Herald Investment Trust shareholders enjoyed a strong year in 2024, with full-year results to 31 December showing its net asset value (NAV) rose 12.1%, while the share price was 26.4% higher.

Despite this, the firm could be about to be wound up, according to chairman Andrew Joy, who has urged shareholders to vote again to keep the trust going at the company’s upcoming annual general meeting (AGM) on 24 March.

The trust has a mandatory continuation vote every three years, with the upcoming AGM marking the next opportunity for investors to cash out should they wish to – something that may spark another battle with large activist shareholder Saba Capital.

Herald chair Joy said the board believes the US hedge fund “may vote against the continuation resolution to trigger a potential winding-up of the company” after Saba lost its battle to remove the directors and replace them with its own nominated directors at the requisitioned general meeting.

"Given Saba's large interest in the company's shares (29.1% as of 15 January 2025, being the date of Saba's latest publicly disclosed holding prior to the publication of this announcement), the board believes that other shareholders representing at least 30% of the company's issued share capital may be required to vote in favour of the continuation resolution to ensure the company continues in its current form.”

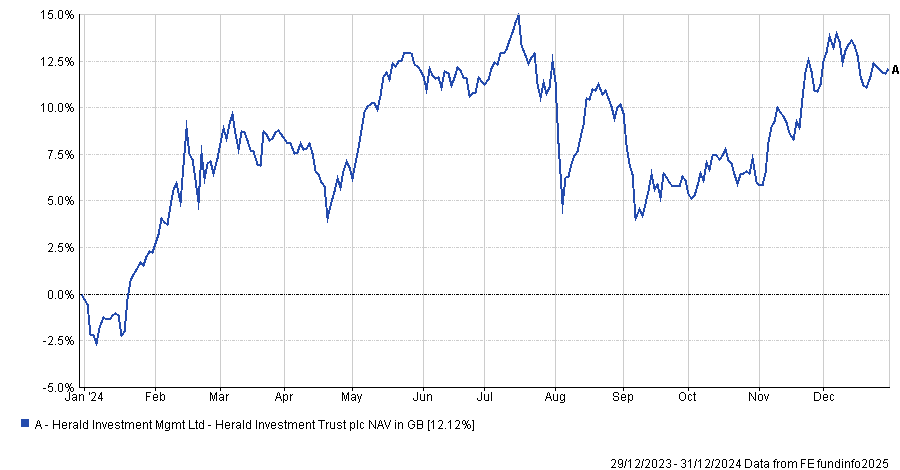

He reiterated Herald Investment Trust is the “only investment trust specialising in the global small and mid-capital sections of the technology and communication sectors”, which has delivered a 27x NAV total return since inception in February 1994.Short-term returns have also been strong. Last year the trust’s share price was 26.4% higher, although this is likely thanks to Saba Capital buying shares. Perhaps more importantly, its NAV rose 12.1% during this time.

“The board believes that the Company's mandate will continue to provide attractive long-term investment opportunities,” Joy concluded.

NAV return of Herald over 12 months

Source: FE Analytics

Manager Katie Potts said the year was “challenging” due to the instability of the company’s share register but the performance was strong.

“The highlight has been the remarkable performance of two North American companies which have seen strong growth in their data centre computers enabling artificial intelligence,” she said.

“With a handful of exceptions, trading performance across the portfolio has generally been good.”

The trust also benefited from merger and acquisition (M&A) activity. Nine takeovers announced in 2023 were completed during 2024, which yielded £21.1m in cash, while a further eight were announced and completed during the year, adding £48.8m in cash. Another nine have been announced but are yet to be completed, with a potential value of a further £50m.

“This level of takeovers is consistent with previous years. However, new issues have been few and far between in all geographies, reflecting the continued withdrawal of assets from active managers in favour of fixed-interest investments and index trackers,” she said.

While there is “a large pipeline of companies funded by venture capital and private equity which would like to float if public markets were receptive and valuations appropriate,” Potts was “optimistic” that the number of new issues will improve in time.

Away from M&A, she remained confident in the wider technology sector, in which the trust specialises. Although artificial intelligence (AI) has largely been focused on large-cap names that have the capital to deploy in the area, she said it is “inevitable” the technology will lead to new applications that will emerge from smaller companies.

Smaller companies are also well placed to take advantage of the drive to net zero, which has some unresolved technical challenges – in particular the storage and distribution of renewable power – as well as military conflicts and a geopolitically volatile world, which is leading to innovation in defence and cyber security, she concluded.