More than 2 million savers could be pulled into paying tax on their savings interest, according to data from HMRC and AJ Bell, as rising interest rates and a competitive savings market mean more people creep over a stagnant tax-free threshold.

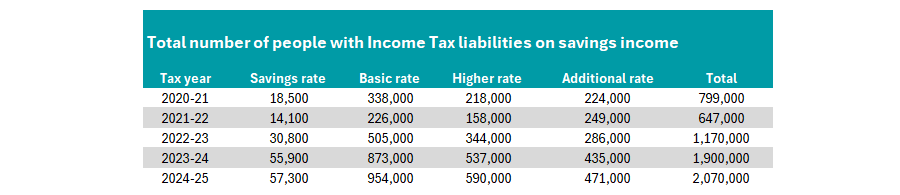

In the current tax year, a total of 2.1 million people are likely to pay tax on their cash savings, a freedom of information request submitted to HMRC by AJ Bell found. This is three times more than the 647,000 clobbered by tax three years ago and up from 1.9 million last year.

Source: HMRC/AJ Bell. The 2020-21 and 2021-22 figures are outturn based on the 2020-21 and 2021-22 Survey of Personal Incomes (SPI) respectively. The 2022-23, 2023-24 and 2024-25 estimates are based on the 2021-22 SPI.

Laura Suter, director of personal finance at AJ Bell, said: “The thorny issue is that lots of people won’t realise they owe tax until a brown letter lands on their doormat. While those filling out a self-assessment tax return will declare any savings interest and subsequent tax due, those taxed under PAYE get any tax liability calculated by HMRC, based on information sent to them by banks and building societies.

“Often this will then mean your tax code is adjusted and you repay the tax through your payslip each month – eating into your take-home pay.”

Although it may be too late for savers to fix this issue before the tax deadline on 5 April, people can organise their savings now to avoid tax traps next year.

The first trap is the most straightforward to understand: savings interest can push people into a higher tax bracket, as the Personal Savings Allowance shrinks when crossing into the next income tax threshold.

For example, someone who earns more than £50,270 can only earn £500 in savings, while those on the lower rate of tax are able to earn up to £1,000 before they start paying tax. Those earning more than £125,140 get no savings allowance, meaning all savings interest is taxed at 45%.

“But bear in mind that savings interest itself can tip you over,” said Suter. “A £50,000 salary plus £1,000 savings interest makes you a higher-rate taxpayer, cutting your Personal Savings Allowance to £500 and leaving £500 of interest taxable at 40%.

“The solutions are to use an ISA to shelter savings, pay more into your pension to stay in a lower tax band, or shift savings to a lower-earning partner.”

Joint accounts also count towards the Personal Savings Allowance, with the interest earned split between the owners. This again could push a higher-rate taxpayer over their allowance if they have other cash savings interest.

“If one partner earns less, it may be tax-efficient to move savings into their name. A higher-rate taxpayer would pay £400 tax on £1,000 interest, while a basic-rate taxpayer would pay just £200. Even if in the same income tax bracket, using a partner’s unused Personal Savings Allowance can reduce a couple’s tax bill,” said Suter.

For parents, they can be hit by interest their children earn. If a child earns more than £100 interest on money gifted by the parents, the interest is taxed as the parent’s.

“With top children’s accounts paying 5%, just £2,000 in savings could hit this threshold. Once that limit is breached, all the interest (not just the excess above £100) counts as the parent’s income, eating into their Personal Savings Allowance,” said Suter.

“To sidestep this, use a Junior ISA or split contributions between each parent to make sure the tax hit is spread. Equally, if one parent has Personal Savings Allowance left, they should be the one to contribute.”

Lastly, savers should look at their fixed-rate accounts. While these offer guaranteed returns over a longer period of time, the interest is only taxed when the money becomes accessible.

This means if savers have put their money away for several years earning good rates, all of the interest accrued will be counted in the final year.

“Longer-term accounts are most at risk. For example, £7,000 in a top three-year fix at 4.63% would generate £1,018 interest at maturity, exceeding a basic-rate taxpayer’s £1,000 Personal Savings Allowance. To avoid this, choose an account that pays interest monthly or annually, or opt for a fixed-term ISA to keep your interest tax-free,” Suter concluded.