UK inflation hit 3.0% in January, data from the Office for National Statistics has shown. The Headline Consumer Prices Index (CPI) came in higher than the expected 2.8%, reaching a year-on-year 10-month record.

Today’s CPI reading, together with yesterday’s stronger-than-expected unemployment and wages data and the knock-on effects from a potential global trade war (not yet factored in) are a cause for concern for the Bank of England, which revised its forecast of peak inflation to 3.8% from 2.75% in the third quarter of 2025. Chances of a March interest rate cut are now looking “remote”, according to James Lynch, investment manager at Aegon Asset Management.

Consumer price index annual rate

Source: Office for National Statistics

Core inflation, which excludes energy, food, alcohol and tobacco, and services inflation accelerated sharply, but were mostly in line with expectations (3.7% and 5.0%, respectively, from December’s 3.2% and 4.4%). The increase in food costs (which came in at 3.1%) is “something to keep an eye on” said Lynch, in case this is the start of a trend in 2025.

But it is the reaction of UK companies that will be key for what is to come, with the employer national insurance increase and national minimum wage rise set to kick in from April.

He said: “How businesses will react to the increase in cost base will be important for Band of England policy rates. The sectors that will be impacted are more likely to be low margin, with higher labour costs, such as retail and hospitality”.

“For now, it is enough not to change Bank of England messaging as there is something for everyone in this inflation print and as such do not expect any change in market rates on the back of this.”

Household costs also rose, with the energy price cap increase filtering through after a 1.2% rise at the start of 2025 from the previous quarter.

Craig Rickman, personal finance expert at interactive investor, said: “Inflation is expected to accelerate further later this year, largely due to higher energy prices, and there are several headwinds that may keep prices elevated for longer, including measures announced at the Autumn Budget.”

“The VAT hike on private school fees is already starting to bite.”

As inflation heads away from the Bank of England’s target, investors and savers should make sure their money is working as hard for them as possible, warned Rickman.

“With tax year end fast approaching, one simple task is to fight inflation to make sure you are using the most of your tax wrappers, such as pensions and ISAs,” he said. “Paying less is one of the most effective ways to guard against the impact of price rises as it means you get to keep more of any growth and income, helping your money to grow faster.”

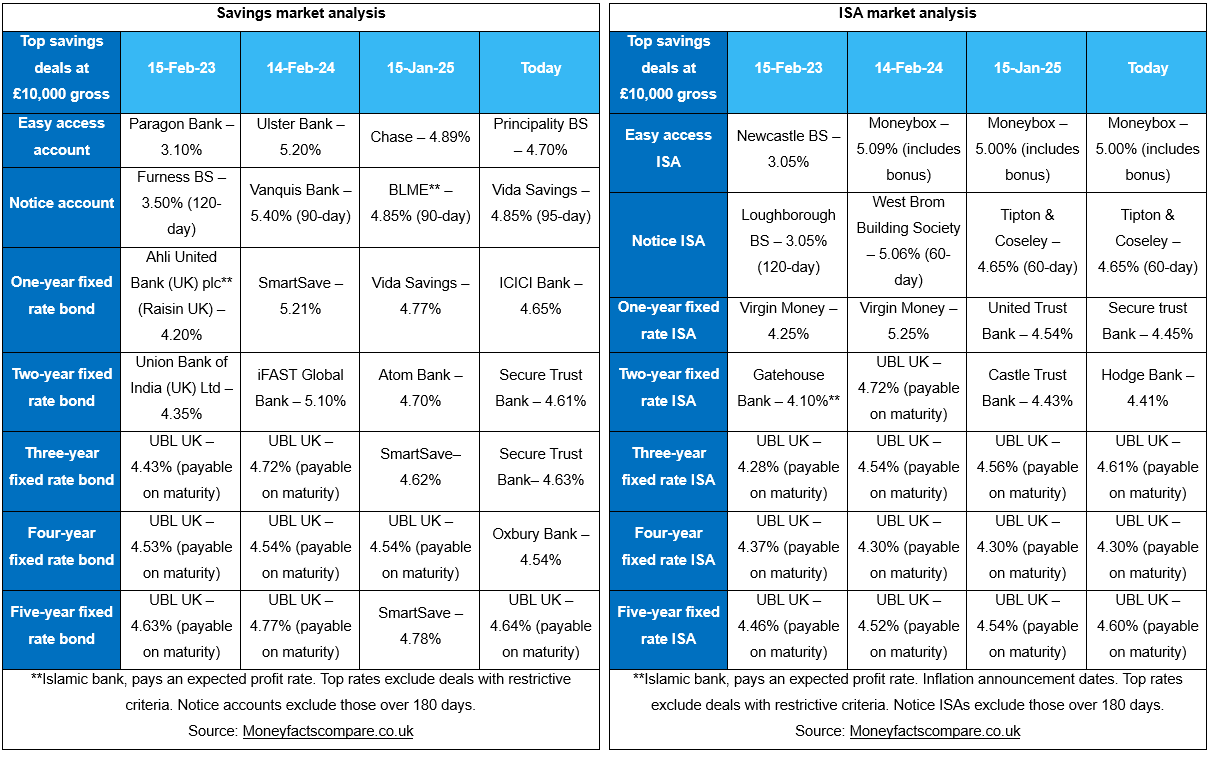

However, the savings market has already suffered and most market-leading rates have fallen, data from Moneyfactscompare has revealed, with Caitlyn Eastell, spokesperson at the firm, encouraging savers to urgently review their rates.

“Across the board, there have been an array of rate movements, with top rate reductions taking centre stage. However, they also showcased some resilience, and a few increases made an appearance,” she said.

“Challenger banks currently occupy all the top spots in the market as they are working hard to attract new business.”

The chart-topping easy access rate has been affected by the largest drop month-on-month of 0.19%. Short-term fixed bonds continue to take a downward trajectory; savers could now be earning up to £56 less in real returns compared to this time last year.

“With market-leading rates falling across the board, earning a fair return may become a pressing issue, so it is key that savers review their current rate and make the switch if it is not working to its fullest potential,” she concluded.