, Strategic Asset Allocation 2025

Equity allocations

Despite expectations that equity markets may struggle for returns, equity allocations have increased in all six of AJ Bell’s risk profiles.

Attractive valuations encouraged greater allocation towards European equities within the portfolios. As a result, the Europe ex-UK allocations has risen by 4-9%.

The need to maintain a certain underweight compared to global indices, which have been increasingly dominated by US companies led to further increases in AJ Bell’s US holdings. In three of it’s six risk profiles, US equities represented more than 20% of the total assets.

One of the biggest changes came in Asia. The firm opted for a more granular strategy, favouring a new emerging markets ex-China approach to investing.

“Chinese equities were way too cheap in the first half of 2024”, James Flintoff, head of investment solutions at AJ Bell explained. He argued that this new structure would give greater flexibility in the portfolios and ensure investors would not end up “hamstrung when it mattered most”.

As a result, emerging markets ex-China allocation rose by 4-21% across the portfolios, while Chinese equities were up by 3-8%.

Bond allocations

This time last year, AJ Bell reduced its exposure to high-yield bonds in favour of investment-grade bonds. While credit spreads have since tightened further, the team still argued that the compensation on high-yield bonds is too low for the risks involved. They also prefer shorter-dated paper, arguing that inflationary fears had made long-duration bonds risky.

“There is an argument that investors have been napping with regards to inflation and government deficits and are now being forced to wake up to the risks these present to bond markets”, Flintoff explained.

With service-led inflation remaining surprisingly sticky, he argued investors are unprepared for inflation to rapidly rise above central banks targets. As such, AJ Bell has reduced bond duration to three to four years, down from five to six.

To this end, AJ Bell has increased exposure to short-duration gilts, US Treasuries and TIPS across risk profiles one, two and three – the three lowest-risk mandates. Indeed, risk profile one now has 18% exposure to sterling and sterling-hedged cash and bonds.

Additionally, analysts at AJ Bell highlighted, due to this move away from long-duration bonds, cash has become increasingly attractive for cautious investors. As a result, allocation towards cash rose by 2-7% across the model portfolios.

Fund moves

AJ Bell has changed some of its holdings in both the active and passive model portfolio’s this year. Perhaps most notable was the inclusion of the iShares S&P 500 Equal Weight ETF, which has been added to the passive portfolios to give a broader exposure to US companies following concerns about concentration risk in the US last year.

Flintoff said: “We feel it is prudent to start thinking about managing that concentration risk in the US specifically, rather than relying on broad geographic diversification to do all the heavy lifting.”

Two synthetic ETFs have also been introduced to the passive portfolios—the Amundi MSCI China ETF and its cousin strategy, the Amundi MSCI Emerging Markets ex-China ETF. Analysts at AJ Bell explained that physical ETFs often take on exposures outside of their intended asset class, whereas synthetics benefit from better collateral control and reduced costs.

In the active range, there were also changes. For the US portfolio, active managers have generally struggled to outperform the US market. As a result, the actively managed JPM US Equity Income fund was replaced by the passive SPDR S&P 500 ETF.

In terms of European exposure, AJ Bell added Lightman European fund. Due to this strategy’s value tilt, it was balanced with the growth-focused BlackRock European Dynamic strategy.

Invesco Emerging Markets ex-China fund has been added to AJ Bell’s emerging markets allocations. The Amundi Emerging Markets ETF will be used to balance the underweight to India in the Invesco strategy. Elsewhere, the FSAA All China fund has struggled to scale and has been replaced by the Franklin Templeton MSCI China ETF.

Lastly, in the most risky model portfolio the firm runs, AJ Bell has upped its exposure to Japan to 9% following the inclusion of FE Fundinfo Alpha Manager Carl Vine’s M&G Japan fund.